Ron Crabtree/DigitalVision via Getty Images

The Fed is Spooked

After weeks of hawkish talk after the February FOMC meeting, the Fed (and the world) suddenly was confronted with a new crisis. Seemingly out of nowhere, a run began on Silicon Valley Bank (SIVB), one of the largest in the US. Within days, bank runs had spread to other California banks like First Republic (FRC) and PacWest (PACW). New York-based Signature Bank (SBNY) collapsed next, followed by the fire sale of Credit Suisse (CS) about a week later. And these were not just some community banks. This month, three out of the 30 largest commercial banks in America have found themselves at or near total collapse. These banks largely catered to the top 1% and 0.1% of income earners in America. And against all odds, they were the first to crumble from the Fed’s rate hikes!

In a normal economy, the Fed would respond to this by cutting interest rates to ease the burden on the banking system. However, this is no normal economy. Out-of-control inflation and previous policy mistakes put the Fed between a rock and a hard place. This time around, the Fed has far less ability to support the financial markets than in the past. Due to inflation, high valuations, and problems with the labor market, they’re more or less stuck into raising more. So when the FOMC meeting came around this week after another hot inflation print, they had no choice but to hike interest rates by 0.25% to a range of 4.75% to 5.00%, lest they risk a massive surge in inflation. If inflation stays stubborn (i.e. no recession), then Powell indicated that they’ll hike rates more. And quantitative tightening is not slowing down.

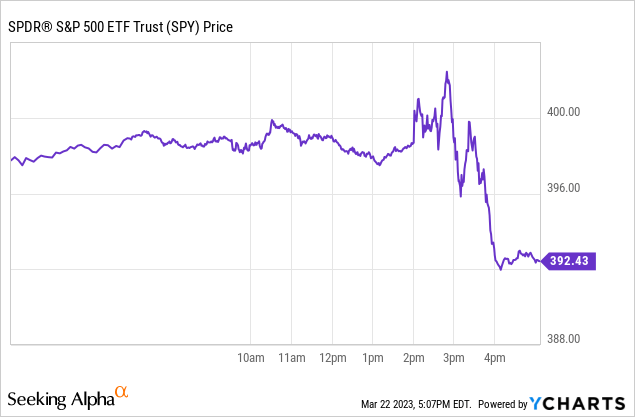

As such, the “pivot” that would help stocks get even more expensive didn’t come, and won’t come. Stocks sold off sharply during and after the FOMC press conference. Caught between inflation on one hand and financial instability on the other, the Fed is in a terrible position.

QE 2023: False Rumors

Twitter has been abuzz over the past couple of weeks that there’s some conspiracy for the Fed to slyly print a bunch of money and give up on fighting inflation. This is not true. While the Fed’s balance sheet has increased, it’s come from advancing money to the FDIC to make depositors whole, and from short-term lending to banks via the discount window and through the new bank term funding program. Short-term loans at high rates of interest are not the same as buying bonds from banks to put money in the system! The FDIC money is a non-starter on inflation – the Fed advanced them money and they’ll get paid back as the FDIC relentlessly liquidates Silicon Valley Bank. It’s essentially a government-to-government loan.

This also is true for the other loans. True to the 1873 banking classic Lombard Street, the Fed is lending freely, at a penalty rate, and against collateral. Banks are not going to take this expensive capital from the Fed and then loan it out and cause inflation. What’s going to happen is that they’re going to deleverage, pull back on lending, and tighten their standards. This means that the supply and velocity of money will dramatically decrease in the areas of the economy that these banks serve. Various banks that are now in trouble had a lot of jumbo mortgage loans (i.e. $1-4 million West Coast mortgages, often with less than 20% down, often ARMs, and often underwritten using bonuses and stock compensation). Loans that had at least two of these four were asking for trouble from the start, and these are going to be very hard to get going forward, and they’ll be a lot more expensive. Anything to do with venture capital, crypto, real estate development, etc., is now facing a near-immediate credit crunch. The truth is actually the exact opposite of the rumors being spread by Bitcoiners on Twitter that the Fed is flooding the system with money to redistribute wealth and/or enrich the American upper class.

In the real economy, this is thought to count for an effect of somewhere from a 25 bps to a 50 bps hike, though Powell noted that it’s “guesswork” how much the exact effect will be. The net effect of this is pretty clear. Areas of the economy that are widely considered to be speculative are going to have serious trouble getting financing going forward. The Fed’s hope all along was that they could slow down speculation and inflation without hurting credit availability to small businesses and the economy at large, and the odds just dramatically narrowed of them being able to do that.

Bulls buying bubbly tech stocks that are up 20% to 50% year-to-date because they think a “pivot” will be good for them could be in for a lot of pain here shortly.

No Soft Landing: Inflation May Accelerate If There’s No Credit Crunch, Forcing More Hikes

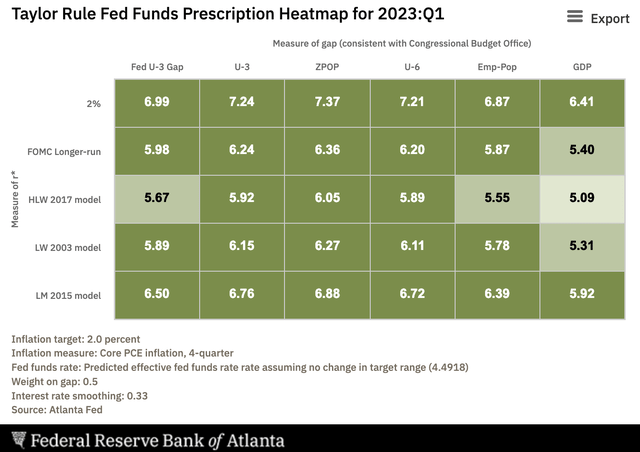

The Fed is doing the best it can here to balance bringing inflation down with avoiding blowing up the financial system. The problem is that under mainstream econometric assumptions, interest rates will need to go above the rate of inflation to slow things down. The Fed’s dot plot came in at a 5.12% Fed funds rate this year, lower than 29 of 30 models I’ve run using the Taylor Rule and various macroeconomic assumptions.

If we escape recession, rates need to go over 6% and might need to go close to 7%.

Taylor Rule (Atlanta Fed)

There’s a huge gap here between what models tell you the Fed funds rate needs to be to bring inflation down and what the Fed is saying. And the only way that core inflation of 5.5% and a terminal cash rate of 5.00 to 5.25% really reconcile is for there to be a recession. Recessions are brutally effective at lowering prices. And in a typical recession, the Fed is able to quickly cut rates and help, but this time they can’t, at least not as quickly. If the Fed thinks that a terminal rate of 5-5.25% will suffice, there’s a strong chance that they know something that stock bulls don’t about an upcoming recession. We just got hot inflation data from the UK and an advance warning that used car inflation in the US (a big driver) will soon accelerate as well. So if we don’t get a recession/credit crunch in short order, the Fed could get completely run over by inflation numbers in months ahead, as we see happening in Europe and the UK now. Either way, it’s not good for stocks.

What Does This Mean For Your Portfolio?

Stocks are very expensive, with the S&P 500 (SPY) trading for about 18x 2023 earnings estimates. This is on the high side of normal and is made worse by the fact that earnings estimates are still inflated by consumers spending what’s left of their COVID savings, and worse still by the fact that the yield on cash is now roughly the same as the earnings yield on stocks. Earnings estimates are steadily falling, the Fed has indicated it will hike at least once more, and stocks rallied on nonsense to start the year.

Look at the biggest holdings of the index funds. It’s crazy how expensive stocks are. The only real parallels in the US are the dot-com bubble and 2021.

- Apple (AAPL) is up 26% YTD, has negative EPS growth, and trades for 27x shaky 2023 earnings estimates. Sell it.

- Microsoft (MSFT) is only about 29x 2023 earnings and has vastly superior growth prospects to Apple. MSFT is still not a great deal, having run up so much. Hold MSFT.

- Amazon (AMZN) doesn’t even have any earnings to value it against. Sell.

- Nvidia (NVDA) and Tesla (TSLA) trade for insane valuations. These are easy sells.

- Bitcoin (BTC-USD) is up like 40% since the banking crisis started. BTC is a hold unless you bought the panic in which case it’s a quick sell. I actually like Bitcoin for the long run but the characters orchestrating panic buying in it on the internet are either lying or don’t understand economics.

Bottom Line

It takes literally zero skill to earn 5% in Vanguard Money Market (VMFXX). But doing so will earn you more return each year than the underlying earnings from investing in the premier businesses in America. And if the Fed is right about the recession (in between the lines of course), stocks are dramatically mispriced. If the Fed is wrong, they’ll be forced to hike and you’ll earn 6% or 7% on cash instead of 5%. And 10-year inflation breakevens between Treasuries and TIPS are about 2.3% as of my writing this. If you think the Fed is full of it and will let inflation soar to avoid a recession, you can buy TIPS (TIP) and make huge profits over the next 10 years. I think a hard landing/recession is more likely at this point. My personal thoughts? Buckle up, stock up on cash, and be extremely selective with what stocks and funds you buy over the next 3-6 months.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.