Image © Adobe Images

UK economic output has been recovering since October, according to a new study from Pantheon Macroeconomics, and all signals point to a strong first quarter outturn for the UK economy.

The independent consultancy and research provider says the UK will record 0.3% q/q growth in the first quarter, which would easily trump the Bank of England’s own forecast and bring a decisive end to the UK’s shallow recession.

“Real incomes are rising again, consumer spending is improving,” says Robert Wood, Chief UK Economist at Pantheon Macroeconomics. “This leaves us optimistic about the near-term outlook for GDP.”

The 0.2% month-to-month rebound in January’s GDP shows last year’s recession is fast disappearing in the rear-view mirror, thanks in large part to January’s rebound in retail sales.

According to Pantheon’s observations, the huge 3.4% month-to-month surge in retail volumes in January accounts for almost all (0.18pp) of the 0.2% GDP gain, while the rest of the sectors net off.

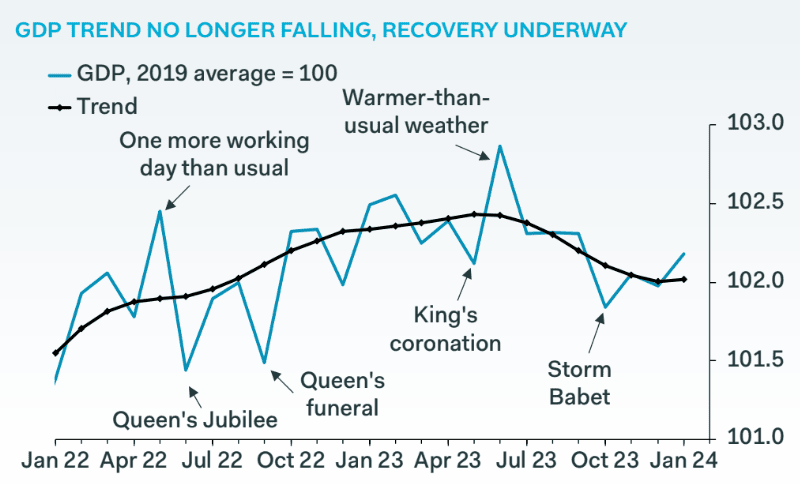

Looking ahead, recent monthly GDP outturns have proven volatile but Pantheon Macroeconomics says the underlying trend is clearly one of recovery.

Image courtesy of Pantheon Macroeconomics.

The above chart plots the monthly level of GDP and its smoothed trend. “Output hit a low point in October and has been recovering since,” says Wood.

The UK economy stagnated in 2023 and entered a shallow recession in the second half of the year as consumers struggled in the face of elevated inflation that whittled down spending power.

However, inflation is widely tipped to fall as low as sub-2.0% in April 2024, while wage settlements remain above long-term trends.

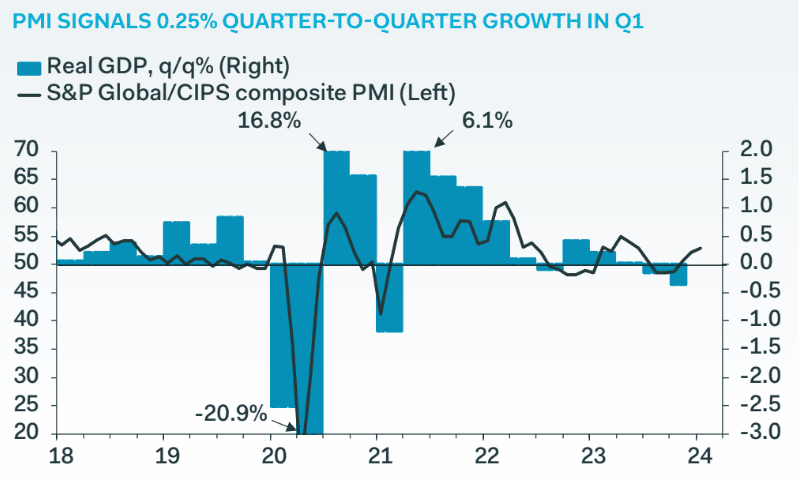

Image courtesy of Pantheon Macroeconomics.

“We think household real disposable income will post a strong 2.2% year-over-year increase in 2024, propelling real consumer spending to an average increase of 0.5% quarter-to-quarter in 2024,” says Wood.

Business and consumer confidence surveys meanwhile point to improving growth in early 2024.

Pantheon Macroeconomics thinks January’s GDP rebound sets the UK up for a solid first quarter that will bring a decisive end to one of the shallowest recessions the UK has experienced.

Calculations show that quarter-on-quarter growth will come in at 0.2% for Q1 – above the Bank of England’s forecast of 0.1% – if GDP simply flatlines in February and March.

“But we look for GDP to rise 0.3% quarter-to-quarter in Q1. Stronger-than-expected growth will keep the MPC on its toes, despite wage growth slowing again in yesterday’s data,” says Wood.

Pantheon looks for the first Bank Rate cut to fall in June, “but the MPC will lack a trigger from weak growth to start the cutting cycle”.