Ralf Hahn/iStock via Getty Images

Early PMI data point to the UK economy gaining growth momentum in February, dispelling recession worries. However, price pressures have intensified.

It’s particularly encouraging to see that the upturn in growth has been accompanied by improved order books and a surge in optimism about year-ahead prospects to the highest for two years, in turn encouraging a second month of increased employment.

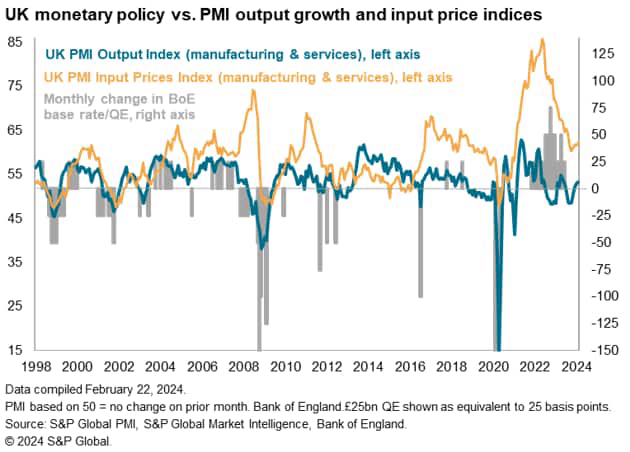

The combination of reviving growth and stronger price pressures will likely lead markets to push back on Bank of England rate cut expectations.

Faster growth dispels recession worries

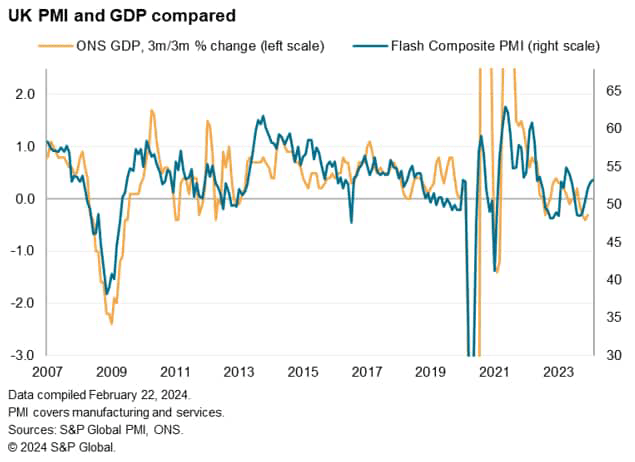

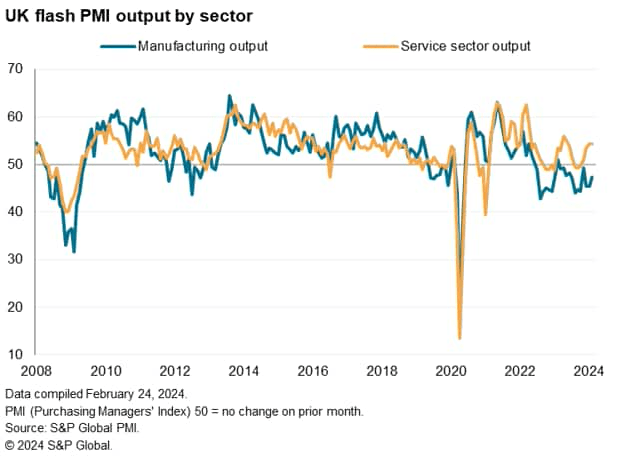

UK economic growth accelerated in February, with the early PMI survey data pointing to the fastest growth of business activity for nine months. This is by no means a one-off improvement, as accelerating growth has now been recorded for four straight months after a brief spell of decline late last year.

The headline economic growth indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK Composite Output Index, rose from 52.9 in January to 53.3 in February.

The rise signals increased output for a fourth month running after three months of decline. At its current level, the PMI is broadly indicative of GDP growing at a quarterly rate of just less than 0.3%, according to historical comparisons, and is so far indicating a rise of just in excess of 0.2% for the first quarter.

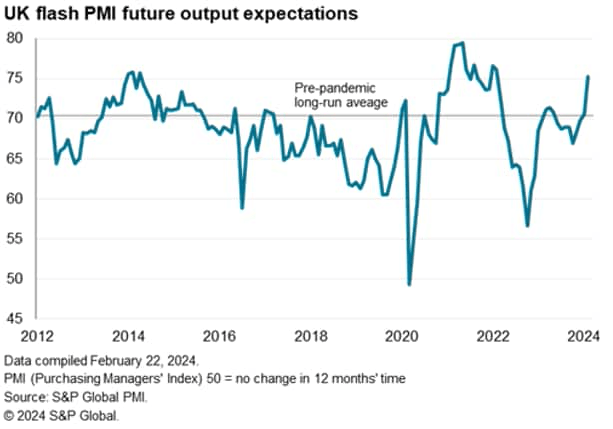

Greater optimism and sustained hiring

The upturn in business growth in February was accompanied by a strong upswing in business expectations about the year ahead. Companies’ own views on their year-ahead outlook rose in February to the highest for two years. What’s more, the rise in the future output expectations index was one of the largest witnessed in the history of the survey.

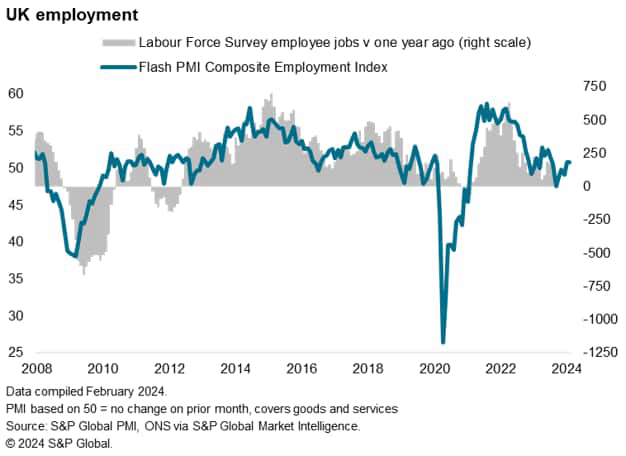

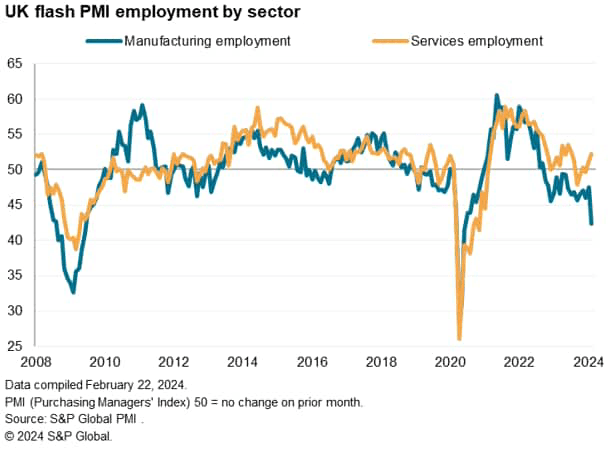

These improved output expectations helped drive a further month of net job creation in February, contrasting with the near-stalled employment picture seen back in November.

Lop-sided expansion

However, there are a number of areas of concern.

First, the upturn is being driven to a large extent by resurgent demand for financial services, in turn predicated on hopes of an imminent pivot to rate cutting by the Bank of England. This helped sustain a strong overall service sector expansion in February. In contrast, manufacturing remained mired in contraction, and also cut workforce numbers at a markedly increased rate. The drop in factory jobs was one of the steepest on record, and the largest since the global financial crisis barring only the initial pandemic lockdown months. Consumer-facing service providers are also reporting falling activity amid the ongoing cost of living crisis.

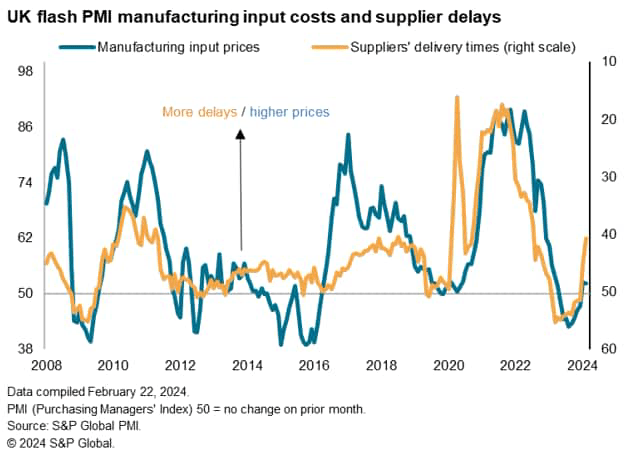

Supply delays

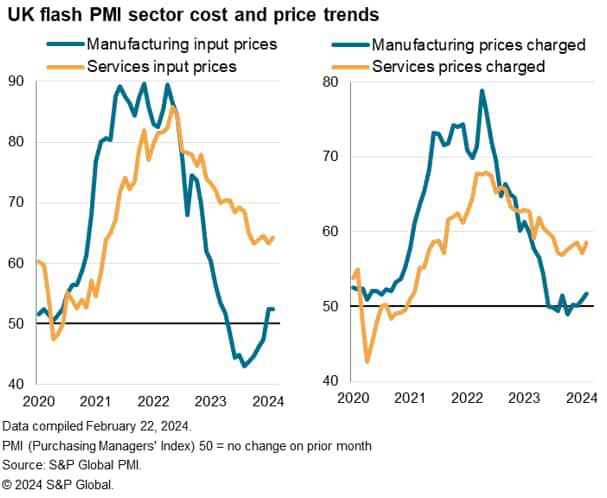

Second, February saw the highest degree of supply chain delays for over one and a half years, linked to Red Sea shipping disruptions. Barring the pandemic, the lengthening of supplier delivery times was the second-greatest recorded over the past 13 years. The resulting increased cost of shipping contributed to an overall rise in factory input costs for a second successive months, which in turn fed through to the largest monthly rise in selling prices for goods seen over the past nine months.

Service sector inflation also ticked higher, remaining stubbornly elevated thanks to higher wage costs and the pass-through of some higher goods prices.

Stubborn inflation

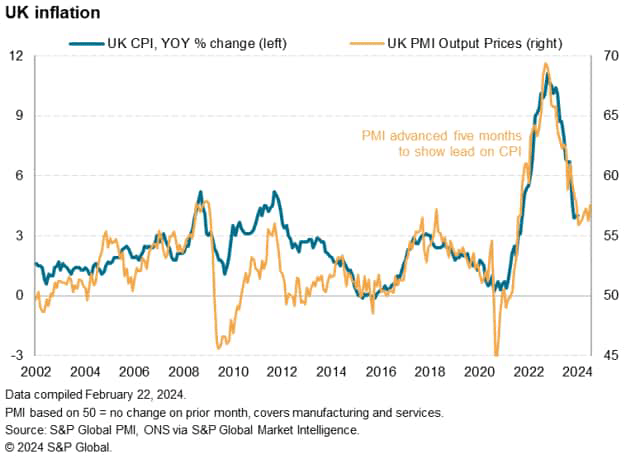

With growth accelerating and prices on the rise again, signalling consumer price inflation running around the 4% level in the coming months – double the Bank of England’s target – February’s data mean policymakers are increasingly likely to err on the side of caution when considering the appropriateness of cutting interest rates.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.