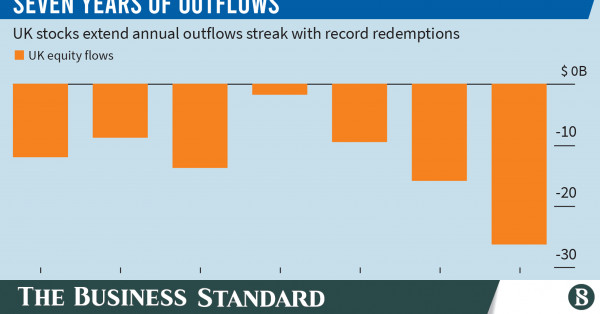

UK stocks suffered record annual outflows in 2022, marking the seventh year in a row that investors have fled the country’s markets.

UK equity funds have had $26.3 billion of redemptions so far this year, according to data from EPFR Global. That coincides with a slump of 20% for the domestic-skewed benchmark FTSE 250 Index, the most since 2008. The FTSE 100 Index is up more than 1%, largely due to its exposure to commodity stocks that have soared.

The country has been roiled by political and economic troubles this year. The onset of a recession, inflation at a 41-year high, two prime ministers resigning and the highest number of strikes since the 1980s helped trigger selloffs in domestic stocks and the pound. That left London losing its crown as Europe’s biggest stock market to Paris.

“For the next year, I am less optimistic about UK stocks — we expect the market focus to switch from macro headwinds to microeconomics and earnings recession,” said Marija Veitmane, a senior strategist at State Street Global Markets. “The UK is less likely to do well, as earnings and profitability of UK companies are not the strongest, which may lead to underperformance.”

The outflows from UK equities are in stark comparison to global stocks, which saw net inflows of $166.5 billion in 2022 despite the biggest drop in the MSCI All-Country World Index since the global financial crisis.