With a dividend yield at the highest level for 10 years, Legal & General (LSE:LGEN) shares look like an obvious buy for passive income investors. Along with the big dividend yield, the company has a good record of returning cash to shareholders.

With interest rates set to fall, it’s likely to be more difficult to find investment opportunities in the next few years. So should investors jump at the chance of 8.8% per year in dividend income?

Dividends

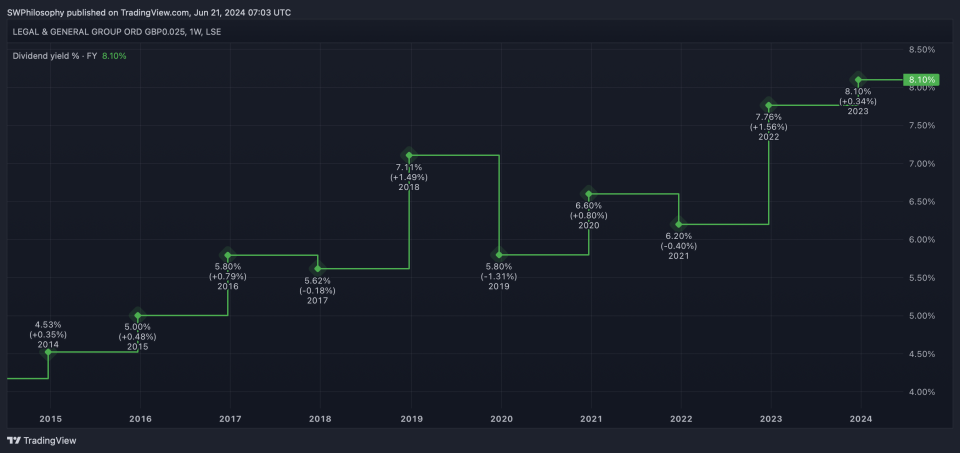

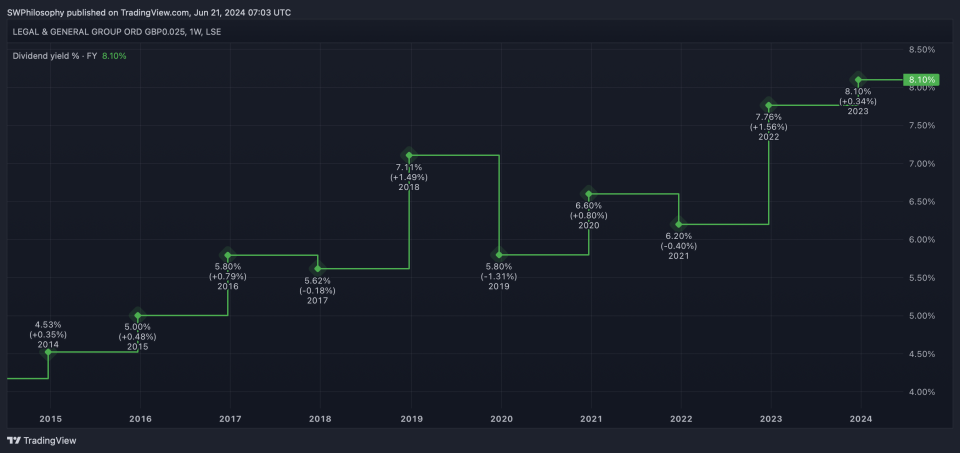

Legal & General has a strong track record when it comes to dividends. Over the last decade, the company has increased its annual distribution to shareholders every year except one.

Legal & General dividends per share 2014-24

Created at TradingView

The exception is 2020, during Covid-19. I view that positively, though, as the firm’s management at the time was focusing on running the business in a responsible way.

There was a lot of uncertainty during the pandemic around potential losses from business interruption claims. Increasing the dividend during this time would have been risky.

While the company has a strong record of increasing its dividend, it’s arguably even better than it looks. The distributions have been growing but without taking unnecessary risks.

Risks

It’s probably worth emphasising the word ‘unnecessary’ in that last paragraph, though. The insurance business is all about risk and Legal & General is no exception.

One of the biggest challenges is inflation. When insurers write policies, they have to try and figure out what the future cost of a claim might be – and rising prices bump this up.

With car insurance, this isn’t so bad. Policies typically last a year and then insurers get the opportunity to reassess what the proper rate should be given the likely costs.

In life insurance, policies last for decades. And if inflation comes in higher than expected over the long term, Legal & General could have to pay out much more than it anticipates.

A once-in-a-decade opportunity

Neither Legal & General nor its shareholders can do much about inflation. In both cases, the best they can do is make sure they’re adequately compensated for the risks they take on.

For the business, that means setting prices to reflect the chance of higher future costs. And for investors, it means buying the stock only when there’s a big enough return on offer.

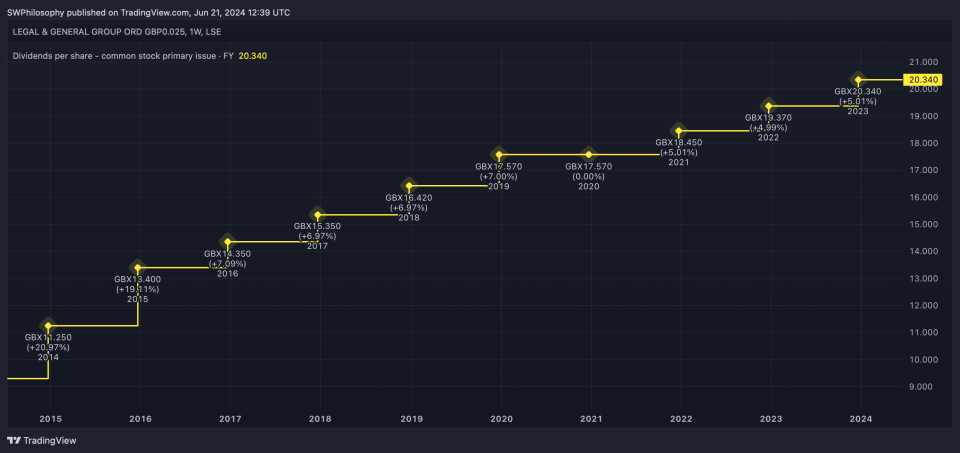

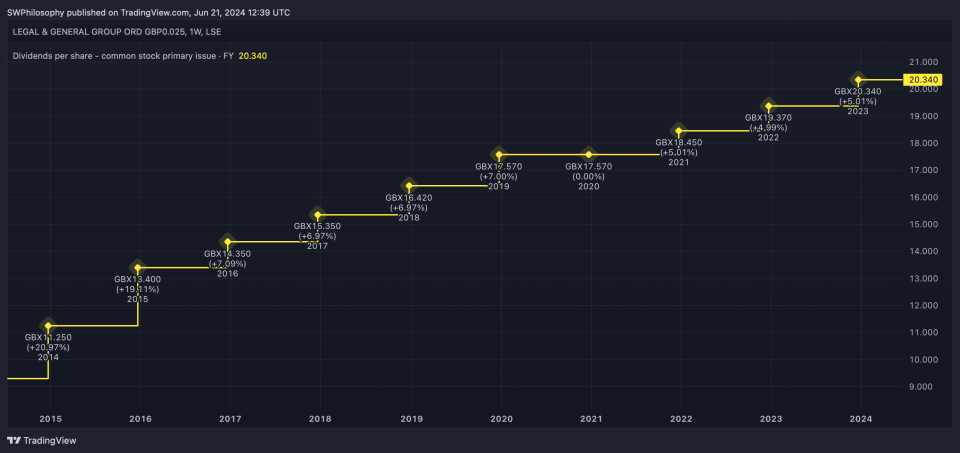

Legal & General dividend yield 2014-24

Created at TradingView

That time might be now – Legal & General shares currently come with a dividend yield of 8.8%. Barring a few share price fluctuations, that’s the highest it’s been for a decade.

With interest rates looking likely to come down from here, I’m not expecting the stock to stay at this level for long. So I think this could be a rare opportunity for passive income investors.

Risks and rewards

Insurance is all about assessing risks and being willing to take them when the compensation on offer for doing so is adequate. And it’s the same when it comes to investing.

Whether the Legal & General share price fully reflects the risk of inflation is impossible to say with certainty. But an 8.8% dividend yield helps push the odds in favour of investors.

The post Legal & General shares: a once-in-a-decade passive income opportunity? appeared first on The Motley Fool UK.

More reading

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024