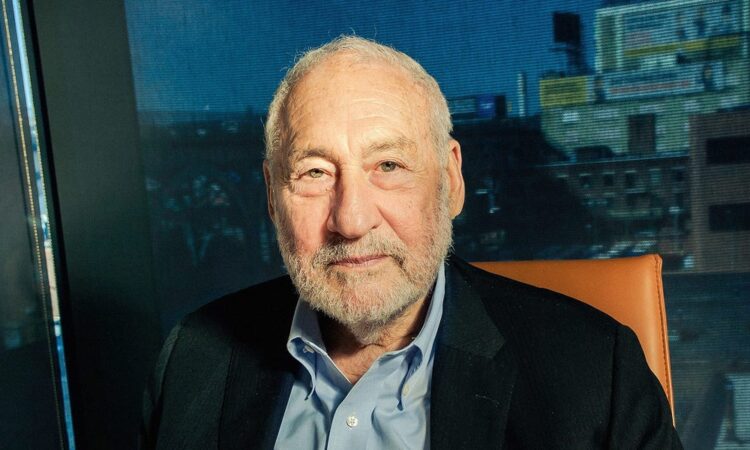

The US economic expansion should continue in the months ahead, assuming there are no major external shocks, according to Nobel Prize-winning economist Joseph Stiglitz.

“I think it’s more likely than not that we will continue to have the kind of economy that we’ve had,” the Columbia University professor told Business Insider on April 22.

Traditional recession indicators like the Treasury yield curve and The Conference Board’s Leading Economic Index have been signaling for over a year now that a downturn is ahead. But the consensus among economists and investors over the last several months is that the US economy is headed toward a soft landing, where inflation comes down without a recession.

So far, data has supported this outlook. Consumer spending, which makes up about two-thirds of the US economy, is still positive, and job gains have been robust. The unemployment rate has also stayed at historically low levels, below 4%.

Despite his generally upbeat outlook, however, Stiglitz is concerned about a number of risks. In the interview, he listed four in particular.

4 economic risks to watch

The first is that economic slowdowns happening elsewhere could seep into the US.

“There is a global slowdown. Other countries have not had the fiscal policy that we’ve had. Some parts of Europe are in recession,” Stiglitz said. “China’s economic recovery has been weak. China is an important player in the global economy. Even if we’re reducing our trade with China, that globally affects us because it affects Europe, it affects the rest of the world, and that comes back. We’re all very closely integrated.”

Second, geopolitical tensions are hot. To start, there are two wars ongoing — one in the Middle East, which now directly involves Israel, Palestine, Lebanon, and Iran, and the other between Ukraine and Russia. Any further escalation threatens to send the price of oil soaring. The price of Brent crude has already climbed from $75 in December to $88 partly due to the conflicts. Rising oil prices strain consumers by pulling up shipping costs and risk seeping into goods costs, fueling inflation.

And then there’s the icy relationship between the US and China, Stiglitz said. The latter continues to threaten to invade Taiwan, which is critical to the supply chains of many US firms.

Third, within the US, there continues to be a risk of inaction from Congress, Stiglitz said. The body has narrowly avoided a shutdown a few times over the last several months, and Mike Johnson, the speaker of the House of Representatives, has put off voting on a slew of bills until the last minute to avoid angering the right flank of his Republican party.

“American politics is, to use a euphemism, complex. Congress could shut down again, we might not get some of the necessary bills that we need to continue government,” Stiglitz said. “We could have a result of this a fiscal contraction, and that would, if the Fed wasnt flexible enough, clearly be bad for the economy.”

Finally, Stiglitz said he believes many are underestimating the policy changes that would come with a Republican administration if Trump is elected in November. For example, if Trump revokes US support for Ukraine, it could raise grain prices. It could also mean Putin would be free to continue his expansionary efforts in Ukraine and Eastern Europe. US-China relations could also deteriorate further, he said.

“Any one of these things are very fragile that things could explode if they were not in a steady hand, with a steady team — in the hands of Republican flamethrowers,” Stiglitz said. “It’s clear they’re throwing hand grenades and seeing what happens. Markets don’t like hand grenades.”

But again, Stiglitz’s baseline outlook remains positive for the next six months until the election outcome is clearer.

“It’s very hard to assign probabilities to any of these events. They’re very unique. So I remain, you might say, a little worried,” he said. “But in the normal course of events, we’re on a stable path.”