What GAO Found

GAO identified the most significant factors—which vary by territory—affecting each territory’s future capacity for economic growth and debt repayment.

Commonwealth of Puerto Rico: Puerto Rico’s gross domestic product (GDP) was $106.5 billion as of June 30, 2021. In March 2022, Puerto Rico finalized its largest debt restructuring: issuing $7.4 billion in new bonds replacing $34.3 billion in outstanding bonds (a 78 percent reduction). The restructuring also contained several initiatives to reform Puerto Rico’s struggling pension system, including a new trust fund—financed by government surpluses—to support future pension payments. Finalizing the overhaul of electric and power operations and adhering to fiscal and financial management reforms are critical to sustained economic growth.

Guam: As of September 30, 2021, Guam’s total public debt outstanding was almost $2.6 billion, or about 43 percent of GDP ($6.1 billion). Guam’s inflation-adjusted GDP declined by almost 2 percent annually from fiscal year 2016 to 2021. The drop reflected the decline in tourism due to COVID-19. However, Guam’s economy is showing signs of recovery. The recent opening of the third U.S. military base on the island is expected to stimulate economic growth.

United States Virgin Islands (USVI): USVI’s GDP was $4.2 billion in fiscal year 2020. As of September 30, 2019—the last year for which USVI reported data—public debt outstanding was more than $2.6 billion, or about 65 percent of USVI’s GDP in that year. In March 2022, USVI refinanced bonds. This created a dedicated source of revenue to fund its pension system, which in turn temporarily extended pension solvency. However, the USVI government’s ability to access traditional capital markets is uncertain. This leaves it without financing flexibility as it faces serious economic, financial, and demographic challenges. These include a shrinking population, dependence on the volatile tourism industry, and weak financial management practices.

Commonwealth of the Northern Mariana Islands (CNMI): As of September 30, 2020, CNMI’s total public debt outstanding was about $114.1 million, or about 12 percent of GDP ($938.8 million). This reflects CNMI’s inability to borrow through capital markets in recent years. CNMI has struggled to finance its pension plan. CNMI officials told GAO they are uncertain how the government will meet its financial obligations. Moreover, its economy continues to decline with limited prospects for recovery as its tourism industry struggles and its largest casino is closed and unlikely to reopen soon. CNMI’s financial management and reporting has also worsened. With CNMI’s limited financial prospects and weak financial management practices persisting, CNMI is at risk of a severe fiscal crisis.

American Samoa: As of September 30, 2021 , American Samoa’s total debt outstanding was $162.2 million, or about 23 percent of GDP ($710.8 million). This reflects recent borrowing to invest in its infrastructure. The government’s pension plan is underfunded and the government is increasing contributions to extend solvency. American Samoa’s economy is stable but continues to depend almost entirely on activity generated by the Starkist Samoa Co. tuna cannery and government employment. Prospects for economic growth outside of these areas face challenges.

Why GAO Did This Study

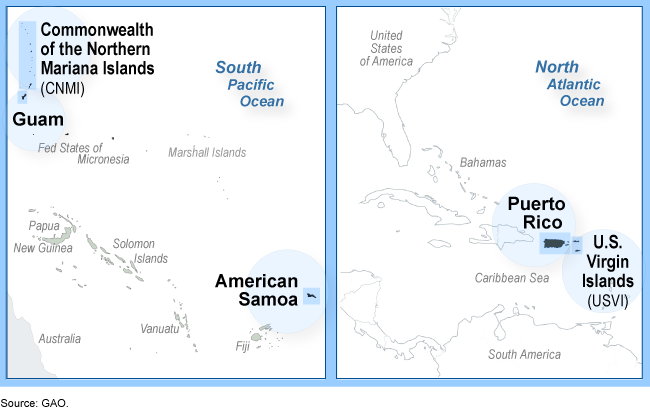

The five permanently inhabited U.S. territories—Puerto Rico, Guam, USVI, CNMI, and American Samoa—historically borrowed through financial markets. Puerto Rico, in particular, amassed large amounts of debt and defaulted on debt payments in 2015.

The territories all face challenges to achieving sustained economic growth, which is critical to debt sustainability. Challenges include, for example, (1) the location of the islands that leads to the high cost of importing goods and energy; (2) vulnerability to increasing frequency and severity of extreme weather events; (3) concentrated economies relying on limited industries; and (4) outmigration and population loss.

In 2016, Congress passed and the President signed the Puerto Rico Oversight, Management, and Economic Stability Act. It contains a provision for GAO to review the public debt of the five territories every 2 years. This is the fourth report in this series.

In this report, for each of the five territories, GAO updates (1) trends in public debt and its composition; (2) trends in revenue and expenses; and (3) risk factors that may affect each territory’s ability to repay public debt. GAO analyzed audited financial statements for fiscal years 2019, 2020, and 2021, as available; reviewed demographic and economic data for each territory; and interviewed credit rating agencies and officials from the territories’ governments.

For more information, contact Yvonne Jones at (202) 512-6806 or JonesY@gao.gov or Latesha Love-Grayer at (202) 512-4409 or LoveGrayerL@gao.gov.