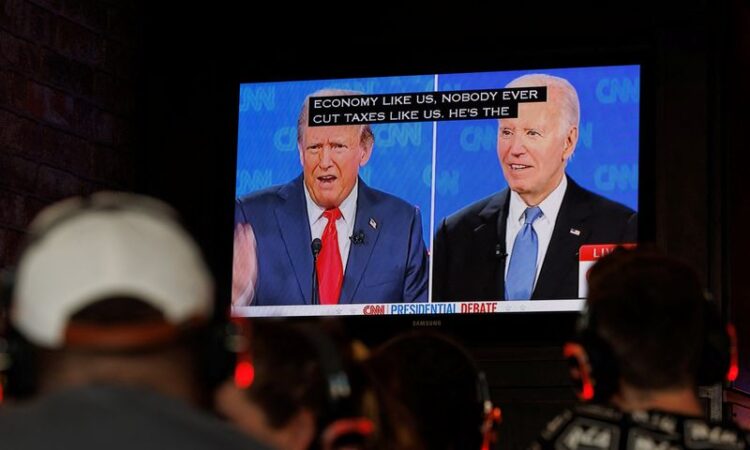

It appears that President Joe Biden and Donald Trump are poised to face each other in a presidential rematch, with expectations of the Senate turning Republican and the House turning Democrat. The contrasting economic policies of the two candidates will have significant implications for trade, fiscal policy, immigration, industrial policy, and antitrust enforcement.

Under a potential second Trump administration, the US is expected to adopt a more protectionist stance. Trump has proposed aggressive tariff policies, including a 60% tariff on all Chinese imports and a 10% universal tariff on all imports.

According to JPMorgan strategists, these measures are expected to raise significant customs revenue but also increase consumer prices by around 1.1% and 1.5%, respectively.

“Going from a static to a dynamic calculation would likely change the results for the Chinese tariff more dramatically, as it may be easier to substitute away from China to other low-cost producers than to substitute away from imported products altogether,” analysts said in a note.

When it comes to fiscal policy, analysts pointed out that President Biden’s approach includes extending the Tax Cuts and Jobs Act (TCJA) provisions for individuals earning under $400,000 while reverting to higher rates for those earning more.

Biden also aims to increase the corporate tax rate from 21% to 28% and raise the Global Intangible Low-Taxed Income (GILTI) tax rate to 21%.

On the other hand, the Trump campaign has been less specific about its fiscal policy strategy. Trump has said he favors a “middle class, upper class, lower class, business class big tax cut.”

On immigration, the candidates’ policies diverge sharply. Biden has tightened border entry rules but maintained firm immigration numbers, while Trump has vowed to shut the southwest border “and begin large-scale deportations of unauthorized immigrants already in the country,” the note states.

On the industrial policy front, the Biden administration’s support for green transition through the Inflation Reduction Act (IRA) and the CHIPS Act has spurred substantial investments in semiconductor and clean tech manufacturing.

“This has been a crucial support to business investment outlays in what would otherwise be a challenging capex environment,” JPMorgan noted.

A second Trump administration, however, could pose risks to this spending by opposing the green transition, potentially hindering investment in these critical areas.

Still, analysts said their energy research colleagues see this as manageable due to two factors: a full repeal of the IRA would require a Republican sweep, which is unlikely, and much of the IRA and CHIPS Act spending occurs in Republican counties, possibly softening their opposition.

Another area that will likely be differently impacted depending on who wins the election is antitrust enforcement. Biden has taken an aggressive approach, targeting major tech companies like Google (NASDAQ:) and Meta (NASDAQ:). In contrast, a Trump administration is likely to adopt a more lenient stance, analysts said, potentially reducing regulatory pressures on large corporations.