The girl power economy is set for a slowdown.

A combination of the Barbie movie plus Taylor Swift and Beyonce tours helped drive surprise growth in the US economy this summer. In aggregate, the concerts and blockbuster movie are expected to add $8.5 billion to US growth in the current quarter, per Morgan Stanley, good for more than a third of the growth in consumption the firm projects in the third quarter.

But their wind-down in the final quarter of the year could contribute to a personal consumption slowdown economists have been waiting for.

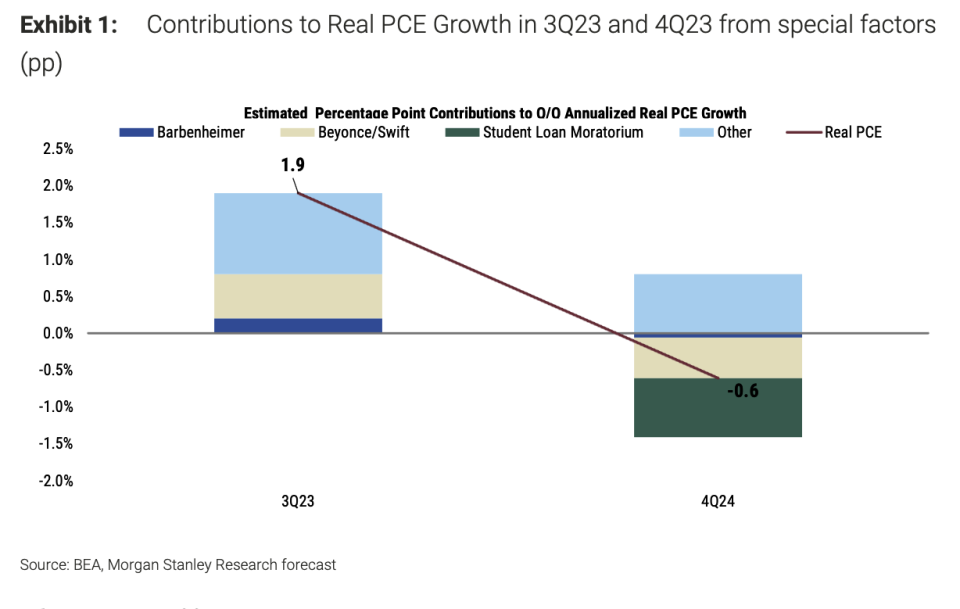

“Consumer spending in 3Q23 is benefitting from large one-offs in consumer spending on ‘Barbenheimer,’ Taylor Swift’s ‘The Eras’ tour, and Beyoncé’s ‘Renaissance’ tour,” Morgan Stanley economist Sarah Wolfe wrote in a note on Wednesday. “The unwinding of these events, combined with the expiration of the student loan moratorium equal 1.4% downside to real [Personal Consumption Expenditures] in 4Q23.”

In July, Barbie and Taylor Swift’s Eras Tour earned a shoutout from Federal Reserve Chair Jerome Powell about the resilient consumer. A day later, Bank of America noted “Barbenheimer,” the double feature of “Barbie” and “Oppenheimer,” likely drove increased weekly consumer spending during opening weekend, per BofA data. Swift’s tour alone likely raked in $2 billion in North America ticket sales alone, per CNN Business.

But Swift’s tour is already over in North America. And sales at the theater traditionally fade the longer a movie is out. As for Beyonce, her tour ends on Oct. 1, the first day of the fourth quarter. Morgan Stanley expects the absence of these “one-off significant lifts” to provide a hangover effect on consumption in the final three months of 2023.

Just as the “Barbie” boom helped explain the better-than-expected economy during the summer, its absence could help explain what many economists believe will be the story of the fall and winter: a consumer slowdown.

Economic indicators out this week have shown signs of softening in the labor market, which is seen as a driver for consumer spending. Job openings in July fell below 9 million for the first time in more than two years, and a consumer confidence survey revealed Americans are feeling more wary about the labor market.

The labor market cooling comes as economic growth in the second quarter was revised downward from 2.4% to 2.1% on Wednesday.

“Incoming data for Q3 show an economy that has continued to expand, but with signs of some moderation,” Wells Fargo economist Shannon Seery wrote in a note to clients on Wednesday. “We continue to expect the economy to gradually slow during the second half of the year.”

Other economic headwinds

While Morgan Stanley isn’t the only firm highlighting the end of the the Taylor Swift tour as an economic downer, there will be other tangible challenges in the back half of the year. Oxford Economics Chief US economist Ryan Sweet noted that tighter lending standards and the expected drag from fiscal policy will be the catalysts driving a slowdown to end 2023.

Additionally, the student loan moratorium is set to end on Oct. 1, which will impact 26.6 million borrowers, per Morgan Stanley. While a provision implemented by President Biden could help some students wait another year to pay, Morgan Stanley estimates a 0.8 percentage point drag on real PCE growth in the fourth quarter from the revival of student loan payments.

Without one-off events to counteract the student loan headwinds, Morgan Stanley sees the economy inching economic growth at a pace of 0.1% in the fourth quarter.

So while eye-popping sales from dominant entertainment figures became the story to explain how the US economy surprised during summer 2023, the moment isn’t expected to last. And the post-pandemic economy will shuffle into its next era of consumption in search of a new catalyst to keep consumer spending out of “trouble.”

Josh Schafer is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance