(Bloomberg) —

Most Read from Bloomberg

Russia looks to be successfully working around European Union and Group of Seven sanctions to secure crucial semiconductors and other technologies for its war in Ukraine, according to a senior European diplomat.

Russian imports in general have largely returned to their pre-war 2020 levels and analysis of trade data suggests that advanced chips and integrated circuits made in the EU and other allied nations are being shipped to Russia through third countries such as Turkey, the United Arab Emirates and Kazakhstan, the diplomat said, pointing to those private assessments.

EU and G-7 countries have introduced multiple rounds of sanctions since the invasion of Ukraine a year ago in an effort to degrade the Russian war machine and undermine its economy. The data suggest that the real impact in some areas is so far falling short of what officials might have hoped for.

“Just signing up to new sanctions is not enough,” said Daniel Tannebaum, global anti-financial crime practice leader at consulting firm Oliver Wyman. “Governments now need enforcement mechanisms.”

Shipments from China to Russia have also surged as Beijing plays an increasingly important role in supplying Moscow, the diplomat added, asking not to be named discussing sensitive information. Those countries outside the EU haven’t sanctioned Russia themselves, but most have repeatedly denied they are helping the Kremlin.

The EU has sanctioned nearly 1,500 individuals, restricted exports on hundreds of goods and technologies, and targeted many of Moscow’s key revenue sources. But some officials worry that the bloc still lacks an effective apparatus to enforce those measures and lags behind the US.

With a longer history of sanctioning foreign powers, the US has a centralized agency, more efficient procedures for gathering information as well as stringent legislation and the tools to enforce the rules at home and abroad.

In the EU, enforcement is a patchwork effort that mostly falls to member states.

While the European Commission, the bloc’s executive arm, monitors implementation and provides guidance, national authorities are responsible for identifying breaches and imposing penalties. And that means the results are inconsistent.

Ultimately, it’s about political will, said one EU official involved in the process, and national officials can come under pressure when it comes to taking tough action against their own companies.

“Our sanctions are biting hard and contributing to sustained economic recession in Russia,” Commission Vice-President Valdis Dombrovskis said in Bulgaria last week. “But their effectiveness also depends on how well they are enforced.”

Kazakhstan’s Semiconductor Sales

On the surface of things, sanctions appear to be effective. Russia’s economy has contracted and many of its banks and companies remain cut off from international financial and trading systems. There is also evidence that the restrictions on European and US technologies have weakened key Russian industries and hampered their ability to innovate in the future.

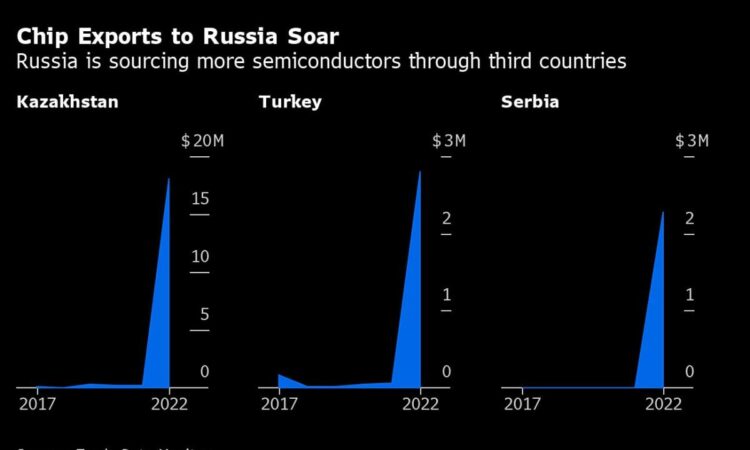

But information collected by the Geneva-based Trade Data Monitor indicates that some sanctioned goods — particularly advanced semiconductors — are being diverted to Russia via third countries, many of which abruptly changed their trading habits following Russia’s invasion.

In some cases, the exports to Russia of technologies that could be used for military purposes in Ukraine have gone from effectively zero to millions of dollars.

Kazakhstan provides a key example. In 2022 the Central Asian nation exported $3.7 million worth of advanced semiconductors to Russia, up from a mere $12,000 worth the year before the war started.

Russia was buying an average of $163 million worth of advanced chips and integrated circuits from the EU, the US, Japan and the UK each year between 2017 and 2021. In 2022, that slumped to about $60 million.

The data show Turkey, Serbia, the UAE and a half-dozen other economies in Eastern Europe and Central Asia helped make up the shortfall. Meanwhile, shipments of high-tech components to those countries from the allied nations surged by a similar amount.

The same sort of patterns are apparent across hundreds of product categories, but it is especially acute when it comes to advanced chips and integrated circuits that can be used for military purposes, the diplomat said.

With Russia’s war in Ukraine now into its second year, the EU and its allies are increasingly focused on tightening any loopholes and preventing successive rounds of sanctions they’ve introduced from being circumvented.

Evading the Tracking Systems

But tracking shipments isn’t a straightforward process. Buyers sometimes use complex corporate vehicles and distribution models to obscure the final destination of their goods. Incomplete paperwork can add to the opacity, as well as so-called transshipment points, where goods are moved between vehicles or rerouted.

On Thursday, the Biden administration released a compliance note aimed at cracking down on intermediaries used to evade sanctions and export controls on Russia. The notice names China, Armenia, Turkey and Uzbekistan as locations that may be used to illegally redirect restricted items to Russia.

The G-7 announced last week a new mechanism to bolster enforcement and the EU has also introduced several tools in its recent packages to go after those aiding Russia.

But EU countries have so far been shy about using some of those tools and going after potential breaches at home, at least publicly. Discussions on toughening up the EU’s enforcement regime has opened a debate over where the share of responsibilities between Brussels and Europe’s capitals should lie when it comes to policing measures, officials and diplomats say.

Patchwork of Enforcement

“It would of course be more convenient for everybody if there was one EU level institution in charge,” Toms Platacis, the acting director of the Latvian Financial Intelligence Unit, said in an interview.

Latvia has criminalized sanctions violations, while other EU countries have not, so violators can “look for other countries where evading sanctions carries less potential penalty,” he said.

In implementing successive rounds of sanctions, EU nations have been careful to limit the impact on their own bottom line and the wider global economy. That has at times led to often tortuous discussions between member states over exemptions and reporting requirements.

With every round of sanctions we take a step forward with new measures and one step back with new exemptions, one senior European minister said. Some member states are less enthusiastic about enforcement and are not doing enough, the minister added.

“Enforcement of export sanctions is not trivial,” said Beata Javorcik, chief economist at the European Bank for Reconstruction and Development. “Every government wants all other countries to enforce them but prefers to be lenient vis-a-vis its own firms. The experience with export restrictions during the Cold War shows this clearly. Thus, leaving enforcement of sanctions to national governments may not always work perfectly.”

–With assistance from Bryce Baschuk and Aaron Eglitis.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.