Lord O’Neill is not alone. The influential Tony Blair Institute (TBI) think tank has called for Reeves to completely overhaul the rules to make them fit for the future.

The Chancellor is resisting calls for a major overhaul. But James Browne, a senior policy adviser at the TBI, says there are two ways Reeves could give herself more space while sticking to the letter of her debt rule.

The first involves including the Bank of England in its debt measure. The reason it is excluded at the moment is because of the term funding scheme (TFS), which offered cheap loans following the Brexit vote and Covid.

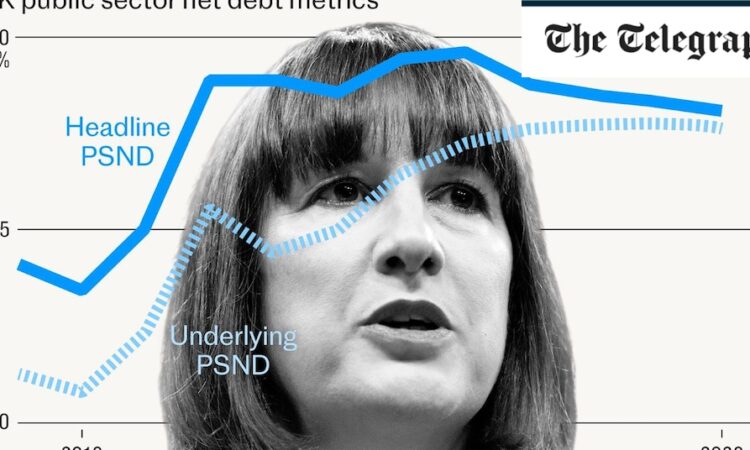

This added significantly to debt while the loans were being dealt out, then reduced as the loans were paid back. The TFS will have wound up completely by the end of the decade. By including the Bank’s debt, Reeves’ headroom could increase to £25bn compared to £8.9bn in the last Budget.

The TBI says going a step further and excluding student loans from the debt measure could hand Reeves £52bn to play with in the Autumn, in a move that would align more closely with her mantra of taking into account investment.

The TBI’s Browne says: “The current debt rule is very constraining. A big reason why you’re not getting a big fall in the official measure by the end of the decade – despite actual borrowing being forecast to be pretty small by then – is because of the student loans that will be issued, adding to the debt.

“So it seems slightly odd to be arguing we should be investing less in hospitals and schools just because we’re issuing lots of student loans.”

While Reeves has said she doesn’t want to tinker with Hunt’s definition of debt, Browne adds that this definition would allow her to borrow £7.3bn for her National Wealth Fund without being constrained by her rules.

‘A simple problem Reeves cannot ignore’

Reeves said in her Mais lecture this year that she would ask the OBR to “report on the long-term impact of capital spending decisions”, adding that she would publish “wider measures of public sector assets and liabilities at fiscal events, showing how the health of the public balance sheet is bolstered by good investment decisions”.

Our headline measure of public investment also includes the student loans that the Government assumes won’t be paid back, according to the Institute for Fiscal Studies. Stripping this out could enable more money to be spent on big-ticket projects.

Accounting tricks aside, there is a simple problem Reeves cannot afford to ignore. Outside the pandemic, the UK is already issuing the most debt in its history.