T’was the first of December, and all through this house, the creatures are stirring because someone forgot to buy advent calendars.

As well as the start of the countdown to Christmas though, in the FAI we also have our exciting countdown to our annual Scotland’s Budget Report! This is being released in a fortnight, on 15th December, and will set out the context for the Scottish Budget which will be presented to Parliament on 19th December.

On Monday, we begin the exciting 12 days of Scotland’s Budget report, with a series of blogs to build up to the big day. Who wants chocolate every day when you could have that?*

You can see all of our publications in the run-up to the report here. Happy Fiscalmas!

Scotland avoids recession in Q3

Wednesday saw the release of bumper set of economic statistics by the Scottish Government – the annual economic accounts (the Supply and Use and Input-Output Tables), September’s GDP, and Export Statistics Scotland for 2020 and 2021.

For the uninitiated, the Supply and Use and Input Output tables are one of the most useful publications that the Scottish Government produces (well, from the point of view of economic analysis). They set out the linkages between all of the sectors in the economy, and are the way we analyse and understand supply chains in Scotland. These are the heart and foundation of Scottish Economic Accounts.

More headline-grabbing though was the monthly GDP figures for September, which showed that the Scottish Economy grew by 0.1% in September, and by 0.4% over the quarter as a whole. This means that Scotland has avoided a technical recession following the contraction in Q2.

Compared to the UK, which had flat (or rather, no) growth in Q3, Scottish growth looks rather buoyant. However, let’s not get too excited – the poor performance in July in the UK was driven by public sector strikes, rather than a real difference in economic performance.

There are some interesting trends in Scotland vs UK particularly compared to pre-pandemic levels – we’ll be analysing these in the coming days. Whilst the growth compared to pre-pandemic levels is roughly the same for both UK and Scotland in aggregate, the sectoral story is very different.

Scottish Exports have not recovered to pre-pandemic levels

After a big (pandemic induced) gap, it is really welcome to see the publication of Export Statistics Scotland, providing data for 2020 and 2021.

Despite a small increase in 2021 to £31 billion, the value of Scotland’s international exports remained lower than before the pandemic (12% lower than in 2019). Exports to the EU comprised just under half of international exports and was also 12% lower than in 2019. In contrast, the value of Scotland’s exports to the rest of the UK was 4% higher in 2021 vs 2019.

Exports to the rest of the UK valued an estimated £49 billion and accounted for the majority (61%) of the value of Scotland’s total exports in 2021.

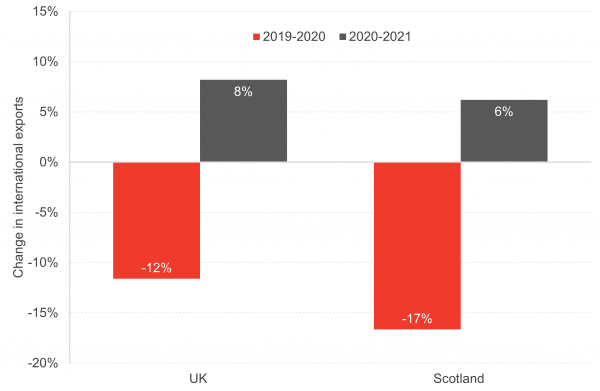

Interestingly, when we look at comparable UK data, international exports in Scotland decreased comparatively more than the UK as a whole during the pandemic, and have been slower to recover.

Chart: UK & Scotland International Exports Growth 2019 to 2020 and 2020 to 2021

Source: ESS

Look out for more analysis of ESS in the coming days!

Building a New Scotland series continues

In the last few weeks, the Scottish Government has published more of their prospectus for an Independent Scotland. This has included:

It feels a little like these papers are struggling to get traction and attention given the prospect of a referendum seems very distant, and of course there is so much else going on in the world. From the first two of these we learned that the vision for Scotland after independence would be more welcoming to immigration and refugees, and that a priority for an independent Scotland would be to join the EU. This is not surprising and fits very much with previous statements from the SNP Government. Indeed, it is difficult to see what is really new in these papers. There is a lot of content, of course, which explains the benefit of both of these approaches.

It is easy just to point to what was missing from such publications– but there were omissions and sleights of hand in the EU Paper. In our response over a year ago to the economic paper – A Stronger Economy with Independence – we highlighted there was no attempt to deal with the challenges of the Scottish fiscal position in the years following independence, given there is currently much higher spending taking place than revenues generated in Scotland. The issue was simply glossed over.

We were disappointed that the EU paper continued this trend. There is a section about the sort of conditions that may be set out by the EU to reduce the deficit in Scotland as a condition of membership. Instead of setting out what the approach would be, the paper simply refers back to the economy paper – which did not deal with the issue at all.

The other sleight of hand was on trade statistics, which implied that despite the fact that Scotland trades more with the rest of the UK than with the EU, UK trade was more dominated by services so frictionless trade with the EU in goods was more important.

It is true that, AS A PERCENTAGE, the trade with the rest of the UK is more dominated by services. However, in absolute value terms, manufacturing trade for 2021 for the rest of the UK is still bigger than trade with the EU (£12bn vs £8bn). Whilst these up-to-date figures were not available at the time the paper was published, not including any figures is not a great approach, and overly downplays the importance of trade with the rest of the UK. Indeed, it may have been better to wait until these new figures were available, as the Government were aware they were coming.

This series of papers must start dealing with challenges, and how they will be handled, as well as opportunities, if it is going to appear as a credible prospectus.

Statistical Refinement

A big Scottish economic story which got a little overshadowed by the Autumn Statement last week was the announcement that Grangemouth refinery would cease refining petroleum by 2025, and move to importing, with the net loss of 400 jobs.

A statistic which was widely used in the media at the time was the claim by Petroineos that Grangemouth’s refining operations were responsible for 4% of Scottish GDP. This statistic is not correct so we took to X to point this out!

While we’re busy analysing the Autumn Statement, I just wanted to do a quick thread one of the figures that has been referenced in relation to the news that Grangemouth is to stop refining petroleum in 2025, with the possible net loss of 400 jobs. 1/

— Mairi Spowage (@MairiSpowage) November 22, 2023

*This is an argument which was not popular in the Spowage household this morning…

Calum is an Associate Economist at the Fraser of Allander Institute (FAI) and a Researcher at the Centre for Inclusive Trade Policy (CITP). He regularly contributes to key FAI publications like the quarterly Economic Commentary and the Scottish Business Monitor, as well as lectures on Strathclyde’s Applied Economics Master’s programme. At the CITP, Calum specialises in regional trade measurement and modelling using national accounts, with a particularly focus on the distributional impacts of trade. Calum holds an MSc in Economics from the University of Edinburgh.