- Investors scale back BoE rate cut bets after CPI data

- But disappointing retail sales revive some recession fears

- Pound traders may now turn attention the UK flash PMIs

- The data comes out on Wednesday at 09:30 GMT

Hotter-than-expected inflation, but disappointing retail sales

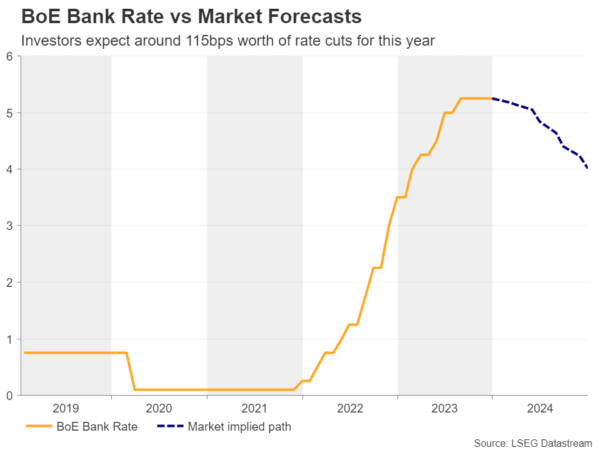

After the hotter than expected UK CPI data for December, investors scaled back their Bank of England rate cut bets, lowering the total basis points worth of reductions expected by the end of the year to 115 from 125 and the probability of the first quarter-point reduction to be delivered in May to 55% from around 90%.

That said, on Friday, retail sales for the same month disappointed and according to the Office of National Statistics (ONS), they are likely to subtract 0.04 percentage points from the UK economic output in the fourth quarter. Given that the National Institute of Economic and Social Research (NIESR) tracker has been pointing to a stagnant economy ahead of the release, this could make the difference between a flat or a negative figure.

Although retail sales may have revived concerns with regards to a potential recession, investors did not add back to their BoE rate cut bets. Perhaps the rebound in the November monthly GDP and the improvement in the December composite PMI acted as safety barriers.

UK Flash PMIs the next focal point for pound traders

With all that in mind and taking into account that the NIESR is forecasting GDP to grow by 0.2% in the first quarter of 2024, on Wednesday, pound traders may focus on the preliminary PMIs for January, as this would be the first information on how the UK economy entered the new year.

Apart from the headline prints, the employment and prices sub-indices may also be of high importance as they could provide a glimpse of whether the rebound in the December inflation prints was only due to base effects and will prove to be temporary, or whether inflation will prove to be stickier than previously anticipated.

Will the data help the pound gain more ground?

Numbers suggesting that the economic activity is faring better than it did during the second half of 2023 and sub-indices pointing to still-sticky inflation may convince investors that the BoE is right in not discussing the prospect of lower interest rates so soon. The probability of a May cut could further decline, and the pound could gain some more ground.

Pound/dollar has been oscillating between 1.2605 and 1.2800 since December 14, two barriers that acted as support and resistance several times in the past. After the hotter-than-expected CPI numbers, the pair rebounded from the lower end of that range and despite the pullback on the worse-than-expected retail sales data, encouraging PMIs may allow another round of advances, perhaps towards the upper bound at around 1.2800.

Nonetheless, for the outlook of this pair to turn positive again, a break above that zone may be needed. Such a move would confirm a higher high on the daily chart and may carry extensions towards the high of July 27 at around 1.2995. Alternatively, a dip below 1.2605 may turn the picture bearish and encourage the sellers to push the action towards the 1.2500 area.