Key Points

- The UK and Japan recorded back-to-back quarters of negative growth in 2023, leading to a “technical recession”.

- Experts say the recessions are largely unsurprising.

- Australia could go down a similar track, especially if interest rates keep rising.

So what does it mean for simmering fears that Australia might be headed for a similar fate?

Why did the UK and Japan fall into a recession?

“The issue with Japan is the demographics are not working in their favour,” Dr Hartigan said. “The population is declining because they’re not having enough children and they don’t have any immigration policy at all… and so there’s less people able to consume.”

“Were it not for that, we probably would’ve been in recession as well.”

“I think Japan’s probably more a bit of an aberration,” he added. “I wouldn’t be too fussed about it. People get excited about it because it’s our second biggest export market, but so far it doesn’t seem to affect demand for our exports.”

Will Australia go into a recession?

While both Britain and Japan sliding into a simultaneous recession shouldn’t necessarily worry Australians, he added, it does highlight that the risk is on the table – and that it is, in his words, a “fairly significant one”.

Credit: SBS News

“This sort of reinvigorates those concerns again, puts them back on the forefront and provides a reminder there that there is a risk,” he said.

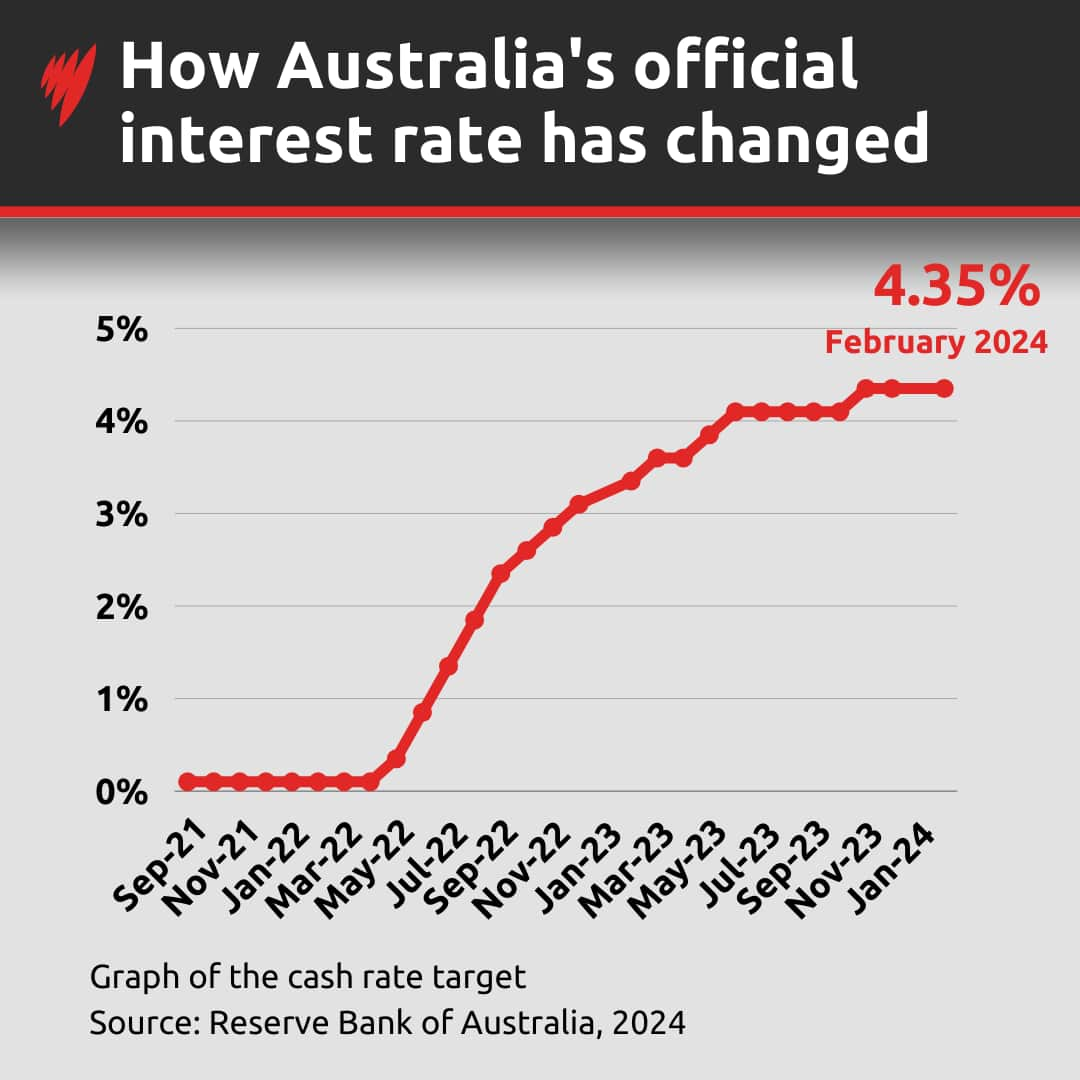

“But the experience around the world does highlight that there is a risk of recession here… The main risk is that the rate hikes have been excessive, and-or rates left too high for too long, getting us over the edge.”