- British retailers experienced their slowest sales growth in 11 months in July.

- US consumer price inflation moderated in July.

- The British economy expanded more than anticipated in June.

The GBP/USD weekly forecast is bearish as the outlook for the British economy remains bleak amid rising interest rates.

Ups and downs of GBP/USD

GBP/USD had a bearish week characterized by US and UK data. On Tuesday, the pound declined after a survey indicated that British retailers experienced their slowest sales growth in 11 months in July. This deceleration was attributed to rainy weather and high inflation.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Meanwhile, the dollar slightly rose on Thursday following July’s US consumer price inflation moderation. This development bolstered expectations that the Federal Reserve is nearing the completion of its rate-hiking cycle. Nevertheless, investors remained cautious about upcoming data before the policymakers’ meeting.

Finally, the pound reversed its three-day losing streak on Friday. This turnaround was triggered by data indicating that the British economy had expanded more than anticipated in June. This outcome provided a marginal boost to sterling against the dollar.

Next week’s key events for GBP/USD

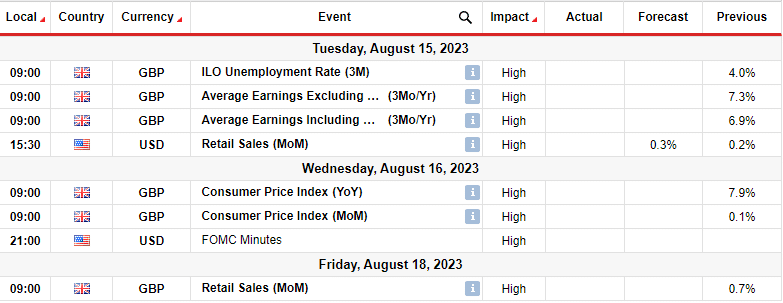

The UK will release many key data in the coming week, including employment, retail sales, and inflation. However, the market will focus on the inflation report, determining the BOE’s next policy move.

Meanwhile, the employment report will show the state of the UK labor market, while the retail sales report will indicate consumer spending. Higher-than-expected readings could increase BOE rate hike expectations.

Moreover, there will be data from the US, including retail sales and the FOMC meeting minutes. The FOMC meeting minutes will show what went into the last Fed policy meeting.

GBP/USD weekly technical forecast: Bears find footing below 30-SMA.

GBP/USD is descending on the daily chart as bears find their footing below the 30-SMA. The bearish bias is strong as there is solid bearish momentum with the RSI below 50. Bears took control when the price broke below the 30-SMA and 1.2803 support levels. The price has retested 1.2803 as resistance and is now heading for the next support level at 1.2602.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

A break below this level would strengthen the bearish bias allowing the price to fall to the next support at 1.2401. Moreover, the bearish bias will stay as long as the price stays below the SMA and the RSI under 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money