Yahoo Finance’s Jared Blikre breaks down the importance of Credit Suisse’s and Deutsche Bank’s health in regard to the U.S. economy.

Video Transcript

DAVE BRIGGS: The latest chapter of the ongoing bank saga features issues plaguing European banks. Credit Suisse was rescued by rival Swiss bank UBS amid a collapse while German-based Deutsche Bank shares plummeted as the cost of insuring the bank’s debt against default leapt to multi-year highs. But why does it matter for the US?

SEANA SMITH: Our own Jared Blikre has all the answers for us. Jared, break it all down.

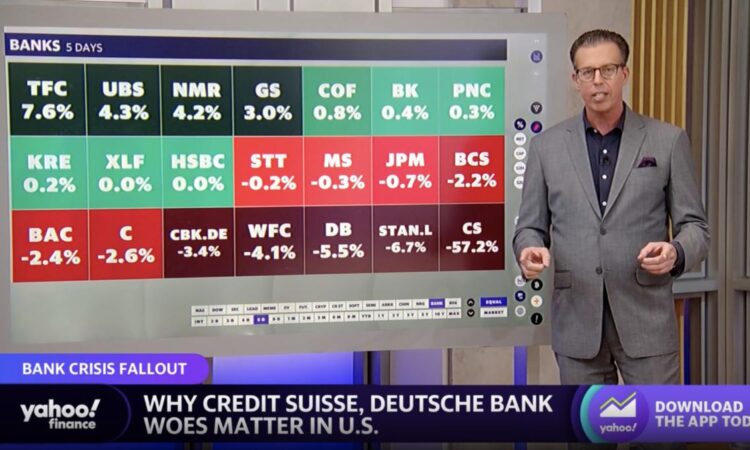

JARED BLIKRE: Oh, with that kind of pressure, let’s begin here. This is– first of all, this is the Euro Stock Banks Index. The SX7E, as they call it, you can see down 4 and 1/2% for the week. Banks are supposed to be boring. That is a very big number. Now, let me show you what’s happened. This is our banking heatmap in the US and also abroad. And you can see kind of a mixed bag here where a lot of the names on the top shelf here are the tried and true US names, which haven’t been affected this week.

And then on the bottom, we have Credit Suisse down 57%. Of course, it was bought by UBS, or that’s in process. Deutsche Bank down 5 and 1/2%. Why does this matter to the US? Because when the banks catch a cold– or is that a sneeze? When the banks sneeze, the rest of the economy, the rest of the sectors, they catch a cold. My point is here, this has the potential to spread into the other areas of the economy. But in the US, we’re specifically looking at the regional banks.

Now, the bigger banks have been ring fenced by Dodd-Frank, and there have been exceptions to the rule that have been given to some of the regional banks. So we have seen them suffer disproportionately. At the end of the day, it has to do with interest rates mismatch. These regional banks and even the big ones are only giving investors half a percent to 1% of their savings account. Meanwhile, investors have figured out if they go to money market funds, they can get 5%. Or Treasury bills, they can get 4 and 1/2% to 5%. So huge mismatch there, and as long as that continues, we’re going to see continued deposit outflows from US banks.

Now, the Federal Reserve has backstopped this. They have issued a new– or they have created a new facility to help this situation. But by no means could this necessarily contain all of the potential contagion. And in fact, there are a lot of unknowns at this point. And so that’s what we’re working up against. Now, going forward the Fed has kind of indicated that they’re going on pause here. Now, that could be good for the markets. It could be bad for the markets. We’re going to have to see.

But in the meantime, we’re going to keep our eyes on the banking sector. And especially on those credit default swaps, which we really haven’t talked about in 15 years, those levels have been elevated in certain European banks. We’re going to see if that spreads to the US. Let me just show you a couple of charts here, and this kind of illustrates what I’ve been saying. These are some tweets that I got from Jim Bianco over at Bianco Research earlier this morning.

And the first here– let me see if we can pull this up. There we go. This is the Fed’s balance sheet. This is reflecting that new facility. Remember, this is the QT effect. This is the Fed winding down its balance sheet. But with the new facility, guess what? Banks are using the emergency lending part. And as long as they’re using the emergency lending part, that has a potential to slow down the economy the same way that interest rates do.

So financial instability, banking panics have the same effect on the economy or a similar effect as interest rate increases. And that’s kind of what Jay Powell and the Fed are banking on right now. So with that– having said that and having thrown out some confusing terms from the global financial crisis, I’m going to send it back to you guys.

SEANA SMITH: No, you did a great job.

JARED BLIKRE: I appreciate that.

SEANA SMITH: You unpacked it all for us. There’s a lot– there’s a heck of a lot that went on in the markets this weekend, specifically in the banking sector. So Jared, great job. Thanks so much.