Welcome to Euractiv’s weekly Economy Brief. You can subscribe to the newsletter here.

As finance ministers meet in Brussels to finalise a deal on the EU’s fiscal rules, Europe’s only hope is that they stop listening to the prophets of fake scarcity and allow more flexibility for investments.

The national finance ministers met on Thursday (7 December) night to hash out the final details of the fiscal rules, but did not reach an agreement. They meet today again with the same goal.

However, as negotiations stand now, it seems clear that investments will not get much preferential treatment in European public budgets if the new fiscal rules are to be agreed. This will create a poisonous political economy that pitches social spending, defence spending, and green investments against each other at a time when all three are needed.

By now, the initial idea of the fiscal rules reform – to make them easier and more considerate of each country’s individual situation and needs for investment – has been thoroughly riddled with numerical “safeguards” that make the rules even more complicated than before and, if respected, will not leave much room for additional investments.

It’s a great irony that German Finance Minister Christian Lindner should be able to push through such a reform at the very moment when the debacle of Germany’s notorious debt brake – the German illusion, as my colleague Jonathan Packroff called it – is becoming obvious.

The Germans now have to decide whether they want to raise taxes or curtail spending during a recession, or if they want to retroactively declare an emergency situation and legalise their deficit spending.

Raising taxes will be unpopular, the retroactive declaration of an emergency will look ridiculous, and curtailing spending will, in all likelihood, reduce climate investments.

The rules create an artificial scarcity that begets real scarcity. Lower public investments will sap the confidence of private investors, who will scale back activity, thus reducing economic growth and tax revenues.

That’s how Europe screwed up its 2010s, and it seems that EU finance ministers are prepared to do the same again now, while the need for investment is much greater.

For one, the demographics of the EU have worsened, meaning that reductions in social spending are not in sight or can only be pushed through with brute force in exchange for a politically toxic environment.

Second, defence spending has to increase in Europe if it wants to protect itself from Russian imperialism, especially if another Trump presidency, barely a year away, simply withdraws NATO’s security umbrella from Eastern Europe.

So, it will probably be climate investments that will be hit by the required “safeguards” of the fiscal rules, as they have no lobby behind them and are championed only by enlightened reasoning and a bunch of young people with a habit of making themselves supremely disliked through pointless protests, for example by glueing themselves to streets.

EU finance ministers stand at the cusp of committing one of the biggest economic policy blunders since then-chancellor of the exchequer Winston Churchill forced the UK back on the gold standard in 1925 at a ridiculous exchange rate to the dollar.

In the name of “sound finance” (sound familiar?), Churchill created artificial scarcity, forcing ruinous deflation on the country, causing social strife, economic mayhem, and, indirectly, also military unpreparedness for the war that was to come.

“Everybody said I was the worst chancellor of the exchequer that ever was,” Churchill said, reflecting on his decision later in 1930. “And now I’m inclined to agree with them.”

Whether EU finance ministers will have such Churchillian magnanimity is doubtful. Better not to commit the mistake in the first place.

Today’s edition is powered by Instagram

Family Centre has resources to support parents

Family Centre on Instagram helps parents keep their family safer, with an Education Hub featuring expert advice and Supervision parents can set up with their teenager.

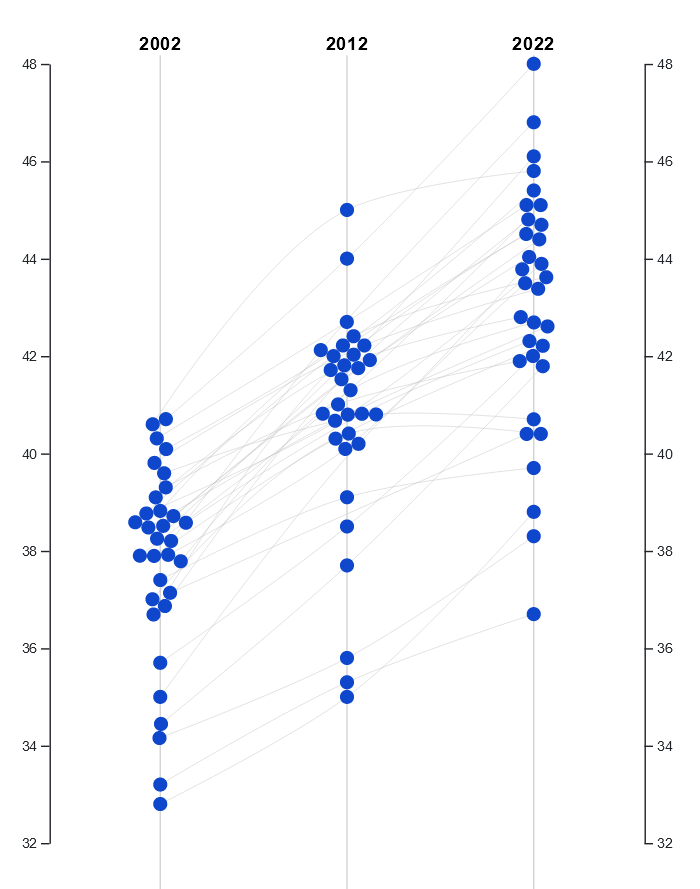

Chart of the Week

Today’s chart goes to show the demographic problem that the EU is faced with. The EU is ageing fast, which will put additional strain on public budgets. Other than productivity-enhancing investments, Europe will also need immigration and policies that make it easier for parents to combine having a family and a career to counter this trend.

While the latter, again, needs public investments in childcare and education, the former is politically difficult to sell to European citizens. They will probably be more amenable to accepting immigration if the economy is running at full steam instead of being hemmed in by low public spending.

If you want to toggle through more EU demography statistics, you can find them compiled by Eurostat here. But be warned, they do not look great.

You can find all previous editions of the Economy Brief Chart of the week here.

Economic Policy Roundup

Nadia Calviño wins race for EIB Presidency. Spanish finance minister and deputy prime minister Nadia Calviño will become the European Investment Bank’s new president, EU finance ministers decided on Friday (8 December), choosing her over the EU Commission’s Margrethe Vestager.

EU countries want to continue using green tech from China. Concerned that excluding Chinese manufacturers of solar panels and other green technologies could slow down the energy transition and raise costs, EU ministers discussing the Net-Zero Industry Act (NZIA) on Thursday (7 December) agreed to continue allowing Chinese products for most subsidy programmes for renewable energy. This goes against the European Parliament’s position that aims to partly exclude Chinese products from public tenders for large renewable energy projects, which some in the solar sector warned against.

Italy, France try to exclude climate transition plans from due diligence law. As trilogue discussions on the Corporate Sustainability Due Diligence Directive (CSDDD) are underway, the Italian and French governments are trying to further water down the provisions. According to proposed amendments, seen by Euractiv, the two governments try to reduce the requirements for corporations to draw up and adhere to climate plans that should make their operations compatible with Paris climate change targets.

Literature corner

Taking rights away seriously: The Council’s position on the long-term residents directive

Inflation is not equal for all

Towards a public sustainable finance paradigm for the green transition

A useful and human grand narrative for the 21st century

How Formula 1 accidentally helped Las Vegas workers land the “best contract ever”

Additional reporting by Théo Bourgery-Gonse and Jonathan Packroff

[Edited by Zoran Radosavljevic]