- By Faarea Masud

- Business reporter

Image source, Getty Images

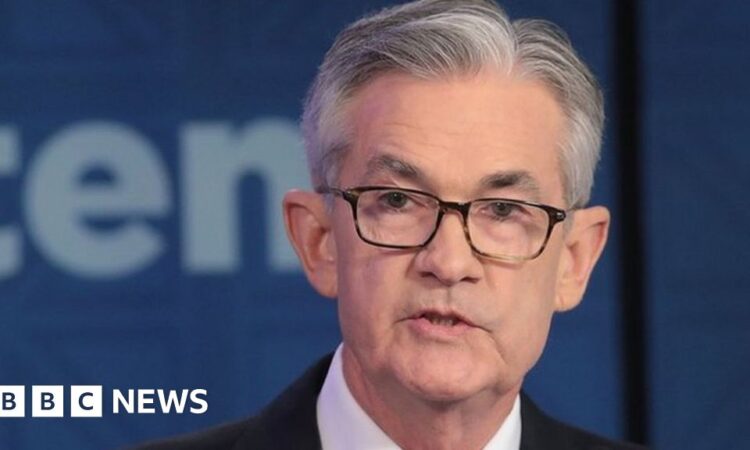

Jerome Powell, the US central bank’s chairman, says price rises still need to be kept under control

The US central bank has held its key interest rate at its current 22-year high as it seeks to stabilise price rises, which had recently reached near-record levels.

The Federal Reserve’s rate target remains at 5.25%-5.5%.

The bank has been raising borrowing costs with the hope of cooling the economy and slowing inflation, the rate at which prices rise.

It comes after recent data showed the US economy grew faster than expected.

Raising interest rates is one mechanism that central banks can use to tackle inflation. The theory is that by raising interest rates and making it more expensive to borrow, consumers will spend less and that would lead to slower price rises.

The bank had faced criticism, with some suggesting that holding interest rates at higher levels could put the US economy at risk of entering into a recession.

In a statement on Wednesday, the Federal Reserve said that the vote in favour of holding rates was unanimous, adding that it was prepared to adjust its policy “as appropriate” if risks emerge.

It said that holding the rate would give the bank time to “assess additional information” on how the economy is performing.

It signals that the central bank may delay lowering interest rates, as inflation currently stands at 3.7% in the US, which is still above the Fed’s target of 2%.

Higher borrowing costs have led to more expensive loans for businesses, homes and other goods and services, ending an era of low-cost borrowing.

Similarly in the UK, households have seen their budgets squeezed by higher mortgage payments or borrowing costs.

The Bank of England is widely expected to hold its current interest rate when it announces its next decision on Thursday.