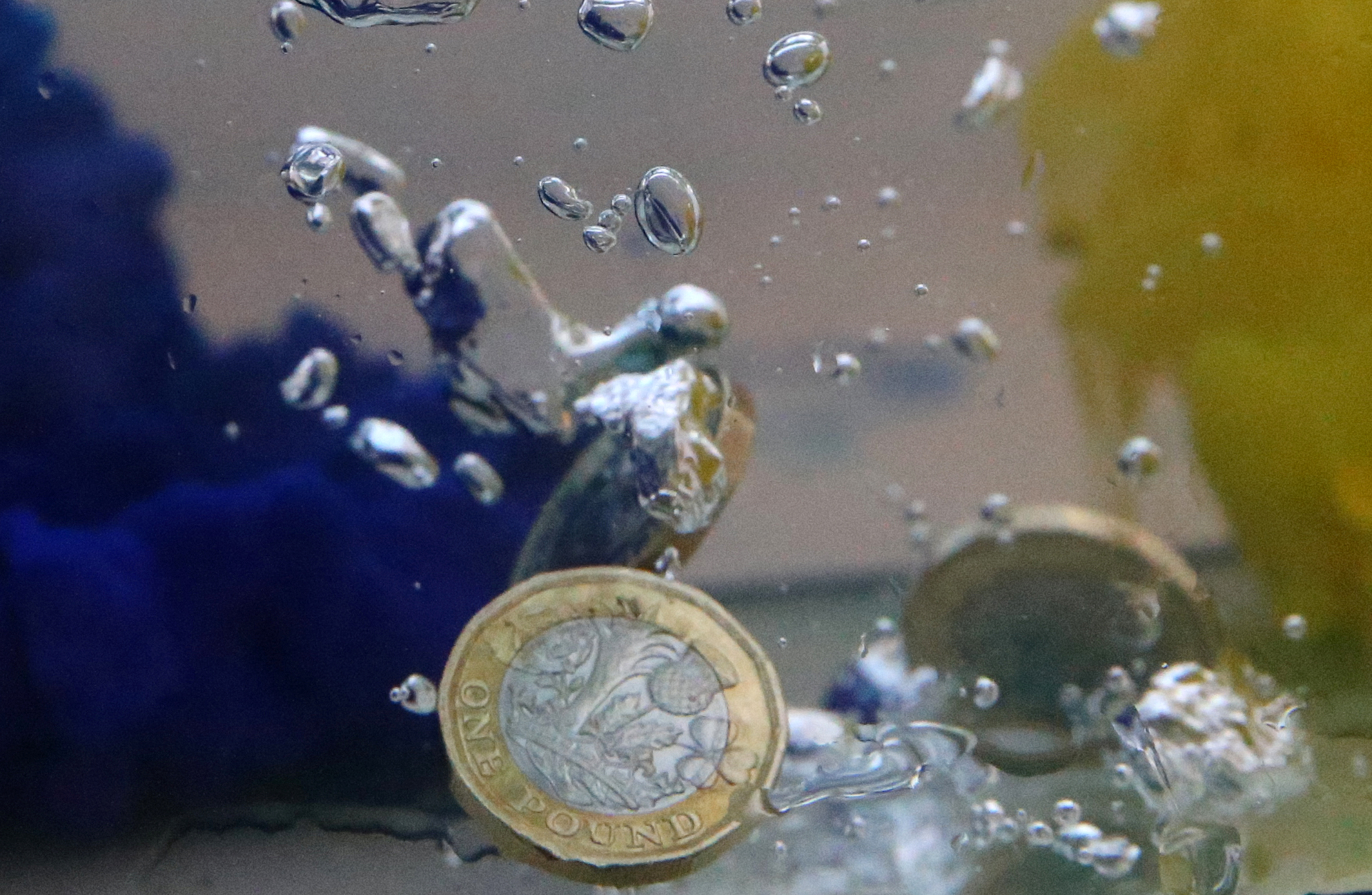

UK pound coins plunge into water coloured with the European Union flag colours in this illustration picture, October 26, 2017. Picture taken October 26, 2017. REUTERS/Dado Ruvic/File Photo Acquire Licensing Rights

LONDON, Oct 26 (Reuters) – Sterling sank to a three-week low on Thursday after a slew of economic market data this week affirmed the view that the Bank of England (BoE) will likely hold rates steady at its policy meeting next week.

Sterling is heading for a third consecutive day of declines, down 0.2% to $1.2090, after briefly hitting its lowest since Oct. 4.

Against a weakening euro , it touched an almost one-week low before flattening on the day at 87.25 pence.

“I would attribute the latest weakening to dovish commentary from the BoE, UK data broadly coming in softer than expected and markets increasingly pricing out the risk of another hike and thus the conclusion of the hiking cycle,” said Kirstine Kundby-Nielsen, an analyst at Danske Bank.

The pound has declined more than 6% against the U.S. dollar over the past three months.

Data on Tuesday showed a labour market that was loosening, while the flash reading of the S&P Global UK Purchasing Managers’ Index (PMI) for the services sector fell in October to 49.2, the lowest reading since January.

Although inflation unexpectedly held steady at 6.7% in September, the highest of any major advanced economy, the BoE is expected to leave rates at 5.25% on Nov. 2, according to the vast majority of economists polled by Reuters.

Money markets now are pricing in no further rate increases, and rate cuts as early as June next year.

In an interview with the Belfast Telegraph published on Friday, BoE Governor Andrew Bailey said inflation data for September, which failed to fall as most economists predicted, was not far off what the central bank had expected.

Adding more evidence on the weakness of the economy, British retailers reported on Thursday their joint-worst October for sales volumes on record and they expect another difficult time in November as households struggle with the higher cost of living, a Confederation of British Industry (CBI) survey showed.

“The weakness of the CBI survey has highlighted the headwinds facing the consumer in the UK,” said Jane Foley, head of FX strategy at Rabobank.

“Looking forward both the UK and the euro zone face the potential of technical recession suggesting that downside potential for the pound versus the euro could be limited”.

Sterling moves on Thursday seem also to be driven by strengthening in the U.S. dollar in anticipation of U.S. GDP data due later, and weakness in the euro as the European Central Bank holds its policy meeting, Kundby-Nielsen said.

Reporting by Joice Alves; editing by Robert Birsel

Our Standards: The Thomson Reuters Trust Principles.