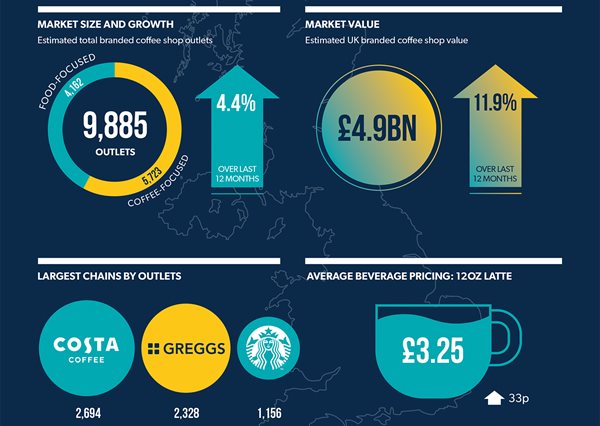

Project Café UK 2023 shows the £4.9bn UK branded coffee shop market achieved 11.9% sales growth over the last 12 months, expanding 4.4% to reach 9,885 outlets. However, total sales remain below pre-pandemic levels as operators grapple with inflation, soaring energy costs and changing consumer footfall

Nevertheless, strong sales and outlet growth demonstrate the enduring appeal of coffee shop culture in the UK, with consumers viewing out-of-home coffee as an affordable luxury despite the cost-of-living crisis

UK coffee chains achieved strong sales and outlet growth over the last 12 months despite being hit by soaring inflation and energy costs | Graphic: © World Coffee Portal

- Costa Coffee, Greggs, and Starbucks are the largest branded coffee shop chains in the UK by outlets

- The latte remains the UK’s favourite coffee shop beverage*, with the average price of a 12oz serving increasing £0.33p (11.3%) to £3.25 over the last 12 months

- Major coffee chains sharpen strategies to pursue drive-thru outlets, neighbourhood, and smaller format stores

UK coffee chains resilient amid sustained economic pressures

UK coffee chains achieved strong sales and outlet growth over the last 12 months despite being hit by soaring inflation and energy costs driven by the lingering effects of the pandemic, the war in Ukraine and inconsistent government policy. Staffing shortages exacerbated by Brexit also remain a key challenge – more than three-quarters of industry leaders surveyed disagree they feel more positive about Brexit’s impact on hospitality than a year ago.

Just 37% of industry leaders surveyed by World Coffee Portal indicated trading conditions are positive, down from 56% 12 months ago. Meanwhile, 61% agreed the cost-of-living crisis has already negatively impacted their business.

However, despite inflationary pressures prompting all major coffee chains to implement price increases over the last year – with the average price of a 12oz latte increasing by £0.33p (11.3%) to £3.25 – overall rising sales indicate UK consumers still consider out-of-home coffee an affordable luxury during the cost-of-living crisis.

Major operators focus on convenience to stay competitive

Larger branded coffee chains broadly saw footfall recover over the last year, but around half of operators surveyed indicated footfall has yet to fully recover to pre-pandemic levels, particularly in city centres.

Major UK coffee chains have responded to shifting consumption patterns by investing in new sales channels, including drive-thru, delivery, self-serve, and smaller format stores. Operators are also seeking to keep operational and product costs low and perceive price consciousness as the most important consumer trend currently.

The UK’s drive-thru coffee market grew 17.6% to reach 696 sites over the last year. Drive-thru market leader, Costa Coffee, added 41 sites over the last 12 months to reach 316, with Starbucks adding 14 to reach 284 and Tim Hortons more than doubling its drive-thru presence to reach 55 locations.

Self-serve coffee concepts, such as those recently launched by food-focused chains Pret A Manger and Leon, are also providing low-cost, convenient alternatives to costly high street locations.

Highlighting the growing popularity of these sales channels, 53% of UK consumers surveyed ordered from a premium self-serve machine in the last 12 months, with 9% purchasing from a drive-thru on their last coffee shop visit. However, 56% of consumers surveyed indicated they prefer counter service, with the proportion of those ordering ahead at least once over the last 12 months falling from 35% to 27%.

UK remains attractive for international coffee chains despite economic challenges

Despite ongoing trading challenges relating to inflation, lingering Covid fallout, Brexit and the prospect of recession in 2023, international branded coffee chains continue to invest in the UK.

Canada’s Tim Horton’s, which first entered the UK market in 2017, added 35 outlets to reach 72 stores. Having made its UK debut in June 2022, US specialty coffee chain Blank Street has rapidly expanded and now operates 12 stores in London.

New Zealand-based Cooks Coffee Company also continues to expand in the UK with its Esquires and Triple Two coffee chains. Meanwhile, South Korean café giant Paris Baguette, which operates around 4,000 stores globally, opened its first UK store in London in October 2022. Dubai’s Coffee Planet has also announced near-term growth plans for the UK.

UK branded coffee shop market has solid foundations for long-term growth

With a year-long UK recession forecast in 2023, and coffee shops having already significantly increased prices, there are concerns within the industry that trading in the year ahead will be even tougher than during the global financial crisis of 2008.

However, with UK coffee culture firmly embedded and the size and strength of the out-of-home market firmly established, there are few signs that consumers are significantly cutting back on out-of-home coffee consumption amid the cost-of-living crisis.

World Coffee Portal forecasts the UK branded coffee shop market will surpass 10,200 outlets in 2024 and exceed 11,600 stores by January 2028. Sales are forecast to exceed

£6.4 billion by 2028, representing growth of 5.6% CAGR.

Commenting on the report findings, Allegra Group Founder and CEO, Jeffrey Young said:

“Our research shows the depth of appeal both quality and convenience-led branded coffee shops have with consumers throughout the UK. The UK branded coffee shop market is now trading strongly post-Covid, however, staff shortages, structural inflation – including energy and food prices rises along with a tightening of consumer disposable income – means success will be found among operators that can maintain an impeccable offering with fine-tuned execution.”

Project Café UK 2023 is World Coffee Portal’s definitive annual analysis of the UK’s dynamic branded coffee shop market. It features the latest market sizing and projections, pricing analysis, brand profiles, consumer trends based on 50,000+ surveys, and industry insight based on 150+ consultations with senior business leaders.

To purchase the report or to make an enquiry, contact:

Ruth Thompson, Commercial Executive

[email protected]

+44(0)20 7691 8800

.jpg.aspx?lang=en-GB&width=700&height=496)