The SHRINKING Dollar YinYang

“The road to Easy Street goes through the sewer.” – John Madden

Interest rate concerns were already in focus as the equity markets digested what Powell and other Fed officials were saying—that they were walking back the dovish 3-cut outlook that was initially a 6-cut one. With the latest hot inflation report, it won’t take long before the Fed starts reducing the outlook for rate cuts again.

One report isn’t a trend, but three reports in a row can be considered the start of one. The latest CPI report makes it three in a row with hotter-than-expected inflation data. Short-term interest rates rose, and the Fed funds futures were hammered on the CPI data, repricing for fewer rate cuts this year and a later start date.

The Fed has long warned that inflation cooling will not be linear, and today’s report reflected the stubbornness of price pressures. While energy and housing contributed over half of the strength, modest gains in many other components suggested a broadening. Indeed, Powell’s “supercore” rate, which also excludes housing, rose 0.65% on the month, after gains of 0.47% in February and 0.85% in January, according to Bloomberg.

Regarding energy, I’ve long warned that a war on fossil fuels will play into higher oil prices that affect everything. On housing, the mainstream “theory” has been that the shelter component will come down. I’ve been asking the question, HOW? With ALL input costs increasing for landlords, rents are NOT coming down anytime soon. Does anyone believe the cost of a home will decrease during an inflationary period? The entire “consensus” argument for shelter costs receding was and is a pipe dream.

AAA says gas will hit $4 this summer, increasing headline inflation. WTI can ratchet higher (on that track), affecting costs and prices in the entire energy complex. Services inflation has been stickier, making the 3-month annualized trend look concerning. The rise was initially attributed to wonky seasonal adjustments. The March report poured cold water on that theory, as inflation now appears to remain a tough nut to crack. We’ll visit other factors regarding “policy” that make the Fed’s job more difficult later.

In the past two weeks, we’ve seen an adverse market reaction to geopolitics, inflation, and, ultimately, the impact on the interest rate path. The inflation backdrop is littered with roadblocks that continue to make the Fed’s job more difficult. Yet, not many want to address the obvious. Today, we break down what is right in front of everyone.

Wages and Inflation

And wages remain a challenge, with the New York Fed’s measure of trend wages remaining stubbornly high lately after falling from 7% to 5%. The current mindset is to increase wages for everyone. While that is a nice gesture, it is undoubtedly inflationary, with California’s proposal for a $50/hour minimum wage a death kneel for small businesses. While we might not get that far, the $20/ minimum wage is already in place in California. Once again, the pendulum has swung too fast and is all inflationary. It may also come with unintended consequences, as owners of these franchises will have trouble absorbing the 25% overnight pay increase.

Everyone wants higher wages, but that adds to the cost of goods, and the ‘CYCLE” continues unabated until a severe downturn enters the scene. That is one reason many believe this inflation story won’t end well. Indeed, they have a history to back up their fears. I’ve remained optimistic but can join that camp if the tide doesn’t turn quickly.

The common belief is that the U.S. may be out of inflation danger once the Fed starts cutting rates. Only once after the Fed began to cut rates has inflation been higher 12 months thence. That was then; this is now. Comparing the two is comparing “apples” and “oranges.” I’ll also remind everyone that the Fed has waited for inflation to roll over before cutting in the past, and it has never had to work in this present backdrop filled with obstacles.

Remember what we have discussed earlier: These higher costs are embedded in many goods. The prime example is food. So, one has to ask, what will take these high embedded prices down? The obvious answer is a relatively significant decline in economic activity, which sparks the Fed to cut rates to break the cycle—one reason investors shouldn’t wish for an abundance of rate cuts.

As the new highs in the S&P 500 (SPY) demonstrate, the market has digested the news and hasn’t blinked over the fact that the rate cut forecast has been cut from six to three. Remember, this rally started over the notion that we would get all six cuts in ’24. One must wonder if the market will continue to be this forgiving when the forecast changes from three to one or maybe none this year. That leaves me with the opinion that a market tantrum over rate cuts could be the catalyst for ushering in the first real pullback this year (it may have started) as the market starts to lose patience with the inflation situation and the Fed.

The ROADBLOCKS to LOW INFLATION

However, this isn’t all about the Fed. External factors over which they have little control add to the inflation issue. Energy and commodity prices are spiking. Geopolitics is yet another catalyst that can keep crude oil prices higher. I said it when inflation first hit the scene—energy prices affect everything. The administration forgives more student loan debt, and spending is not curtailed, with “illegal migration” and “green energy” at the top of the spending list. All of that is impacting the inflation scene.

Inflation is the boogeyman; when it first enters the scene, it negatively affects everything. After all, everyone still feels the impact of the initial spike in inflation. Does anyone believe the prices paid at the grocery store will decrease now because the inflation rate has slowed? Once it’s embedded, it is tricky to reverse. Hence, the Consumer and Small Business Confidence Survey results are at or near historic lows.

So unless the Fed caves (that would seem impossible now), the FED won’t allow inflation to get out of hand.

MACROECONOMY and CLEAN ENERGY MANDATES

The new “marching” orders for cleaning the environment have been declared. The Environmental Protection Agency chose Good Friday to roll out its burdensome electric truck mandate, a rather ODD choice of timing. The anti-green movement has pushed back to little avail. They continue to point out damage that is being done in the name of climate change. There is little reason to argue over these edicts. There is a contingent, of which the administration is part, that is driven to announce every regulation, perform every task, and ensure EVERYONE will comply in the name of climate change.

The latest mandate comes from the EPA’s new emissions standards for heavy-duty trucks. This new regulation will effectively require (MANDATE) that electric semi-trucks make up an increasing share of manufacturer sales from 2027 through 2032, similar to its recent rule for passenger cars. The passenger car mandate was rolled out without any thought to the infrastructure required for the plan to work, and the latest rebuke by the consuming public confirmed the failed plan. It has been established as a “greenie” dream costing US taxpayers billions.

After that failed experiment, it is hard to believe this new truck mandate was proclaimed as it is more costly and fanciful. Less than 1% of U.S. heavy-duty truck sales are EVs, and nearly all are in California, which heavily subsidizes and mandates their purchase (At an ADDED cost to the taxpayers).

The EPA will require electric models to account for 60% of new urban delivery trucks and 25% of long-haul tractor sales by 2032. The harm is very predictable in return for what is expected to be no measurable benefit to the climate. The EPA claims this mandate will “avoid” one billion metric tons in CO2 emissions from 2027 through 2055. That is equal to the emissions from China and India last year alone. The truck mandate will do nothing to reduce global temperatures. While we may not measure any benefit, we can look at the data to determine the economic harm associated with these mandates.

First, no electric long-haul tractors are currently in mass production. If and when any new startups in EV tucks suffer the same fate as the bevy of EV car manufacturers that went bankrupt, this money pit will make that look like a divot. The few electric trucks on the road today can’t go more than 170 miles on a charge. Of course, that will slowly increase over time, but that is our starting point today. Electric semis require bigger and heavier batteries, which means they must carry lighter loads to avoid damaging roads. Fleet operators will have to use more trucks to transport the same amount of goods. Since 70% of freight is moved by truck, the cost of all goods goes higher, adding more inflationary pressures.

More trucks equals more congestion, especially around ports and distribution centers. The EPA says its rule will reduce pollution in “environmental justice” communities near major truck freight routes, but more overall traffic will result in more pollution. Like all other electrification projects, the EPA never determines how much pollution will be reduced. The reason, no one can. There has never been any cost/benefit analysis associated with these projects. The notion that everyone should possess blind faith and “believe” it will “help” the climate is an absurdity. We are to spend hundreds of billions, and perhaps we will see a difference in the future.

Electric trucks also generate more soot from their wear and tear on roads and vehicle braking. Like the “charging” issue (no infrastructure) that is yet to be solved for EV passenger cars, power generation and transmission will have to massively expand to support millions of new “zero-emission” trucks. An electric semi consumes about seven times as much electricity on a single charge as a typical home does in a day. Truck charging depots can draw as much power from the grid as small cities.

But that is just the beginning of this nightmare. It is estimated that ~1-1.5 million chargers will have to be installed by 2032 to achieve the EPA’s mandate, about 15,000 a month. In January, the administration proudly announced that 1100 new charging stations were built during the second half of ’23. More money will be tossed at this project ($5 billion in the infrastructure bill), so we can hopefully assume the installation rate will increase. However, the 15k-a-month goal for Trucks alone falls into the wishful thinking column.

Major grid upgrades will be required at the grid level when critical components such as transformers are scarce. Developing transmission and substations to support truck chargers in many places could take three to eight years. Forget about wind and solar providing the added capacity; even if they were reliable, they could not be built fast enough to make a difference, leaving fossil fuels as the primary energy source.

Truckers estimate the EPA rule will cost utilities $370 billion to upgrade their networks. On top of that, truckers will have to invest $620 billion in their internal charging infrastructure. This doesn’t include the cost of electric trucks, which are typically two to three times more expensive than diesel cabs.

Replacing diesel trucks with electric will cost the industry tens of billions of dollars yearly. Truckers will pass on these costs to customers—meaning U.S. manufacturers and retailers—ultimately passing them on to Americans, which equals higher prices for EVERYTHING.

Oh, by the way, this eight-armed Druga presents another dilemma. China’s (BYD) was California’s top-selling electric truck maker in 2022. Rest assured, all the “other” materials needed to escalate battery development and manufacture in the US will come from China. If the US allows China to manufacture and control it all, it will be at the mercy of its fiercest competitor. As th US electrifies and seeks out alternative energy sources, China continues to laugh its way to the bank. Eventually, this will impact the entire US automotive industry, and on top of the obscene cost, the economic ramifications will become disastrous.

The EV transition is a travesty, and the MANDATE to add long-haul trucks to this farce adds to this folly. A folly that will cost Billions, if not trillions, if allowed to proceed. At a time when the debt burden in the US is growing exponentially, it is on a trajectory that cannot be sustained.

US Debt (www.statista.com/)

The US EV policy is a race to the bottom—the bottom of a never-ending money pit with no return on investment. We are witnessing trickle-down economics, but unfortunately, higher costs will trickle down from policy that comes from the top and negatively affect everyone below.

Don’t lose sight of the entire Green movement being highly inflationary.

GEOPOLITICAL SCENE

Oil prices are rising, and one of the reasons remains the continuation of Ukrainian drone strikes against Russian oil refineries. Ukraine has limited capabilities to dislodge Russia’s occupying forces, but its use of drones to damage Russia’s critical infrastructure has been more and more effective.

Israel recently attacked an Iranian consulate building in Damascus, Syria. Despite the intense level of headlines generated by this attack, both Israel and Iran understand where the red lines are from each other’s perspective, and they are careful not to cross them. Neither side is attacking the other’s territory for fear of escalation that such a move would provoke. Despite these “red lines,” recent actions are enough to keep the oil markets on edge.

The war on fossil fuels resulted in the US no longer controlling its destiny regarding energy prices. Global “policy” remains slanted toward controlling production, keeping oil prices at the middle to upper end of the trading range. Saudi Arabia appears to have no interest in increasing production, and the feeling is that the Saudis would like to see the $90-$95/bbl level come to fruition to maintain their budgets for expansion. The Saudis also realize the US war on fossil fuels has eliminated the threat of a US production increase, allowing them to control pricing.

With the two wars ongoing and the chance that Iran may enter the fray with Israel, Geopolitics may also play a part in the “supply” issues. As mentioned in the opening paragraph, Energy costs affect EVERYTHING, and when they are rising, inflation will remain cemented in place.

A new headline emerged as the market trading ended for the week; if true, it is one of history’s most highly publicized attacks. Military intelligence says it uncovered information that Iran is going to attack Israel in the next couple of days.

Another instance where U.S. ‘policy” has allowed a terrorist organization to remain in control. in our opinion, instead of supporting an all-out destruction of Hamas and its sponsor (Iran), the calls for a ceasefire have emboldened the terrorists and their allies. The die is cast, and an escalation of this war on terrorism will not be a positive for energy prices and inflation.

POLICY and INFLATION

Despite the Supreme Court ruling that forgiving 6 trillion in student loan debt is illegal, the administration announced another round of loan forgiveness. This second wave of forgiveness will add to the first round and effectively cancel approximately $1.7 trillion of debt owed to the government. This continued expansion of student loan relief significantly exceeds the original $10,000 loan forgiveness proposal. It will likely significantly impact consumer discretionary spending and the growing US debt problem. ThIs “program” will cost the US taxpayer 500 BILLION and ironically cancels the interest due that is currently helping to pay for Obamacare.

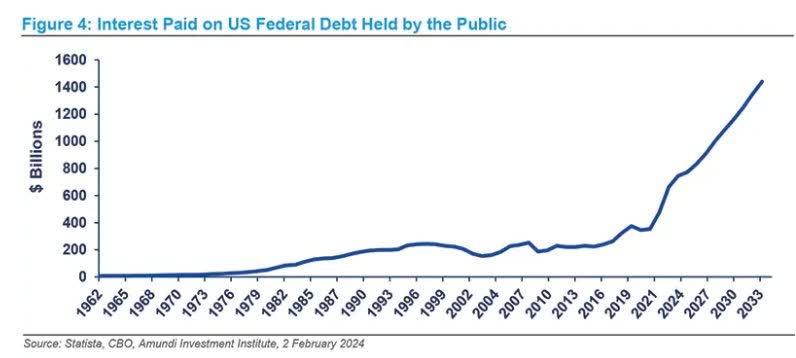

The “forgiveness” programs are inflationary. They come as the Fed attempts to reduce a sticky inflation scene. Next year, servicing the country’s debt will exceed the US defense budget. The cycle is very simple. More debt leads to more interest, and that leads to more debt.

The folks relieved of their loan burden are happy, those who paid their loans are frowning, and every taxpayer is now wondering why they are paying off student loan debt with taxes while they watch the debt/GDP ratio expand.

The FED

I find it amusing listening to the parade of analysts and economists who continue to debate Fed policy, specifically whether the present stance is too “tight.” Each will cite a bevy of statistics to make their case but, in reality, miss what is right in front of everyone. Since March 2022, we’ve seen the Fed raise the Fed funds rate from zero to 5.5%, and GDP has improved and remains resilient. The rate increases were swift, and it is a plausible conclusion that the new rates have filtered through. Economists keep marching to the tune that the economy will weaken, but I’ll remind everyone they have been saying that since mid ’22. Given all of the data, it’s obvious that the Fed funds rate is not too restrictive.

So, it’s puzzling to me why Jay Powell has been consistently talking about “rate cuts” (meaning Fed funds rate reductions) when the economic data doesn’t seem to support the policy change. Assuming they aren’t about to enter the political scene in an election year, is the Fed worried about something else?

I recently told members of my service that the strength in the large money center bank sector (XLF) might signal a “higher for a longer” environment. On the other hand, the regional banks (KRE) face different issues. KRE could use lower Fed funds to help them bleed off some of this commercial real estate exposure and the CMBS (commercial mortgage-backed securities) that go with it.

A Chicago periodical recently noted that Chicago’s office vacancy rate hit 25% last week. As of January, the vacancy rate for office buildings in Manhattan, New York City, is over 20%, a record high.

CMBS, commercial real estate, not to mention bank portfolios, could use some Fed funds relief. Perhaps that is what Chair Powell is concerned with, and if that is the case, then the Fed will be in a quandary after the latest hot inflation report.

The rate situation has been the same since the Fed started raising rates, and my stance is well documented. It remains “higher for longer,” and the market is now sifting through what has become a more complex backdrop for stocks. We discussed the many factors that are at play. Continued spending on “illegal migration” and “green energy,” among other things, such as other policy mandates regarding energy, loan forgiveness, etc. The Fed has no control over any of those issues, and the message I hammered home for the last two years has not changed. The past, present, and proposed policy decisions are making the Fed’s job more difficult. All combined, these factors hinder the Fed’s efforts to keep a lid on inflation.

With investors coming to grips with no rate cuts in June and July, the consensus is that any rate cuts have just been pushed out. However, a very plausible scenario says the next rate cut will be due to a faltering economy. I’m not rooting for that and, therefore, not rooting for rate cuts. Furthermore, if the economy stays as is and inflation remains moderate but above target, don’t be surprised if a rate hike enters the Fed’s vocabulary. Barring an event – the economy is months away from anything occurring on the interest rate scene. So, it is time to focus on this earnings season and the economic data.

SUMMARY

We now have the S&P 500 (SPY) pulling back from all-time Highs. After reading this, one might conclude that I am Bearish on the equity market. Nothing could be further from the truth. While the short-term trend has been disrupted, as shown in the daily chart of the S&P 500, the intermediate and longer-term Primary trend is BULLISH.

S&P 500 (www.freestockcharts.com)

It should be evident that for investors to be successful, they MUST separate the short term from the MACRO scene, but the issues highlighted here today will have a major impact on the US MACRO economy. With that comes the potential for severe ramifications for the stock market. There doesn’t appear to be any ‘change’ on the horizon, which keeps this runaway spending/inflationary train on a clear path over the cliff.

Over my career, I have invested in various economic backdrops, each with specific challenges. I have never encountered an economy so fraught with “agendas” that produce no appreciable results, creating situations that work against the fight against inflation.

I am not an author who produces warnings, scare tactics, or gloom and doom articles to garner attention. My record speaks for itself. I’ve been on the right side of the market since I became an author on Seeking Alpha in 2013. I don’t produce “clickbait” articles; my work here is well-received and documented.

What I’ve highlighted here today is just the tip of the iceberg. I could have produced a dozen more examples of the ineptitude and policy errors that investors face. All of that makes for a treacherous road ahead. How these issues are resolved (or not) will determine the investment scenario heading into the latter part of this year and 2025.

As the opening photo shows – consumers are left with a shrinking dollar, and the warnings were sounded when the outsized spending bills passed well after Covid was a non-event. Not many in D.C. listened or were concerned. That was two-plus years ago, and the same attitude exists today. Perhaps, as the opening quote says- They will have to visit the sewer before the US economy can revisit Easy Street.

Finally, the US adds 1 TRILLION to its debt every 100 days. That is all one needs to know about the severity of the situation.

THANKS to all the readers who contribute to this forum to make these articles a better experience. These FREE articles help support the SA platform. They provide information that speaks to Both the MACRO and the short-term situation. With a diverse audience, there is no way for any author to get specific unless they’re simply highlighting ONE stock, ETF, etc. Therefore, detailed analysis, advice, and recommendations are reserved for members of my service offering on the platform.

Links are provided as supporting documentation. If anyone can point out a comment in any article I put forth and demonstrate that it is factually INCORRECT – I will REMOVE it. –

Best of Luck to Everyone!