The Southeast’s economy outperformed the rest of the country during the

pandemic, new research from the Federal Reserve Bank of Atlanta shows.

Although the southeastern economy has long experienced faster growth than the

national average, the region’s lead has significantly widened since 2019.

Research conducted by Laura Kuehl, Emily Mitchell, and Jon Willis of the

Atlanta Fed combines analysis of economic data with business insights from

interviews and roundtables the Atlanta Fed’s Regional Economic Information

Network (REIN) team conducted with business leaders. (In the Atlanta Fed’s

Research Department, Kuehl is an economic research analyst, Mitchell is a REIN

director, and Willis is a senior economist.)

Regional economy a microcosm of US economy

For some time, the Southeast’s economy has represented an instructive

bellwether for the broader national economy when it comes to assessing overall

economic conditions. The diverse mix of firms across the region is broadly

representative of the overall composition of GDP by industry for the US

economy.

Although the Southeast’s firm composition generally reflects that of the

country as a whole, the region has seen notable economic growth compared to

the rest of the nation. A key contributor to the strength of the Southeast has

been rising population growth. Regional population growth during the past 50

years has been 0.5 percentage points per year faster than that of the nation

overall, according to the analysis the Atlanta Fed conducted in Alabama,

Florida, Georgia, Louisiana, Mississippi, and Tennessee (the states that, in

whole or in part, make up the Sixth District).

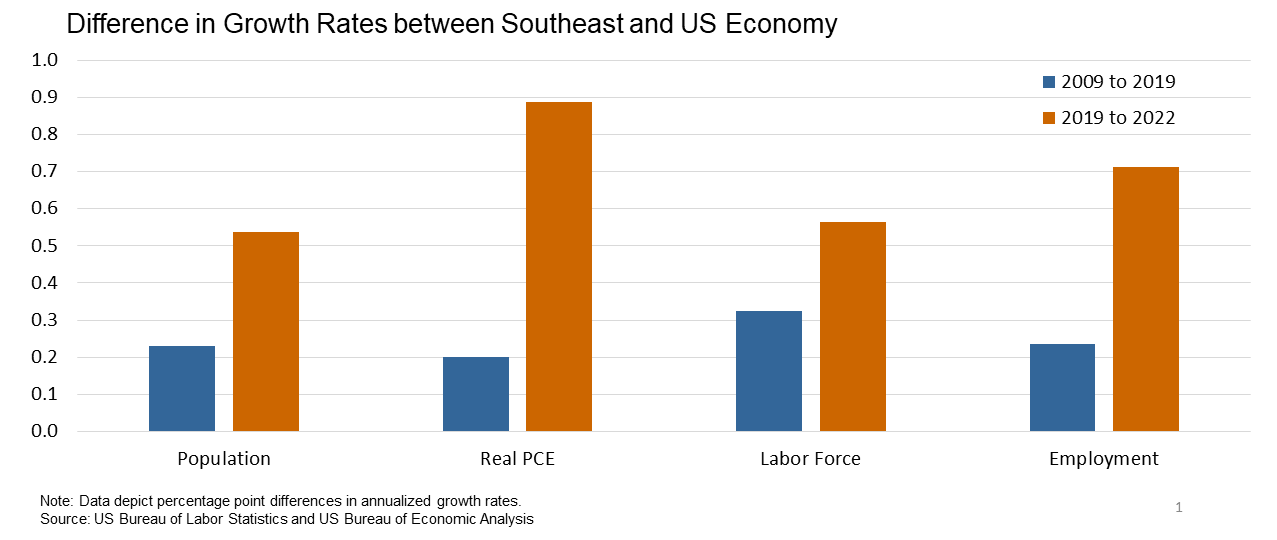

More recently, in the decade prior to the pandemic, the Southeast grew around

0.2 percentage points per year faster than the United States in most major

metrics of economic performance, including population, labor force,

employment, and real personal consumption expenditures (see the blue bars in

the figure).

However, since the start of the pandemic, this growth differential has widened

significantly. Between 2019 and 2022, the Southeast more than doubled the

differential in growth rates of population between the Southeast and the

nation overall, likely reflecting an acceleration of migration to the region

during the pandemic (see the orange bars in the figure). During the same time,

the growth differential for consumption demand (real personal consumption

expenditures) more than quadrupled to a nearly 0.9 percentage point growth

differential per year.

The excess demand grants firms more pricing power in the region. Several firms

noted during interviews that although pricing is very localized and

regionalized, southeastern firms have more pricing power compared to those in

other regions.

The labor force undergoes changes

This rapid growth exerted pressure on southeastern firms to meet increased

demand for their products and services, but one area of constraint was the

number of workers available. Though the labor force growth differential

between the Southeast and the United States was the same as that of population

growth, that amount of labor force growth was insufficient to meet the demand

for workers by firms in the Southeast. Consequently, many businesses struggled

to meet the surge in demand for their goods and services.

Regarding the composition of their workforces, business contacts have noted

several trends. First, several firms have observed a significant number of

retirees knocking on their doors once again, a development that firms

appreciate as retirees are much more experienced and don’t demand salaries as

high as younger workers. Second, one firm speculates that prime-age workers

(those 25–54 years of age) are increasingly attracted to the gig economy

because these jobs offer greater flexibility than traditional jobs.

Firms expanded their workforces at a faster pace in recent years, illustrated

by the employment growth differential between the national and southeastern

economies. exceeding the growth differential in population and the labor

force. As a result of the rapid employment growth, the unemployment rate in

the Southeast is now lower than the prepandemic level, while national

unemployment basically didn’t change during the same time period.

These dynamics have created a very tight labor market in the region, posing a

challenge for firms as they attempt to deliver on demand. During interviews, a

large insurance brokerage noted that workers have been extremely sensitive to

wage changes, arguing that the heightened demand for labor—especially at the

blue-collar level—has exacerbated wage sensitivity.

Continued growth in the region will depend in part on the Southeast’s ability

to combat production constraints brought on by the labor supply’s anemic

growth. Additionally, some firms point to a spillover effect in which this

growth could hamper the region’s public service infrastructure.

Several firms with a national footprint reported experiencing some geographic

bifurcation in their firms’ sales growth, with growth in the Southeast

outpacing that of other regions. Mike Honious, president and chief executive

officer of GEODIS in Americas, said “When comparing the Southeast region to

other regions in the US during the pandemic recovery period on shipment

volumes, the Southeast region shows a very stable and consistent recovery as

compared to other regions. Most importantly, the volume shifts were less

volatile in year over year comparisons and consistently in the ‘middle of the

pack’ each year when compared to the rest of the United States.”

Because of such strong demand in the Southeast, contacts at other firms in the

region noted that companies are accelerating investment here, expecting that

these trends will continue. For example, a large national retailer described

plans to speed up investment specifically in the Southeast. The company views

the region as a safe bet as it caters to residents who continue to move to the

Southeast for reasons including quality of life (such as pleasant weather) and

the cost of living (such as states with low or nonexistent state tax rates).

Although residents in the Southeast are facing rising costs along with the

rest of the nation, five out of the six states in the Atlanta Fed’s district

were below the national average cost of living in 2023.

Maintaining the momentum

National fiscal policy is contributing to a surge in public and private

investment. The Infrastructure Investment and Jobs Act, a bipartisan deal

targeting transportation and other infrastructural improvements, and the

Inflation Reduction Act, set to stimulate domestic clean energy production,

have significantly stimulated investment in infrastructure and the supply

chain, including in electric vehicle manufacturing and clean energy

production.

According to Rebekah Durham, an Atlanta Fed REIN director, “Our energy sector

contacts describe billions of dollars in investment across the Southeast

fueled by the Inflation Reduction Act, from facilities that produce clean

energy feedstocks to technology that traps hydrocarbons produced by

petrochemical production and stores them underground, a process called ‘carbon

sequestration.'”

Several firms noted that the region’s inability to compete in certain areas of

public services (namely, public education and transportation infrastructure)

has and will continue to pose challenges in recruiting new businesses and

households, especially those relocating from regions with strong public

investments in those areas.

The analysis concludes that the Southeast has been on a steady path of growth,

outpacing the nation according to a range of major economic indicators. The

region is poised to grow if it can rise to the challenge associated with labor

supply constraints and infrastructure limitations.

By Laura Kuehl, an economic research analyst; Emily Mitchell, a REIN director; and Jon Willis, a vice president and senior economist, all in the Atlanta Fed’s Research Department