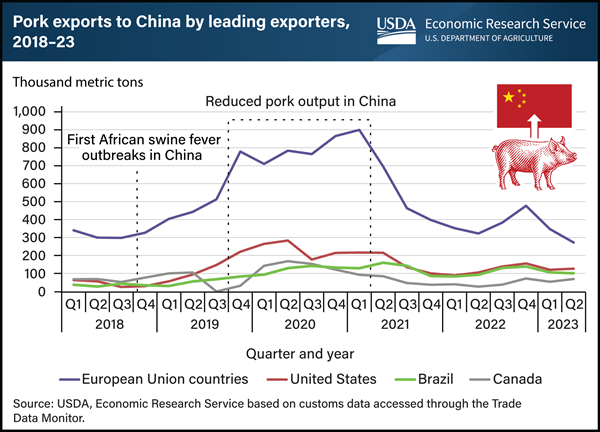

The 2018 spread of African swine fever (ASF) to China had reverberations in the global pork market. ASF—a virus often fatal to swine—caused an estimated loss of 27.9 million metric tons in China’s pork output from late 2018 to early 2021 and led to a doubling of China’s domestic pork prices. These high prices attracted a surge of pork exports from four major suppliers—the European Union (EU), United States, Brazil, and Canada. While the EU was the top supplier, U.S. pork exports were sizable and reached a record high of more than 287,000 metric tons in the second quarter of 2020. After surging, exports by all suppliers began declining during 2021 as China’s domestic production rebounded and associated prices plummeted. According to a recent report from USDA’s Economic Research Service (ERS), pork exports to China might have increased even more during the ASF outbreak if not for several factors. Specifically, China banned pork from some EU countries that also had ASF outbreaks. In addition, U.S. pork faced high retaliatory tariffs because of trade tensions, and China rejected some Canadian pork shipments. Also, during the COVID-19 pandemic, China launched stringent inspections of foreign meat suppliers and required decontamination of meat at Chinese ports. In aggregate, pork imports replaced about an estimated one-fifth of the domestic pork supplies lost in China during the ASF epidemic. Official data indicate that China’s pork production returned to its pre-ASF level in 2021. While exports to China are down from their peak, China is still one of the top 3 overseas markets for U.S. pork, with sales in the first 6 months of 2023 exceeding annual totals posted in years before ASF hit China. This chart first appeared in the ERS report How China’s African Swine Fever Outbreaks Affected Global Pork Markets, published November 2023.