The United Kingdom market has recently experienced a surge, climbing 1.8% in the past week, though it has faced a decline of 5.4% over the last year with earnings expected to grow by 12% annually. In this context, a good dividend stock typically offers investors steady income and potential for capital appreciation, qualities that may be particularly attractive amid such fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

|

Name |

Dividend Yield |

Dividend Rating |

|

Record (LSE:REC) |

7.80% |

★★★★★★ |

|

BAE Systems (LSE:BA.) |

2.25% |

★★★★★☆ |

|

AstraZeneca (LSE:AZN) |

2.18% |

★★★★★☆ |

|

M.T.I Wireless Edge (AIM:MWE) |

6.53% |

★★★★★☆ |

|

DCC (LSE:DCC) |

3.30% |

★★★★★☆ |

|

Imperial Brands (LSE:IMB) |

7.97% |

★★★★★☆ |

|

Intertek Group (LSE:ITRK) |

2.44% |

★★★★★☆ |

|

Nationwide Building Society (LSE:NBS) |

7.77% |

★★★★★☆ |

|

Dunelm Group (LSE:DNLM) |

6.92% |

★★★★★☆ |

|

Cohort (AIM:CHRT) |

2.47% |

★★★★★☆ |

Click here to see the full list of 49 stocks from our Top Dividend Stocks screener.

We’ll examine a selection from our screener results.

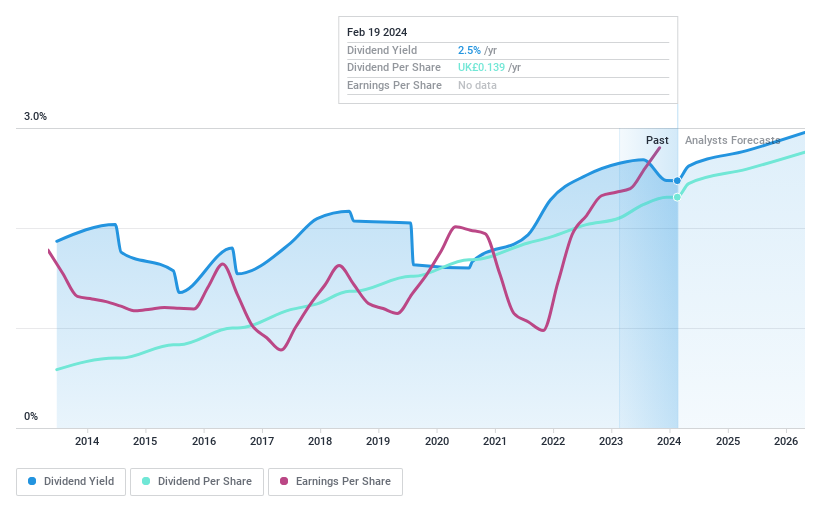

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cohort plc is a multinational company offering a range of products and services in the defense and security sectors across the UK, Germany, Portugal, and various regions including North and South America, Asia Pacific, and Africa, with a market capitalization of approximately £226.2 million.

Operations: Cohort plc generates its revenue primarily from two segments: Sensors and Effectors, which brought in £103.6 million, and Communications and Intelligence, contributing £97.1 million.

Dividend Yield: 2.5%

Cohort plc, a UK-based defense and security company, presents a mixed picture for dividend investors. Although its debt to equity ratio has risen over the past five years, the company maintains a strong cash position with more cash than total debt. Cohort’s earnings have shown consistent growth, outpacing its five-year average in the past year, and both earnings and operating cash flow comfortably cover its dividends. The payout ratios indicate sustainability of dividends; however, its dividend yield is modest compared to top UK dividend payers. Despite this lower yield, Cohort has demonstrated reliability with stable and increasing dividends over the past decade. Forecasted growth in profits and revenue appears steady but not robust when set against high-growth benchmarks.

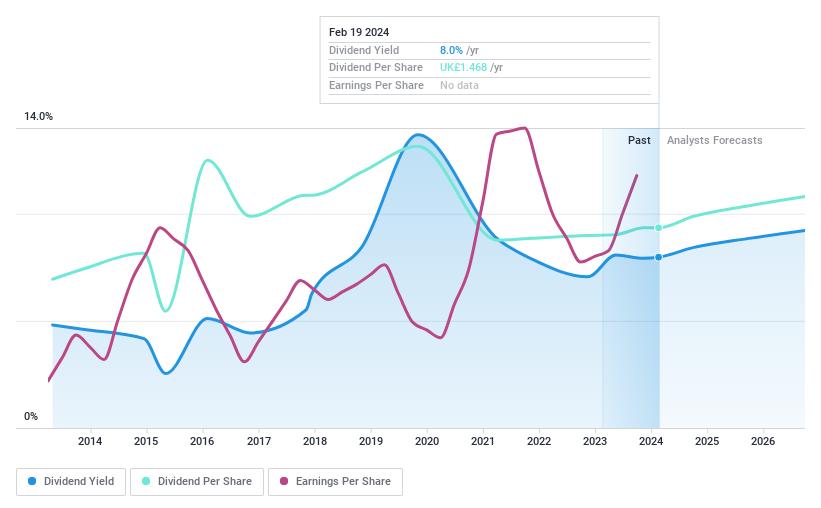

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Imperial Brands PLC is a multinational company engaged in the manufacturing, marketing, and sale of tobacco and related products across various regions including Europe, the Americas, Africa, Asia, and Australasia, with a market capitalization of approximately £15.97 billion.

Operations: Imperial Brands PLC generates its revenue primarily through the distribution of products, which accounts for £10.8 billion, and the sale of tobacco and next-generation products (NGP) across three key regions: Europe at £11.7 billion, Americas at £3.7 billion, and Africa, Asia & Australasia at £6.9 billion.

Dividend Yield: 8%

Imperial Brands offers a nuanced choice for dividend seekers in the UK market. The company has improved its financial health by reducing its debt to equity ratio over five years, alongside a notable uptick in profit margins and accelerated earnings growth in the past year. Cash flow robustly covers debt and sustains dividend payments, evidenced by reasonable payout ratios. While dividends have increased over time, their history of volatility may give investors pause. Additionally, projected revenue declines could cast a shadow over future profitability despite current strengths.

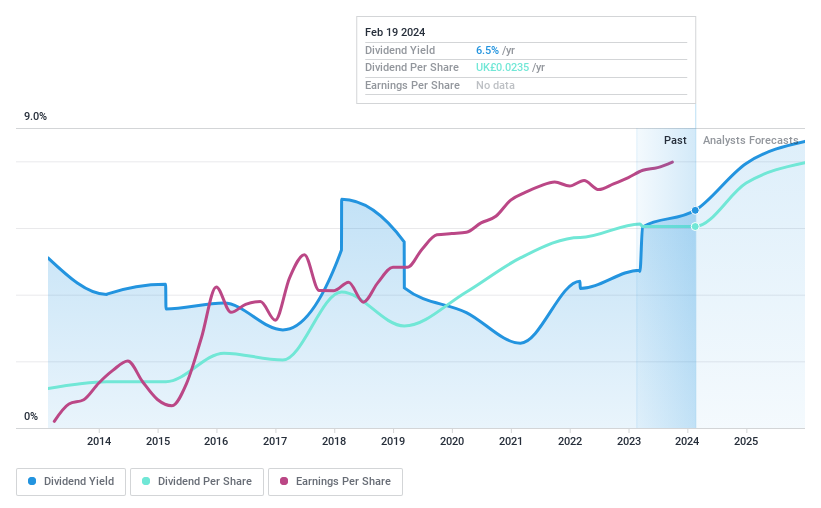

Simply Wall St Dividend Rating: ★★★★★☆

Overview: M.T.I Wireless Edge Ltd. is a company specializing in the design, development, manufacturing, and marketing of antennas for both civilian and military applications, with a market capitalization of approximately £31.7 million.

Operations: M.T.I Wireless Edge Ltd.’s revenue is primarily derived from three segments: Water Solutions at $17.459 million, Distribution & Consultation at $15.999 million, and Antennas at $11.917 million.

Dividend Yield: 6.5%

M.T.I Wireless Edge emerges as a compelling, albeit not top-tier, dividend stock within the UK landscape. The company has fortified its financial position by significantly lowering its debt over five years while consistently growing profits and improving net profit margins. Earnings growth has moderated recently but remains positive. Dividends are well-supported by both earnings and cash flows, with a history of increases despite past volatility. MWE’s dividend yield stands strong in the market, though future growth prospects appear modest.

In Conclusion

The Simply Wall St Screener has been instrumental in pinpointing a selection of UK dividend stocks that could enrich your investment portfolio. Access the full spectrum of 49 Top Dividend Stocks by clicking on this link.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]