-

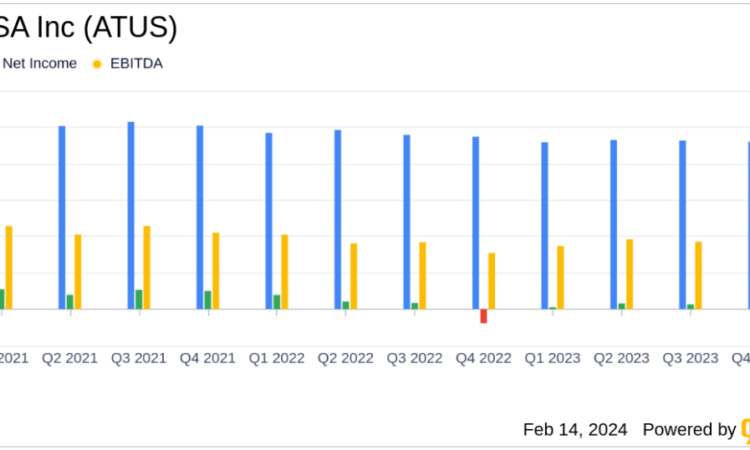

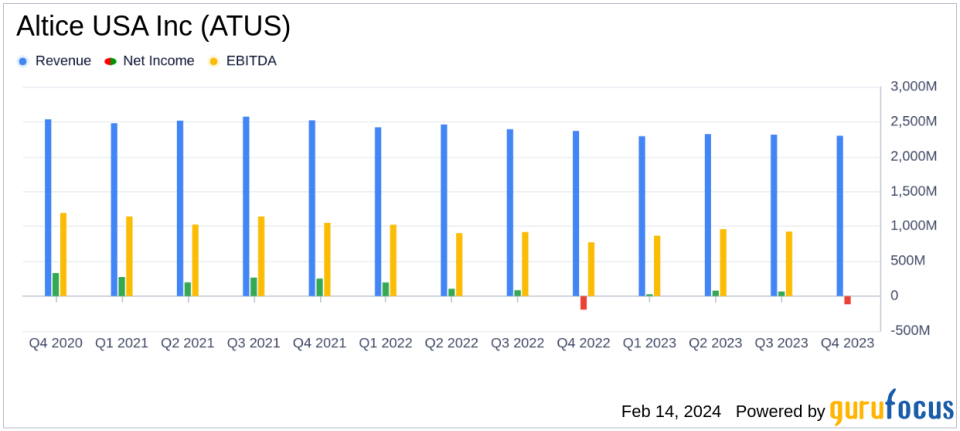

Revenue: Q4-23 at $2.3 billion (-2.9% YoY), FY-23 at $9.24 billion (-4.3% YoY).

-

Net Income: Q4-23 at ($117.8) million, FY-23 at $53.2 million.

-

Adjusted EBITDA: Q4-23 at $903.3 million, FY-23 at $3.61 billion.

-

Free Cash Flow: Q4-23 at $201.0 million, FY-23 at $121.6 million.

-

Fiber Customer Growth: Net adds of +46k in Q4-23, reaching 341k fiber customers.

-

Mobile Growth: Net adds of +34k in Q4-23, reaching 322k lines.

-

Debt Management: Proactive focus with refinancing activities in January 2024.

On February 14, 2024, Altice USA Inc (NYSE:ATUS) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, which operates under the Optimum brand name and owns News 12 Networks, i24News, and Cheddar, has shown signs of operational improvements despite a year-over-year decline in revenue.

Financial Performance and Challenges

Altice USA’s total revenue for Q4-23 was $2.3 billion, marking a 2.9% decrease compared to the same period last year. The full year revenue also declined by 4.3% to $9.24 billion. The company attributes the decline primarily to the loss of higher ARPU video customers over the last year. However, residential revenue per user (ARPU) showed a slight increase in Q4-23, suggesting an improvement in customer value.

Net income attributable to stockholders was negative at ($117.8) million for Q4-23, but positive at $53.2 million for the full year. Adjusted EBITDA for Q4-23 was $903.3 million with a margin of 39.2%, showing a decline of 1.1% year-over-year. The full year Adjusted EBITDA was $3.61 billion with a margin of 39.1%, a 6.7% decline from the previous year.

Operational Highlights and Financial Achievements

Altice USA has made notable strides in expanding its fiber customer base, with a record 46,000 net adds in Q4-23, reaching a total of 341,000 fiber customers. The company also saw significant growth in its mobile segment, with 34,000 net adds in Q4-23, an 8.2x growth year-over-year, reaching 322,000 lines.

Free cash flow was $201.0 million in Q4-23, driven by a reduction in cash capital expenditures in the latter half of the year. The company also proactively managed its debt maturity profile, with refinancing activities in January 2024 aimed at improving its leverage position.

Balance Sheet and Debt Management

As of December 31, 2023, Altice USA’s consolidated net debt stood at $24,422 million, representing a consolidated net leverage of 6.7x. The company has taken steps to manage its debt maturity profile, including issuing $2.050 billion of senior guaranteed notes due 2029 and notifying holders of the intent to redeem 5.250% senior notes due 2024.

“2023 marked the beginning of a transformative journey for Optimum as we drove significant improvements across every area of our business by acting with operational and financial discipline,” said Dennis Mathew, Altice USA Chairman and Chief Executive Officer.

Altice USA’s performance in 2023 reflects a company in transition, with efforts to improve customer experience and network investments beginning to bear fruit. The company’s focus on fiber and mobile growth, along with disciplined capital expenditure and debt management, positions it for potential long-term growth despite the current revenue and income challenges.

For detailed financial tables and further information, please refer to the full 8-K filing.

Investors and potential GuruFocus.com members interested in the telecommunication services industry may find value in Altice USA’s operational achievements and strategic focus on improving its financial health.

Explore the complete 8-K earnings release (here) from Altice USA Inc for further details.

This article first appeared on GuruFocus.