The Bank of England has just announced that it is raising interest rates from 3.5% to 4%.

The news offers some insight into where the UK economy is right now, as the cost of living crisis continues and we teeter on the edge of a recession.

Here’s what you need to know.

Why does the Bank of England’s announcement matter?

The Bank is the UK’s central bank charged with managing the overall economy, and independent of the government.

It released its quarterly Monetary Policy Report today, setting out its economic analysis and inflation projections for the UK, along with its new interest rate.

The Bank has to manage inflation – the rate at which prices rise – and tries to keep it at a level of 2% at all times. This rate would allow the economy to grow, but not mean prices spiral out of control.

When inflation veers away from the 2% target, the Bank uses interest rates to try and rein it back in.

Why is the latest announcement so important?

The UK economy is in a precarious state right now.

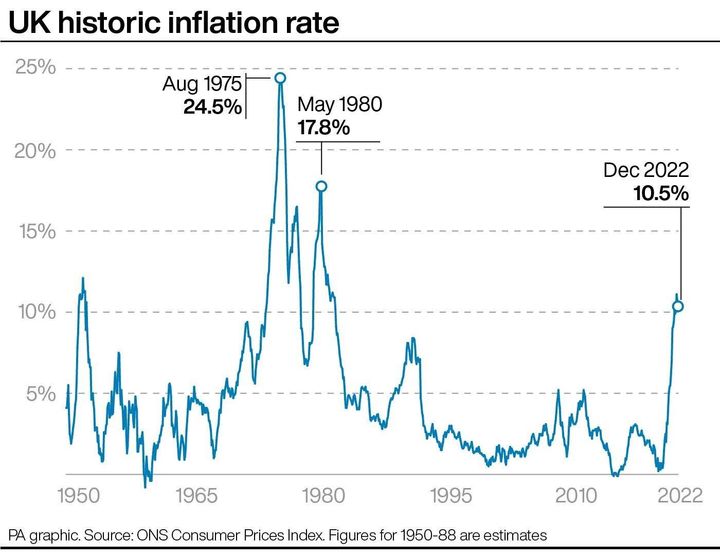

The cost of living crisis has continued, with energy bills still high and grocery prices driving inflation to 10.5%.

Although that is a small decrease from the peak of 11.1% in October, it’s still far from the ideal inflationary rate of 2%.

The International Monetary Fund (IMF) also predicted this week that the UK will perform worse than every other major country in 2023, including Russia, with the economy shrinking by 0.6%.

This new announcement from the Bank is the 10th consecutive time it has increased the interest rates.

The Bank also said: “Global consumer price inflation remains high, although it is likely to have peaked across many advanced economies, including in the United Kingdom.”

The Bank pointed out that the recession – two quarters of negative growth – will be shorter than previously expected.

It said the economy will “fall slightly” in 2023 as energy costs and other prices ease.

It admitted that inflationary pressures have been “firmer” than expected, with inflated prices still at a 40-year-high, but predicted that rates will slow this year with firms potentially holding back on redundancies.

What are interest rates?

An interest rate is the amount it costs to borrow money.

Although it’s not mandatory for other banks to copy the Bank’s interest rate, it does usually influence the saving and borrowing rates charged by those on the high street.

Interest rates are decided by the Monetary Policy Committee, a team of nine economists who work for the Bank of England and who meet eight times a year.

The last increase occurred only in December, when the rates climbed from 3% to 3.5% – yet another noteworthy increase, the highest rate for 14 years.

This increase was voted for by a majority of 7-2 members of the MPC.

What does it mean if interest rates change?

If interest rates go up, that means people are encouraged to spend less.

Mortgage rates become more expensive, meaning homeowners will have to pay lenders more money each month.

The same happens with credit card debt and bank loans, though savers will be able to get more money back on the amount they keep in their accounts (they are considered the only “winners” when interest rates rise).

Generally, if interest rates rise, it means your living costs climb.

if interest rates go down, those with savings will earn less on their money, but it will also cost less to borrow money.

That means it becomes an ideal time to take out a mortgage, a car loan, businesses might look to expand or take on more employees.

What has happened to interest rates in the past?

These rates in the UK used to be much higher, but the financial crash meant they were slashed to reduce the fall-out. They’ve been at historically low levels since, and during the pandemic, they dropped to 0.1%.

This number has stayed low for the last 14 years, and only last year did it creep back up to late 2008 levels.

PA Graphics via PA Graphics/Press Association Images

What does the Bank think will happen next?

More rate rises are expected, but there’s a belief that it will peak in the summer at 4.5%, meaning today’s announcement is almost at the highest amount.

The Bank won’t want to go much higher than that out of fear of damaging the economy as we teeter on the edge of a recession.

There were fears that Liz Truss’s mini-budget would have taken interest rates even higher, but those seem to have dissipated.

Now, the Bank expects inflation to fall sharply from mid-2024, with interest rates declining to “just over 3.25% in three years’ time”.

: 1.4%

: 1.4%  : 0.1%

: 0.1%  : 0.7%

: 0.7%  : 0.6%

: 0.6%  : 1.8%

: 1.8%  : -0.6%

: -0.6%  : 5.2%

: 5.2%  : 6.1%

: 6.1%  : 0.3%

: 0.3%  : 1.2%

: 1.2%  : 1.7%

: 1.7%  : 2.6%

: 2.6%  : 3.2%

: 3.2%  : 1.2%

: 1.2%