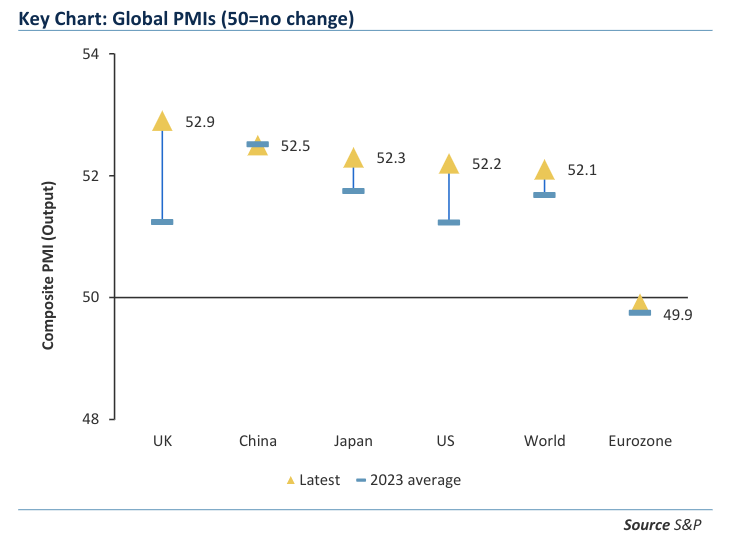

The UK economy has made a stronger start to the year than advanced economies around the globe, according to a closely watched survey.

The latest round of purchasing managers’ index (PMI) surveys, released earlier in March, showed that the UK outperformed other developed economies, including the US.

Although the PMI dipped slightly compared to February’s reading of 53.0, it remained comfortably in expansionary territory at 52.9. Anything above 50 indicates growth.

In fact revised figures from the manufacturing sector published earlier this week suggest that the UK performed better than first estimated, with the ‘flash’ reading of 49.9 revised up to 50.3.

This meant the manufacturing sector recorded growth for the first time since July 2022. Revised figures on the services sector in both the UK and eurozone are due out tomorrow.

“For all the caution surrounding the UK economy, its PMI is currently top of the developed economy league table,” Simon French, head of research at Panmure Gordon said.

Ashley Webb, assistant economist at Capital Economics, said “the PMI has been a surprisingly reliable predictor of GDP over the past six to nine months,” suggesting it is compatible with GDP rising by 0.2 per cent in the first quarter.

The UK’s strong start to the year has been fuelled by falling inflation and hopes of lower interest rates. A strong labour market has also kept wage growth high, meaning households have seen a boost to their real income.

The euro area meanwhile continues to struggle as the manufacturing sector remains mired in a deep downturn.

Revised figures out earlier this week showed a slight improvement, but still put the PMI index for the manufacturing sector at 46.1.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said: “The eurozone’s manufacturing sector usually runs on several cylinders, mainly the Euro-4 countries of Germany, France, Italy and Spain.”

“We currently have the unusual situation that two cylinders, Germany and France, are more or less out of action,” he continued.