‘Tis the season when forecasters reflect on the past year: what we got right and where we missed the mark. The big miss has been stronger global economic growth, but this is mostly attributed to the U.S. economy. With each passing quarter, the soft landing narrative went from being a long shot to the more likely outcome, particularly when it came to the American economy. The Federal Reserve was also caught off guard, evidenced by serial upgrades to forecasts for the economy, inflation, and the path for interest rates.

Europe and China showed evidence of slipping below expectations, prompting Chinese authorities to respond with an increase in deficit-funded infrastructure spending. Although inflation globally is cooling and central banks are likely done tightening monetary policy, the lagged effects from past interest rate hikes are still snaking through business and consumer behaviours (Chart 1). And, the landscape has now become more difficult to navigate under the weight of another war. The first half of next year is expected to be the low point for global growth in this cycle. It should also mark a pivot point in when central banks either begin to gingerly cut rates or entertain rhetoric to that effect. However, the speed of the economic recovery within the second half of the year will be determined by the confidence of central banks to fully normalize interest rates. This action, we don’t expect to be completed until 2025. Either way, whether the landing turns out to be hard, soft, or more likely, bumpy, the runway is within sight.

U.S.’s Immaculate Dis-inflation

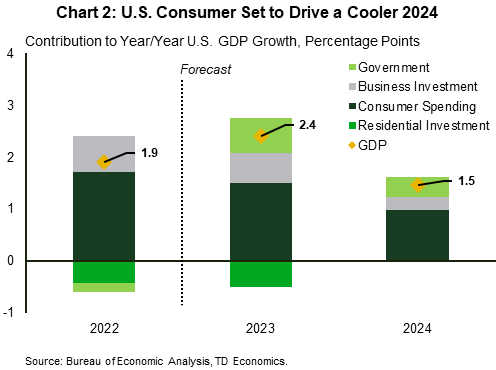

Fed Chair Jay Powell likely had a much better performance review this year having presided over an impressive feat: inflation has moved very close to the Fed’s target with little economic cost. The labour market has stayed close to full employment. Strong productivity growth has helped cool growth in unit labour costs in recent quarters, dampening the inflationary impulse. The U.S. economy is on track to beat last year’s growth of 1.9% with a 2.4% pace, despite a forecast to slow to 1.5% in 2024 as many of the tailwinds that lifted the economy in 2023 fizzle out (see details here).

The biggest tailwind is the continued impact of past fiscal policy, which has played a key role in keeping the U.S. economy humming in the face of high inflation and interest rate increases. Generous pandemic stimulus payments to households have buoyed consumer spending. While government incentives for investment in clean tech and semiconductors has helped to keep business investment solid despite higher financing costs. And thanks in part to past fiscal transfers from Washington, state and local government spending has contributed nearly a full percentage point to growth over the past four quarters – a reversal from 2021-22 when the unwinding of peak Covid-era stimulus was a drag on the economy.

Looking ahead to next year, weaker consumer spending will be a key ingredient in slower U.S growth (Chart 2), with excess savings set to be drawn down by mid-year. We are already seeing consumers look a bit more cautious in the fourth quarter, and delinquency rates for credit cards and auto loans have risen above pre-pandemic levels despite a very low unemployment rate. This suggests many households are increasingly feeling the pinch from high inflation and rate increases and are likely to become more cautious in their spending.

With Washington in a stalemate and likely to remain funded under continuing resolutions until the election, the fiscal impulse is likely to peter out, weighing on government’s contribution to growth. The one area of the economy which is likely to see its fortunes improve is housing, where lower borrowing costs are expected to bolster activity in the second half of the year.

Slower growth next year should create better balance in the labour market. Cooler wage growth is needed to get inflation all the way back to 2%, and the next stage of the disinflation process is expected to be a bit slower.