The EU taxonomy for sustainable economic activities (“EU taxonomy”) is an important tool used to redirect investments towards environmentally sustainable activities. This article[4] presents the key findings on the impact that the EU taxonomy and related initiatives could have on European financial markets. We find that, currently, only 1% of the European financial markets finance economic activities that are “green”, i.e. aligned with the taxonomy. We estimate that green instruments could reach about 10% of overall debt financing, with even higher growth potential for green finance in sectors such as transport and buildings.

1 Introduction

The Taxonomy Regulation[5] was adopted in June 2020 as part of the EU action plan on financing sustainable growth published by the European Commission in March 2018.[6] The Taxonomy Regulation sets out the conditions that an economic activity has to meet to qualify as environmentally sustainable under EU law. The EU taxonomy will be further developed as part of the Commission’s strategy to achieve climate neutrality in the EU by 2050, which includes a renewed intermediate target to reduce greenhouse gas emissions by at least 55% by 2030.[7]

The EU taxonomy aims to redirect capital towards sustainable activities, providing for a common language and a clear definition of what constitutes a sustainable activity. It is expected to play an important role in helping the EU scale up sustainable investment. The EU taxonomy provides companies, investors and policymakers with appropriate definitions regarding which economic activities can be considered environmentally sustainable. This is expected to help companies shift investments towards more sustainable activities and to facilitate the transition to a sustainable economy. Although several green taxonomies are being developed globally, the EU taxonomy is the first classification system to be included in financial regulation.[8]

Our findings suggest that currently only a very small share of EU securities is used to finance environmentally sustainable activities. We estimate that only 1.3% of EU bond and equity markets, corresponding to €290 billion, are currently financing activities aligned with the taxonomy for the objective of climate change mitigation. At the same time, around 15% of the market currently finances “eligible” activities, i.e. activities which could become green but are not there yet. These activities that need to transition include some which are particularly harmful. Investors’ exposure to activities of this type, as well as to activities generally related to fossil-fuels, carry a so-called “transition risk”. We estimate such exposures to transition risk at around 5% overall.

Looking ahead, we calculate that green loans and bonds could grow to around 10% of total debt financing. This points to an enormous growth potential for green financial instruments, starting from our status-quo assessment, in particular in sectors such as transport and buildings. At the same time, greening 10% of financial markets appears feasible, meaning that the achievement of EU climate targets could be within reach from a financial perspective.[9]

2 The EU taxonomy: legal framework

The Taxonomy Regulation, which was published in the Official Journal of the European Union in June 2020 and entered into force on 12 July 2020, establishes the basis for the EU taxonomy. It does so by setting out the conditions that an economic activity has to meet in order to qualify as environmentally sustainable. The Taxonomy Regulation establishes six environmental objectives: (i) climate change mitigation, (ii) climate change adaptation, (iii) the sustainable use and protection of water and marine resources, (iv) the transition to a circular economy, (v) pollution prevention and control, and (vi) the protection and restoration of biodiversity and ecosystems.

The Taxonomy Regulation sets out the conditions for an economic activity to be “taxonomy-aligned”. It sets out four conditions that an economic activity has to meet to be considered taxonomy-aligned: (i) make a substantial contribution to at least one environmental objective laid down in the Taxonomy Regulation, (ii) do no significant harm to any other environmental objective, (iii) comply with minimum social safeguards, and (iv) comply with the technical screening criteria established by the European Commission through delegated acts. For each economic activity, the technical screening criteria specify a number of environmental performance requirements that ensure that the activity makes a substantial contribution to the environmental objective in question and does not significantly harm the other environmental objectives.

The Taxonomy Regulation’s delegated acts define the criteria according to which economic activities can be considered environmentally sustainable. The European Commission is developing the technical screening criteria to define what it means to (i) “make a substantial contribution” and (ii) “do no significant harm” to the EU climate and environmental objectives. The first set of technical screening criteria focuses on the mitigation and adaptation environmental objectives. An activity qualifies as substantially contributing to climate change mitigation if it substantially contributes to keeping the average global temperature increase from pre-industrial levels to below 2 degrees Celsius (with the ambition of keeping it to 1.5 degrees Celsius, as set out in the Paris Agreement). On the other hand, an activity qualifies as substantially contributing to the adaptation objective if it includes adaptation solutions that substantially reduce the risk of climate change having an adverse impact on that activity.[10] The technical screening criteria for “do no significant harm” ensure that an economic activity does not hinder the other environmental objectives from being reached, i.e. that it has no significant negative impact on them.[11]

The taxonomy recognises three different types of activities as environmentally sustainable. According to the EU taxonomy, the following activities are considered environmentally sustainable: (i) activities that avoid or reduce emissions, such as zero-emission transport, or that increase GHG sequestration, such as carbon capture and storage technologies, or that use sustainably sourced renewable materials; (ii) activities that enable other activities to make a substantial contribution to one or more objectives, e.g. the sorting of non-hazardous waste so that material can be recovered from this (non-hazardous) waste; and (iii) transitional activities, i.e. activities for which there is no technologically and economically feasible low-carbon alternative, but that have the minimum level of emissions in their sector.[12]

Taxonomy-aligned activities are rather limited for two reasons. First, the EU taxonomy focuses on activities that can make a substantial contribution to environmental objectives, of which there are few considering the whole economy. An activity that is in transition is not (yet) making a substantial contribution, hence it is not green. Second, the technical screening criteria for the “substantial contribution” and the “do no significant harm” conditions are often stricter than the provisions of sectoral legislation, resulting in a very ambitious taxonomy. At the same time, the taxonomy expands the green investable universe far beyond renewable energy, covering a broad range of economic activities in various sectors, including manufacturing, transport, buildings and others. Moreover, the definition of taxonomy-aligned activities for other environmental objectives, which will expand the current set of taxonomy-aligned activities, is ongoing.

Activities that have the potential to become green, but are not necessarily green yet, are called “taxonomy-eligible”. Taxonomy-eligible activities comprise all activities explicitly listed in the Regulation, e.g. electricity generation from wind power, but also the manufacture of cement, aluminium, iron and steel, and chlorine, as well as the construction of new buildings, among many others. These activities are taxonomy-aligned only if they meet the taxonomy criteria. For example, in the case of manufacturing activities, an eligible activity is green only if its CO2 emissions do not exceed a particular threshold. In the case of buildings, green buildings are identified as the top performers in terms of energy efficiency. It follows that eligible activities also include activities that are not green or may even be harmful. Finally, power generation activities from solid fossil fuels are explicitly excluded from being taxonomy-eligible, i.e. they can never become green.

Financial investments are green if they finance green activities. For example, bonds issued for the purpose of financing specific activities are taxonomy-aligned to the same extent as the financed activities. In this case, the main activity of the bond issuer is irrelevant. On the contrary, the taxonomy-alignment of general-purpose loans and bonds, as well as that of equity exposures, is linked to the taxonomy-alignment of the counterparty.[13]

The Platform on Sustainable Finance is working on the taxonomy’s future development. The Platform on Sustainable Finance, a permanent expert group set up by the European Commission under the Taxonomy Regulation, is currently developing a proposal on how to extend the taxonomy to the other four environmental objectives, based on a framework developed by the European Commission’s Joint Research Centre.[14] The Platform is also tasked with advising the Commission on the review of the Taxonomy Regulation and on the extension of the taxonomy to significantly harmful and low impact activities.

3 Estimating the greenness of financial markets

The impact of the EU taxonomy on financial markets will be linked to how much additional investment we need to make to achieve the targets associated with the low-carbon transition in the EU. Alessi et al. (2019) provide an overview of available estimates for relevant economic sectors (such as energy, transport and buildings) at an aggregate level. Updated estimates factoring in the EU’s increased ambition in terms of emission reductions point to increased yearly green financing needs of around €400 billion compared with the 2011-2020 average for climate objectives only.[15]

The impact of the EU taxonomy on financial markets will also depend on where we start from, i.e. the extent to which EU financial markets are currently aligned with the EU taxonomy. To estimate the greenness of euro area capital markets we use confidential security-by-security data on corporate bonds and equities. The main data sources are the Eurosystem’s Centralised Securities Database and the Securities Holding Statistics Database. The latter records which securities are held by which investor, with investors being aggregated at the level of institutional sector (e.g. banks, central governments, etc.). The former contains information on the securities, notably including the issuer’s sector of economic activity, which is essential information for sustainability analysis.

The share of investments currently financing economic activities aligned with the taxonomy is estimated at 1.3%, corresponding to around €290 billion. These are financial investments that already support taxonomy-aligned activities (for climate change mitigation), i.e. contribute to achieving the EU climate targets.[16] The resulting estimate is very small, owing to the fact that the taxonomy focuses on a limited set of economic activities and is restrictive in its technical screening criteria.

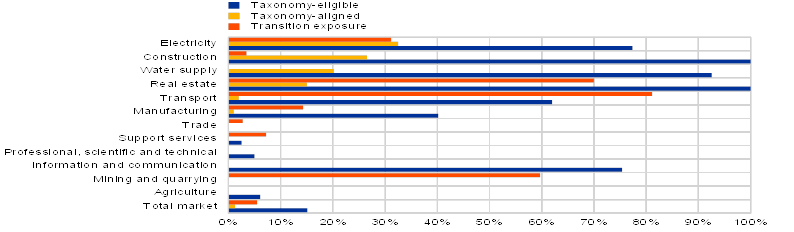

Based on the economic sector of the issuer, unsurprisingly, the sectors attracting the largest green financing shares are electricity production, construction and water supply, sewerage and waste management (see the yellow bars in Chart 1), as these are the sectors where the largest emission reductions can be achieved and, hence, the sectors comprising the largest number of taxonomy-aligned activities. The blue bars in Chart 1 indicate the share of activities in a given sector that are taxonomy-eligible, i.e. covered by the taxonomy, but do not necessarily meet the requirements to be considered green.[17] The taxonomy-eligible share of outstanding securities for the market as a whole is estimated at 15.1%. This share is small because the taxonomy focuses at this stage on activities that can bring a substantial contribution to the sustainability objective of climate mitigation (i.e. activities that can help to reduce CO2 emissions or improve energy efficiency). It should be emphasised that in several sectors the discrepancy between the share of eligible and aligned activities is extremely large.

A related issue is the share of financing currently going to economic activities that will need to be progressively abandoned in the transition, such as those related to fossil fuels, which is estimated at 5.5%.[18] As shown by the red bars in Chart 1, this share is largest in the mining and quarrying sector, followed by the transport sector. In other words, these are the sectors that are most exposed to the risk associated with the low-carbon transition. They include those where the risk of stranded assets is highest.

Chart 1

Investments in EU taxonomy-eligible activities, EU taxonomy-aligned activities and activities exposed to transition risk

(percentage share)

Source: Alessi and Battiston (2021).

Notes: Based on 2020 data. Some sectors in the chart, as well as all of the sectors not shown in the chart, have no taxonomy-eligible share (and hence, no taxonomy-aligned share) as they are not covered by the EU Taxonomy Climate Delegated Act, i.e. no technical screening criteria exist yet for those sectors. For some sectors, technical screening criteria exist (i.e. the share of eligible activities is positive), but owing to the strictness of the criteria, only a negligible (zero) share of the sector is currently taxonomy-aligned.

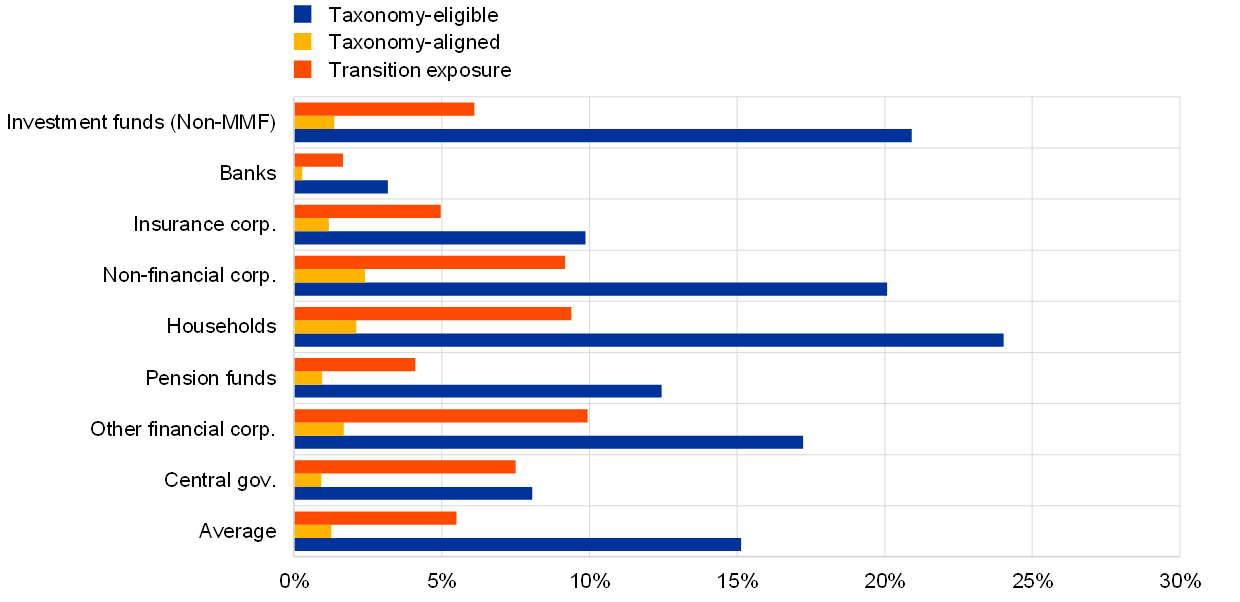

Euro area investors are more exposed to transition risk than to taxonomy-aligned activities. As shown in Chart 2, non-financial corporations (NFCs) hold the greenest portfolio, with a 2.4% share of taxonomy-aligned assets (yellow bars) – although their “greenness” is ultimately assessed based on their business and not on their investments. However, the share of high-carbon assets (red bars) reaches higher levels, e.g. above 9% for households and other financial corporations. For institutional investors, i.e. investment funds, banks, insurers and pension funds, the shares of taxonomy-aligned assets are 1.4%, 0.3%, 1.2% and 0.9% respectively. The estimate of the share of taxonomy-aligned holdings provides a proxy of the green asset ratio (GAR) and the green investment ratio (GIR). Banks will be required to disclose the former and investment funds, insurers and pension funds the latter under the EU Taxonomy Regulation, Article 8, Delegated Act, starting from 2024.The exposure of institutional investors’ investment portfolios to transition risk stands at 6.1%, 1.7%, 5.0% and 4.1% respectively. While these numbers suggest a relatively small exposure to high-carbon activities overall, risks are concentrated in specific countries and investor portfolios.[19] In absolute terms, these shares correspond to a transition risk exposure of around €570 billion for investment funds, €74 billion for banks and €223 billion for insurers and pension funds together – looking only at their holdings of non-financial corporate bonds and equities. These results, which consider neither transition risk exposures via loans, sovereign bonds and other assets, nor contagion and amplification mechanisms, provide a preliminary assessment of the materiality of transition risk. Further research is warranted to assess whether financial institutions, as well as any other institutional sectors, are resilient enough to deal with the transition risks they are exposed to.

Chart 2

Investments in EU taxonomy-eligible activities, EU taxonomy-aligned activities and activities exposed to transition risk

(percentage share)

Source: Alessi and Battiston (2021).

Note: Based on 2020 data.

4 Outlook for green finance

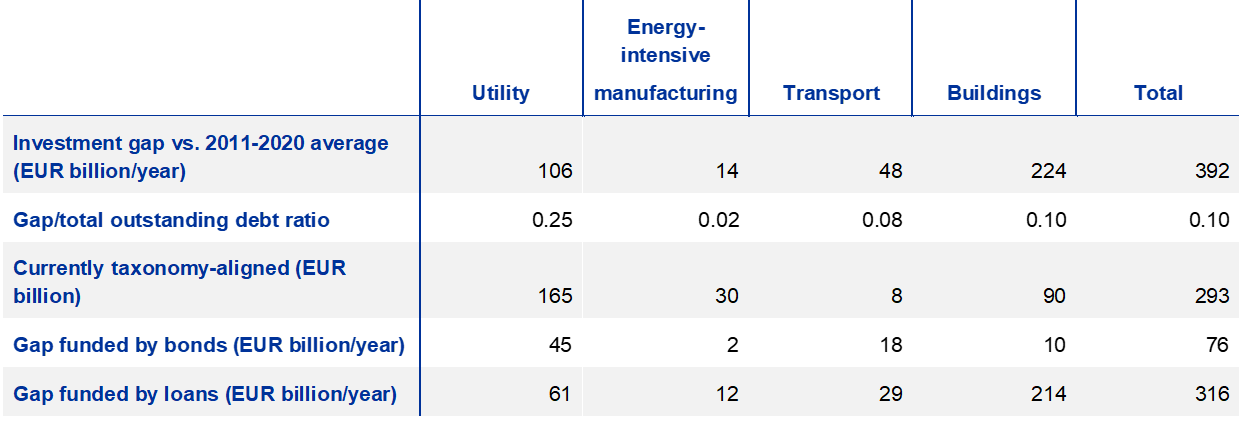

Finally, we estimate the potential growth of European green financial markets. The EU taxonomy will help redirect financial resources towards sustainable economic activities and aims to contribute towards filling the investment gap in the relevant sectors. Our analysis estimates the impact that this could have on financial markets. Table 1 shows the estimated green market expansion across key economic sectors.[20] The amounts correspond to new “green” loans and bonds financing the achievement of EU climate targets. In particular, the table’s first row reports the additional funds needed on top of those already invested in relevant sectors each year. The second row compares the investment needs by sector with the outstanding amount of corporate bonds and loans to NFCs. The last two rows show the amounts of new green bonds and loans that are needed each year to fill the gap.[21]

Overall, additional green bonds and loans amount to 10% of outstanding bonds and loans, with even larger growth potential for green finance in particular economic sectors.[22] Estimates show that bond issuance and borrowing could increase by as much as 25% in the utility sector owing to an increased supply of green financing instruments (see the second row in Table 1). In this sector, estimates show that only €165 billion of outstanding bonds are currently supporting green activities (see the third row in Table 1), while we will need another €106 billion each year. In the energy-intensive manufacturing sector we estimate €30 billion of taxonomy-aligned outstanding bonds, while the additional needs amount to €14 billion per year. Green financial flows are expected to grow much more in the transport (€8 billion versus €48 billion per year) and buildings (€90 billion versus €224 billion per year) sectors.

The increased financial investment needed in the relevant sectors appears to be feasible considering the amount of outstanding loans to NFCs and recent green bond market developments. Looking at the last two rows in Table 1, the largest share of the investment gap is expected to be funded each year by €316 billion in new green loans, together with €76 billion in new green bond issuance. Considering that outstanding bank loans to NFCs in the second quarter of 2021 amounted to €4.8 trillion[23] and that €86 billion of corporate green debt was sold in the EU in 2020[24], the green finance targets seem to be largely realistic.

Table 1

Projected increased financing needs by sector

Source: Update of Table 13 in Alessi et al. (2019).

Notes: The underlying macroeconomic scenario is the MIX scenario in the EU Emissions Trading System impact assessment published in July 2021, while the sectoral disaggregation is based on Table 12 in the Impact Assessment accompanying the European Commission Communication “Stepping up Europe’s 2030 climate ambition: Investing in a climate-neutral future for the benefit of our people”, SWD (2020) 176 final. The amount of loans granted by euro area banks to the transportation and storage sector (H) and information and communication sector (J) are only available at an aggregate level.

5 Conclusion

Our findings suggest enormous growth potential for green finance, particularly in certain sectors. Still, the increased financial investment needed in relevant sectors appears to be feasible. The additional investment needed to achieve the targets associated with the low-carbon transition will imply a huge growth of green finance in the transport and buildings sectors. At the same time, looking at the market as a whole, the increases needed in green financial flows are relatively small based on recent developments in the green corporate bond market and compared with the large amount of outstanding loans to NFCs. This also means that filling the investment gap is compatible with a reasonable increase of the exposure of institutional investors, via bond holdings and loans, to firms in the relevant sectors.

Several policy actions are being implemented, which will make it easier for financial market participants to channel their investments to taxonomy-aligned activities. For example, the introduction of an EU Green Bond Standard will make it possible to identify those green bonds that only finance taxonomy-aligned activities. An EU Ecolabel will be awarded to the best environmentally performing retail financial products, such as investment funds, also taking into account the share of underlying investments in taxonomy-aligned activities. Finally, mandatory disclosure requirements will increase transparency on the taxonomy-alignment of borrowers and investee companies. On this front, though, more work is needed to develop simplified disclosure standards for SMEs. Further work is also needed to develop a “common ground taxonomy” at the international level, which will make it easier to assess investments in non-EU companies.

References

Alessi, L., Battiston, S., Melo, A.S. and Roncoroni, A. (2019), “The EU Sustainability Taxonomy: a Financial Impact Assessment”, Technical Report, European Commission – Joint Research Centre.

Alessi, L. and Battiston, S. (2021), “Two sides of the same coin: Green Taxonomy alignment versus transition risk in financial portfolios”, Working Paper, European Commission – Joint Research Centre, forthcoming.

Battiston, S., Mandel, A., Monasterolo, I., Schuetze, F. and Visentin, G. (2017), “A climate stress-test of the financial system”, Nature Climate Change, Vol. 7, pp. 283-288.

Born, A., Giuzio, M., Lambert, C., Salakhova, D., Schölermann, H. and Tamburrini, F. (2021), “Towards a green capital markets union: developing sustainable, integrated and resilient European capital markets”, Macroprudential Bulletin, Issue 15, ECB.

Canfora et al. (2021), “Substantial contribution to climate change mitigation – a framework to define technical screening criteria for the EU taxonomy”, EUR 30550 EN, Publications Office of the European Union, Luxembourg.

European Central Bank (2021), “Climate-related risks and financial stability”, ECB/ESRB Project Team on climate risk monitoring, July.