Legal & General (LSE: LGEN) shares offer a brilliant dividend income. I already hold the FTSE 100 insurer and asset manager, but I’m tempted to buy more as part of this year’s Stocks and Shares ISA limit. So what if I went all in?

Typically, I’ve been reluctant to go big on just one stock. I bought L&G’s shares on three occasions last year, but invested just £4,000 in total. Maybe it’s time to show more courage in my convictions.

L&G has a blockbuster trailing yield of 8.8% a year. However, I don’t want to get that kind of return for just a year or two. I want to receive it for decades.

I want rising dividends

Ultra-high yields are notoriously vulnerable and dividend cover recently plunged to just 0.4. I like my shareholder payouts to be covered twice by earnings.

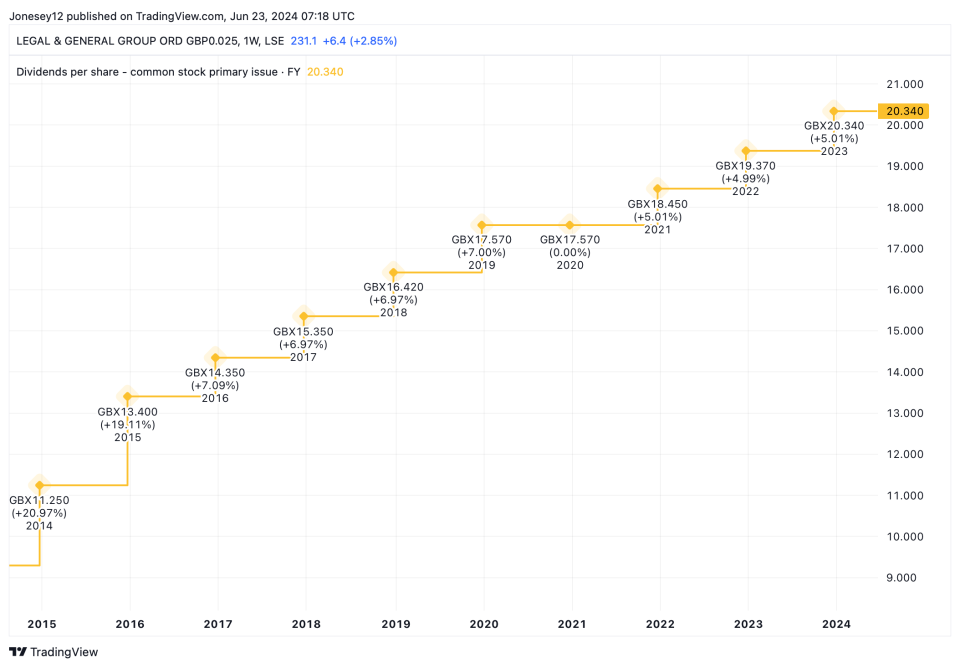

Markets still expect the yield to climb to 9.1% in 2024, with improved cover of 1.1. That’s better, but doesn’t completely set my mind at rest. However, Legal & General does have a strong track record of increasing dividends over the past decade. Let’s see what the charts say.

Chart by TradingView

On 12 June the board set out its dividend strategy from 2024 to 2027. It pledged to hike the dividend by 5% in 2024, then 2% thereafter.

Markets were nonetheless unimpressed. The Legal & General share price has plunged 8.44% over the last month. Even a £200m share buyback – and the promise of more to come – didn’t cheer them up.

The firm has frustrated investors for some time. The shares are down 13.25% over five years. Over the last 12 months, they’re up just 2.48%.

The board is now targeting of 6% to 9% compound annual growth in core operating earnings per share over the next three years, with an operating return on equity of more than 20%. If it fluffs that, investors won’t like it.

The share price should get an automatic lift when interest rates finally start falling. That will make its bumper yield look even more attractive relative to cash and bonds. A stock market recovery would lift financial stocks across the board.

FTSE 100 frustration

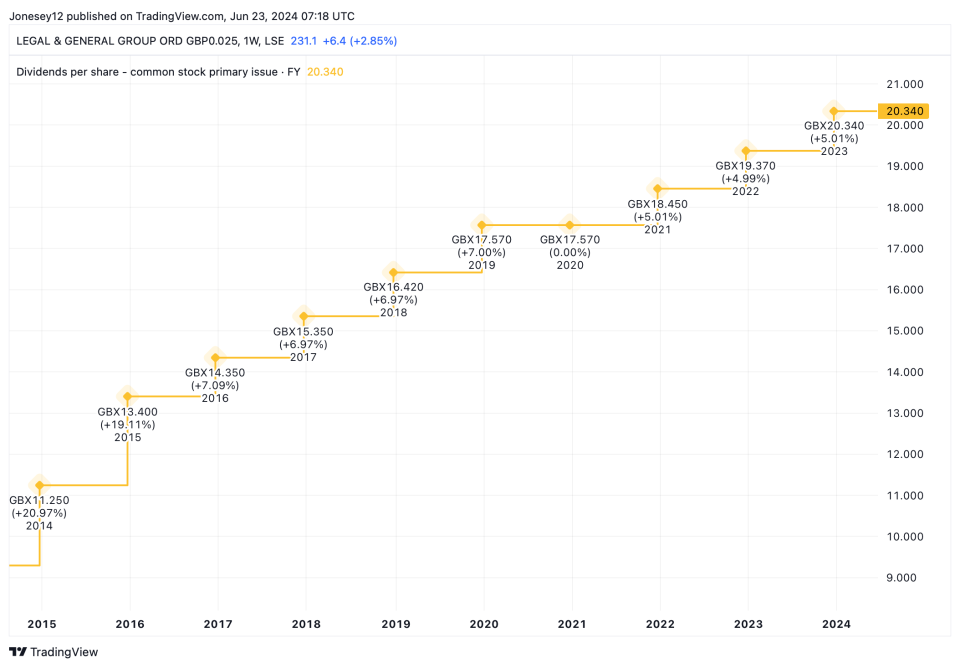

Despite its troubles, the shares aren’t cheap. When I bought them, they traded at around six times earnings. Its price-to-earnings valuation has suddenly rocketed to 33.35 times.

Chart by TradingView

That’s down to a sharp drop in earnings per share from 12.84p in 2022 to just 7.35p in 2023. The board’s turnaround plan had better fix that.

There’s a long-term opportunity for the savings and retirement market, as we can’t rely on the state to deliver a comfortable retirement. Yet Legal & General has struggled to deliver.

If I invested up to my full £20k ISA limit at today’s share price of 232.1p, I’d pick up 8,617 shares. If the 20.34p dividend per share increases by 5% in 2024, I can expect 21.36p. That would give me a stunning passive income of £1,840 a year. Given the risks, I lack the guts to go all in. I’ll stick to investing another £4k.

The post Buying 8,617 Legal & General shares would give me a stunning income of £1,840 a year appeared first on The Motley Fool UK.

More reading

Harvey Jones has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024