The new version of the pre-pandemic fiscal rules, if imposed, would jeopardise the European economy.

The new fiscal rules for the eurozone, set to replace the Stability and Growth Pact (SGP) and the Fiscal Compact, will be revealed in the coming months. Key decisions are going to be made, including the possibility of keeping the old rules, by the Council of EU finance ministers (Ecofin). The starting point has been a general acknowledgment of the ineffectiveness, lack of transparency and difficult enforceability of the current framework.

The European Commission’s initial proposal, unveiled in November 2022, would introduce a four-year adjustment plan for countries exceeding the deficit (3 per cent) or debt (60 per cent) ratios of the SGP, in relation to gross domestic product, stemming from a country-specific ‘debt sustainability analysis’ (and taking account of interest payments and ‘automatic stabilisers’). Member states would be monitored on their adherence to this agreed ‘technical trajectory’ but could ask for a three-year extension if evidencing stronger commitment to ‘structural reforms’ and growth-enhancing investments.

Bridging the gap

In April, the commission updated its proposal, strengthening the ‘national ownership’ of these medium-term adjustment plans, to be presented by member states to the commission and voted on by the council. To address concerns raised by fiscal ‘frugals’, however, stricter rules for high-debt countries were announced: debt-to-GDP ratios would have to decrease by the plan’s end, preventing undue postponement of adjustments (no ‘backloading’). Moreover, for countries with deficits exceeding 3 per cent of GDP, an additional adjustment of at least 0.5 per cent per year was introduced.

Despite this more restrictive stance, Germany and others such as Austria and the Netherlands still criticised the updated proposal—deeming the expenditure constraints too soft, the incentives for ‘structural reforms’ too weak. Germany raised the bar by proposing a new minimum debt-reduction requirement after the adjustment period and a yet-to-be specified deficit ‘safety margin’, below the 3 per cent benchmark. Even more dangerously pro-cyclical is a request that the growth of public expenditure never exceed that of potential GDP.

As the conflict between the German-led frugal camp and the other member states (led by France and Italy) mounted, the Spanish presidency of the council tried to bridge the gap. It took on board the German request for an average annual debt reduction of 1 per cent of GDP (whether over four or seven years) while extending the time horizon (to 14 or 17). According to Politico, this commanded greater support.

Italy and France meanwhile pushed for a golden rule, excluding some investments—green and digital for Italy and defence-related for France—from the calculation of the deficit-GDP ratio. At the European Defence Agency in late November, the commission president, Ursula von der Leyen, said there was now broad support for considering increases in defence spending ‘as a relevant factor when assessing whether a member state has an excessive deficit’, implying room ‘to reduce the required near-term fiscal effort for member states that are simultaneously increasing their defence spending’.

Become a Social Europe Member

Support independent publishing and progressive ideas by becoming a Social Europe member for less than 5 Euro per month. Your support makes all the difference!

Victim of own contradictions

Beyond the noise of the intergovernmental conflicts, Europe is still victim of its own contradictions—a pro-cyclical fiscal stance, a deflationary growth model and a swampy and inherently conflictual institutional set-up—which threaten another existential, systemic crisis. It is as if the great crises of the last decade never happened or no one learnt their lesson, defying the Latin injunction errare humanum est, sed perseverare diabolicum (to err is human but to persist in error is diabolical).

First, the ideological foundation of all the proposals on the table remains the old austerity principles. Public spending is a cost to be contained, not a growth driver—here, no one seems to have read any Keynes. Public debt is considered much like private debt, a liability to be reduced—with no consideration of the contrary effects of public-expenditure cuts and (even more so) privatisations. Yet the International Monetary Fund now recognises that, depending on the size of the multipliers, fiscal consolidation tends to increase debt-to-GDP ratios in advanced economies. And one-off revenue gains from privatisations may very well translate into permanent and painful destruction of productive and/or technological capabilities.

Italy serves as a warning. Historically an austerity ‘poster-child’, boasting record primary surpluses since the euro’s inception, it has left its European counterparts behind in privatisation, product-market ‘liberalisation’ and labour-market ‘flexibilisation’. The outcome is well-known, though—a long-lasting stagnation in labour productivity, a high public-debt burden, vulnerability to periodic increases in interest-rate spreads and unemployment persistently above the European Union average. Italy shows the fallacy of an economic-policy framework that, by seeking efficiency and growth through constraints, liberalisations and curbs on demand (particularly public), ends up exacerbating fragilities and risks jeopardising the sustainability of the entire union.

Secondly, the methodology of the ‘debt sustainability analysis’ is based on the same ‘voodoo economics’—as George Bush dismissed Ronald Reagan’s tax-cutting agenda when they were competing in the 1980 Republican presidential primary—that plagued European policy-making in the recent past. Inside the macro-model remain theoretically fallacious and inherently pro-cyclical concepts, such as ‘potential growth’, ‘output gap’ and ‘structural balance’. Projection of the current situation into the future meanwhile introduces a path-dependent bias into the ‘technical trajectories’—for example, according to the latest commission Debt Sustainability Monitor, the primary balances for Italy and Germany are projected to remain negative up to 2033 (-2.2 per cent and -2.6 respectively).

Nor is there any consideration of economic interdependencies between countries. The negative macroeconomic implications which slashing demand in high-debt member states may have on the rest of the EU economy are ignored. The harms of containing demand in low-debt ones are equally disregarded.

Hawkish approach

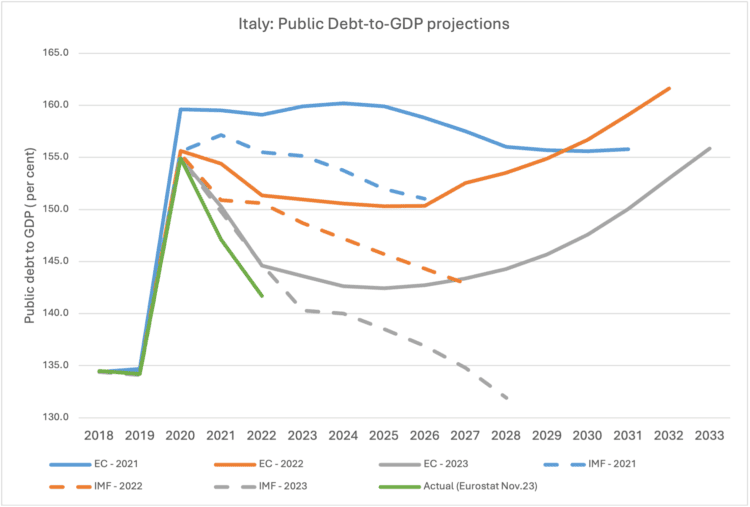

Finally, the commission seems to adopt a peculiarly hawkish approach. Despite using IMF methodology, its projections are always more pessimistic, as shown below for Italy’s debt-to-GDP ratio. In 2021, 2022 and 2023, the commission projected ratios which were worse and further from the outcome (green line) than the IMF—which now predicts a sustainable debt trajectory where the commission foresees an upward slope. The divergence stems from different assumptions on the ‘structural’ primary balance: the IMF assumes a return to its average value over the previous 15 years, the commission that it remains as now.

What are the policy implications? A glimpse was provided at the end of November by the director of the Bruegel research institute, during a workshop organised by the Dezernat Foundation and the Vienna Institute for International Economic Studies. Under the new debt-sustainability-analysis framework, Italy would be expected to achieve a +3.2 per cent structural primary balance by the end of the four-year adjustment. This would be an unprecedented turn towards austerity, worse than its harshest application during the eurozone crisis. While this is a tentative estimate, it shows how strong is the austerity bias to which the commission remains wedded.

The discussions on EU fiscal rules are at a critical juncture, with potential consequences going well beyond technicalities and numerical benchmarks. The diehard mentality of debt reduction at all costs is a dangerous path to follow, as history has repeatedly shown.

Instead, the EU should learn from its mistakes, acknowledging the importance of public investment, structural interdependencies and the unique circumstances of each member state—not forgetting that rules (including fiscal ones) are a means to an end, not an end in themselves. To foster economic growth, support the green and digital transitions and maintain debt sustainability, the EU should chart a new course, finding the courage finally to face the fundamental contradictions it has avoided.