in partnership with

Author

Jonathan Ashworth, Chief Economist, ACCA

Date published

June 10, 2024

Categories

2023 was a challenging year for the UK economy, which expanded by just 0.1%, and experienced a technical recession in the second half of the year. Admittedly, it was not all doom and gloom. Despite the feebleness of growth, the unemployment rate remained very low around 4%, and wage growth was robust at a time when inflation fell sharply.

The economy’s prospects have brightened somewhat in 2024. This is evident in the improvement in business confidence. Despite some pullback in May, driven by the services sector, the closely followed S&P Global UK Composite PMI has risen from an average of around 50[1] in the second half of 2023 to 52.8 on the latest reading, with the manufacturing sector also beginning to grow again. The ACCA and IMA survey of accountants also exhibited a decent gain in confidence among UK SMEs in the first quarter.

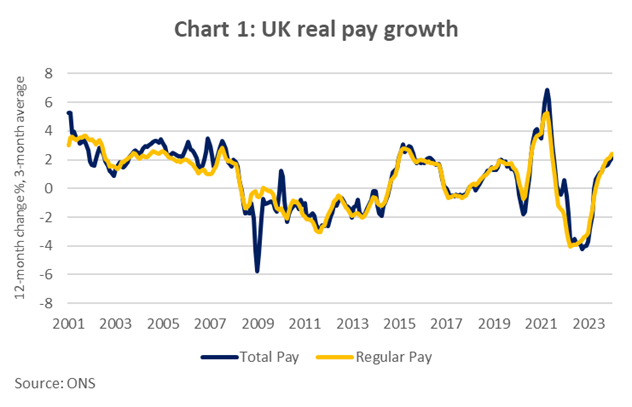

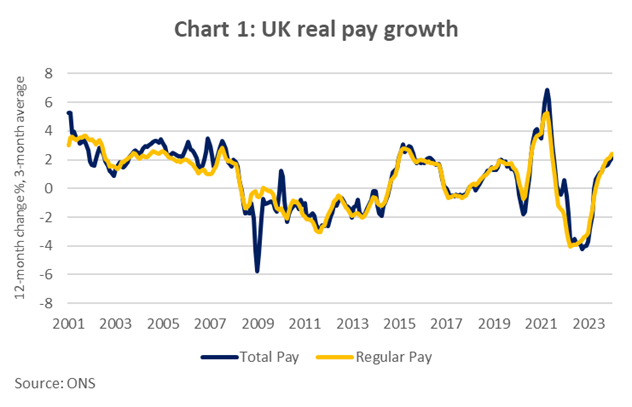

Consumers are becoming less pessimistic too. The headline GfK consumer confidence index and most sub-components have risen meaningfully over the past twelve months. Improving real incomes have likely been a key driver. Headline inflation is now 2.3%, down from an average of 5.5% in the second half of 2023. With tight labour markets fuelling robust wage gains, this has resulted in real income growth of around 2% currently (see Chart 1).

Monetary policy should also become somewhat less restrictive. With the improving inflation backdrop, it seems likely that the Bank of England should begin to trim interest rates over coming quarters. That being said, with services inflation still high, tight labour markets, and risks to energy prices from geopolitical developments, the policy easing cycle will likely be very gradual and cautious. Financial markets expect between one and two quarter-point rate cuts by year-end, followed by another couple by the end of next year. While rates will remain high by the standards of the past decade, the turn in the monetary cycle should be helpful for growth.

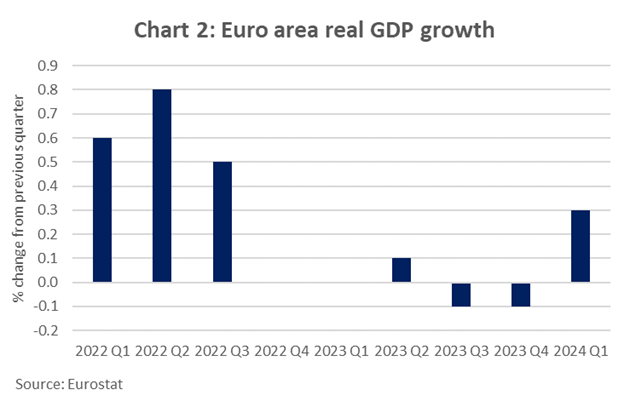

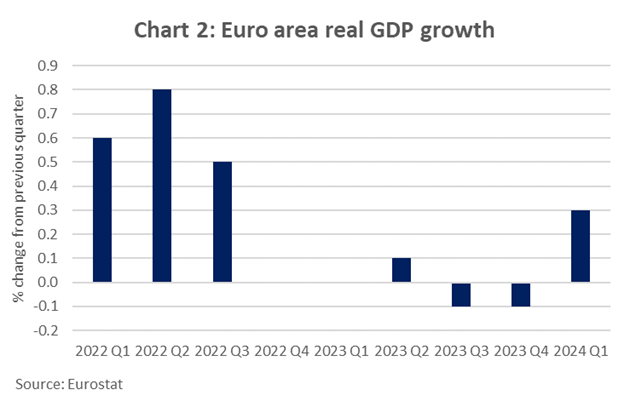

The global economy is also becoming more supportive. Business confidence has improved, with the J.P. Morgan Global Composite PMI rising quite materially over recent quarters[4], while the ACCA and IMA survey of accountants recorded a rise in global confidence in the first quarter for the first time since Q1 2023. Somewhat encouragingly for the UK, the euro area, which accounts for around 40% of our exports, is showing clear signs of improvement (see Chart 2), while the U.S. looks to have avoided the sharp slowdown many feared.

Hence, as we head into the summer the economic backdrop for the UK is looking somewhat better than many people may have feared towards the end of last year. That said, risks still remain. Inflation could remain stickier than expected, which could limit the scope for monetary easing by the Bank of England (and the other major central banks). Geopolitical tensions also remain very elevated.

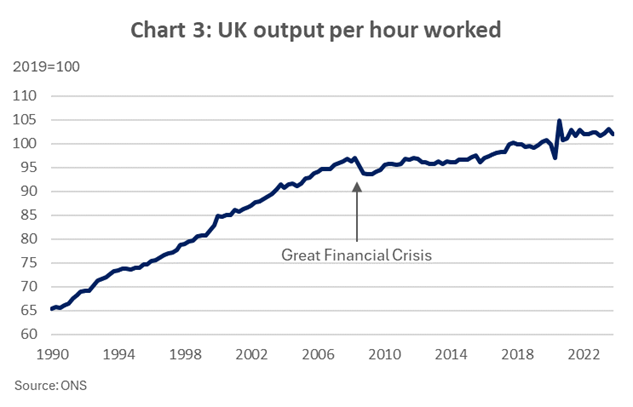

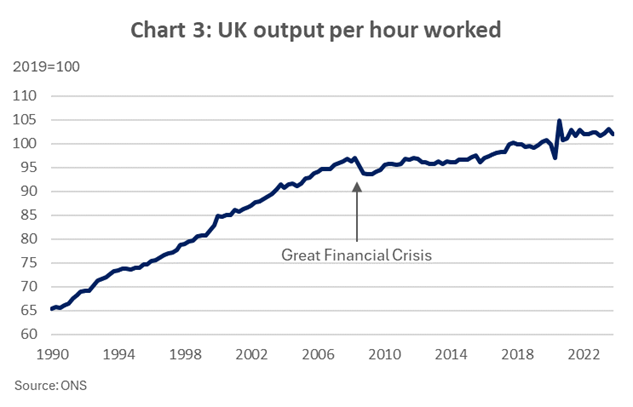

Moreover, growth is still likely to be weak by historical standards, amid restrictive fiscal and monetary policies, and, importantly, given the weakness in the economy’s supply side. The major driver behind the latter is the abject weakness in UK productivity growth since the Great Financial Crisis (see Chart 3). This is important because productivity gains are the key determinant of long-term economic growth in advanced economies.

Unfortunately, there are no quick fixes available for the next government. Current opinion polls point to a decisive Labour victory, allowing it to come to power for the first time since 2010. However, no matter the winner, high government debt levels and pressures to raise spending in various areas, mean that the incoming administration will have very little room for manoeuvre on the fiscal front.

Meanwhile, other measures to improve the economy’s long-term performance, such as planning reform, improving workforce skills, and strengthening trade links with key partners such as the EU, will likely take time to bear fruit. Like many other hard-pressed governments across the world, the next administration will be hoping that Artificial Intelligence will become a game changer for productivity growth in coming years.

[1] the cutoff level that separates expansion from contraction.