Sunbit’s pay-over-time technology brings true 0% APR to F&I customers, with no chargebacks

Since 2016 we’ve worked side-by-side with dealerships to offer their service drive customers the best possible consumer financing. From day one GMs asked us if they could utilize our product in the financing department, so customizing our solution to F&I departments is a natural next step.

LOS ANGELES (PRWEB)

March 30, 2023

Sunbit, the company building financial technology for everyday expenses, today announced that it has expanded its footprint within auto dealerships, now offering its technology to power pay-over-time solutions to finance and insurance (F&I) departments. Today Sunbit is the most established and trusted consumer financing tool for auto dealership service drives in the US. This expansion will allow F&I departments to offer car buyers access to pay-over-time financing options for add-ons, extended warranties, and other products and services.

Sunbit is already the preferred financial technology partner for fixed operations of 14 auto OEMs, is offered in more than 6,400 dealerships and 1,500 independent service shops, and is the partner of choice for 22 of the top 25 largest auto dealer groups in the nation. Through customizing its technology for F&I departments, Sunbit is expanding its fixed ops success by delivering more value to consumers and participating dealerships.

“We’ve been working side-by-side with dealerships to offer their service drive customers the best possible consumer financing choices since 2016. Since day one GMs have asked us if they could utilize our product in the financing department, so customizing our solution to F&I departments is a natural next step. People want F&I products because it gives them peace of mind. We help them to buy those products and not break their monthly budgets. Both the dealerships and people win, which is our main motivation,” said Tal Riesenfeld, CRO, Sunbit.

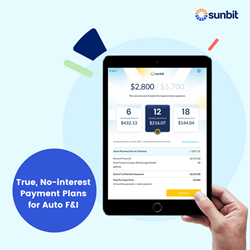

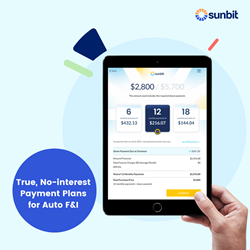

Sunbit’s F&I program provides all approved applicants access to a true 0% interest payment plan, with either 6, 12, 18 months terms with no late or penalty fees. Sunbit technology powers the simple 30-second application process, all with more than 90% approval rates. The technology can be accessed in-store through a tablet app or remotely through a customer’s own connected device and it also is integrated into an online checkout process.

Sunbit has already driven nearly $1B in sales in the automotive sector by working with more than 930K service drive customers. More than 100 dealerships started offering Sunbit’s F&I solution in an early access program that began in early 2022. Sunbit is currently rolling out its F&I program to dealerships within its existing merchant network.

Sunbit builds financial technology for real life. Our technology eases the stress of paying for life’s expenses by giving people more options on how and when they pay. Sunbit offers a next-generation, no-fee credit card that can be managed through a powerful mobile app, as well as a point-of-sale payment option available at more than 18,000 service locations, including auto dealership service centers, optical practices, dentist offices, veterinary clinics, and specialty healthcare services. Sunbit was included on the 2022 Inc. 5000 list. The financial technology company has also been named a Most Loved Workplace®, Best Point of Sale Company, A N.A. Deloitte Technology Fast 500 company and a Top Fintech Startup by CB Insights. Loans are made by Transportation Alliance Bank, Inc., dba TAB Bank, which determines qualifications for and terms of credit. The Sunbit Card is issued by TAB Bank, pursuant to a license from Visa U.S.A. Inc. Use of the card is subject to the cardholder agreement.

Share article on social media or email: