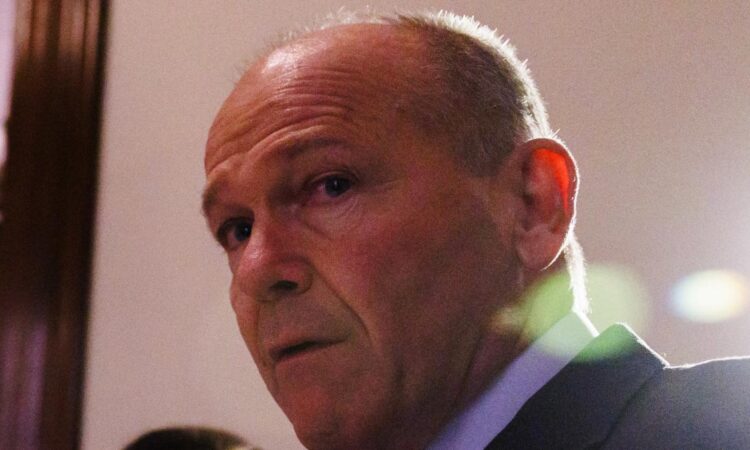

Boeing (BA) CEO Dave Calhoun announces his intention to step down from his chief executive position sometime in late 2024 following federal inquiries into the airline manufacturer’s 737 Max 9 jets.

European Union regulators launch probes into tech giants Meta Platforms (META), Apple (AAPL), and Alphabet (GOOG, GOOGL) over supposed violations of the EU’s Digital Markets Act.

Lastly, stock futures (^DJI, ^IXIC, ^GSPC) are mixed ahead of Monday’s market open to start the final trading week of 2024’s first quarter.

For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.

Editor’s note: This article was written by Luke Carberry Mogan.

Video Transcript

– Let’s get to it with the three things that you need to know, though. For right now, your roadmap for the trading day. Yahoo Finance’s Pras Subramanian, Madison Mills and Josh Schafer have more.

– Hey, Brady. Shares of Boeing moving higher after the company announced CEO Dave Calhoun will step down at the end of the year. Calhoun’s departure comes as the playmaker has dealt with a raft of production issues this year, most notably when one of its 737 MAX 9 planes flown by Alaska Air lost the panel in mid-flight back in January. Along with Calhoun’s resignation, Steve Mollenkopf, former CEO of Qualcomm and Boeing board member since 2020, will lead the company’s search for its next CEO.

– And big tech under fire again. The European Union launching probes into Apple, Alphabet, and Meta on Monday for potential violations of the EU’s Digital Markets Act. Under those new rules, laws designed to prevent tech giants from cornering digital markets by informing customers about alternative offers outside of their main app stores.

Apple, Alphabet, and Meta could be slapped with big fines of up to 10% of the company’s total global turnover.

– In stock futures slipping this morning to start the last trading week in March, but markets are poised to hit a fifth consecutive month of gains, and the S&P 500 is pacing towards double digit percentage gains to cap off a strong first quarter of the year. It’s all about the Bulls on Wall Street right now. Oppenheimer’s John Stoltzfus upping his S&P 500 target to a street high of 5,500, and Goldman Sachs saying it sees a scenario where mega-cap tech could lead the S&P 500 up another 15% just this year.