By Michael G Plummer

In the context of high inflation, rising interest rates, fiscal dysfunction and geopolitical conflict, many dismal scientists predicted that the US economy would finish 2023 in stagnation or even a recession. Yet the US economy has proven to be remarkably resilient.

In November and December 2023, the US consumer price index rose by 0.1 per cent and 0.3 per cent, respectively. Relatively good news on inflation has prompted the Federal Reserve at its last meeting to keep interest rates unchanged and pointed to possible rate cuts in 2024. Throughout 2023, the unemployment rate remained at historic lows and the labour participation rate increased over the year. US GDP performance beat expectations with robust 4.9 per cent and 3.3 per cent annualised growth rates in the third and fourth quarters of 2023. The S&P500 stock index rose 24 per cent over the year and the US dollar remained strong.

Unsurprisingly, most forecasters are revising their estimates for 2024. While they still anticipate slow growth in 2024 — the International Monetary Fund expects a mere 1.5 per cent expansion — it is difficult to find anyone that still predicts a recession. The country’s policymakers may well have been able to engineer one of the rarest of all macroeconomic feats — the ‘soft landing’.

Much of this is good news for economies in the Asia Pacific. The United States is one of the largest foreign investors in the region. It accounts for about 15 per cent of East Asia and the Pacific’s trade. The United States is by far the largest export market for emerging and developing countries in Asia. Relatively robust growth suggests stronger demand for the region’s exports, especially important given the challenging external environment in 2023.

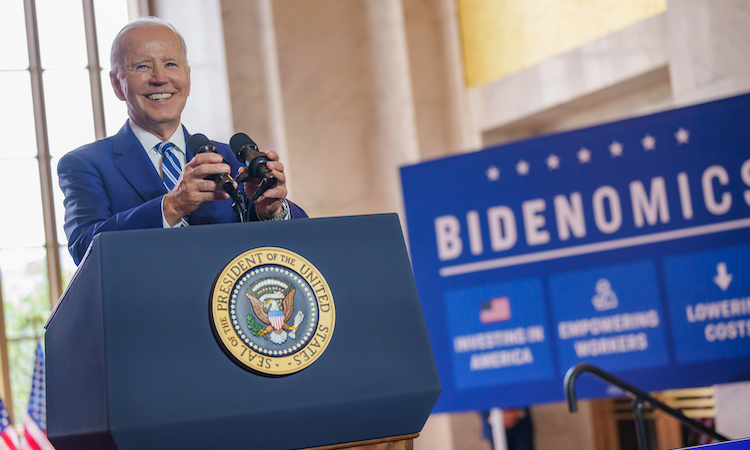

US–China relations appear to be improving after the November 2023 meeting between Chinese President Xi Jinping and US President Joe Biden. This is significant for the rest of the region — the dangers of negative spillover effects from trade and investment conflict and of tech wars between the region’s most important economic partners are self-evident.

Still, significant risks remain for the US economy in 2024, especially in the short and medium term. A soft landing is not guaranteed. While news over the past few quarters has been positive, the fallout from the massive swing in monetary policy during 2023 could well bite more in 2024, as the impacts of monetary policy on the real sector are delayed.

Fiscal dysfunction is also casting a dark shadow on US economic prospects. The budget deficit increased rapidly to US$1.7 trillion in fiscal year 2023 from US$1.4 trillion in fiscal year 2022. The gross national debt has increased from US$5.8 trillion in 2000 to US$33.2 trillion — 120.1 per cent of GDP — as of the third quarter of 2023.

While the budget was a major political issue in 2023, 2024 began with a promising budget deal to keep discretionary outlays essentially flat. There is pressure to increase spending and it could rise in a presidential election year like 2024. But any significant fiscal stimulus is unlikely given the particularly politically fractured Congress and the deficit could even narrow. Still, no political party seems to have a plan in place to address long-term fiscal challenges. This could well be an important issue after the election if not before.

Geopolitical conflict is a source of major uncertainty. Besides the Russian war on Ukraine, the new war in the Middle East also has the potential to escalate with unpredictable consequences for the global economy, with Houthi attacks on shipping through the Red Sea an ominous example.

The 2024 US presidential election campaign will become increasingly intense through November 2024 — possibly later, should the loser not accept defeat. The polarisation of US politics is becoming singularly divisive. It is no longer just between the Democratic and Republican parties but between factions within each party.

But both parties have adopted an inward-looking policy stance. In effect, the international commercial policy of the Biden administration looks much the same as the previous Donald Trump administration, albeit with different rhetoric. The Biden administration has left in place many tariffs and administrative actions of the Trump administration. The Biden administration has failed to invest in new free trade agreements or to revive the World Trade Organization, leaving its Appellate Body in limbo.

The admirable green goals of the 2022 Inflation Reduction Act (IRA) have been tarnished by inward-looking content requirements. The US Congress is considering the implementation of a carbon tariff, in part motivated by the Carbon Border Adjustment Mechanism that the European Union has already begun to implement. Should Trump win the 2024 presidential election, he promises to apply a 10 per cent across-the-board tariff and match foreign tariffs on an ‘eye for an eye, tariff for a tariff’ basis. Such Old Testament commercial policy would be disastrous for both the region and the United States.

In short, the slow but positive growth and falling inflation in the United States is a reasonable scenario and good news for the Asia Pacific. With the 2023 soft landing, US imports from the Asia Pacific — an important source of growth for this very outward-oriented region — will likely increase in 2024.

Some regional economies like Vietnam will benefit from continued de-risking from China. Others, like Australia, will gain in part from aspects of the IRA that incentivise investments in inputs to the green economy like lithium. But we live in a time of extraordinary uncertainty and disruptive storms may be brewing.

- About the author: Michael G Plummer is the Eni Professor of International Economics at Johns Hopkins University and a non-resident Senior Fellow of the East-West Center.

- Source: This article is part of an EAF special feature series on 2023 in review and the year ahead.