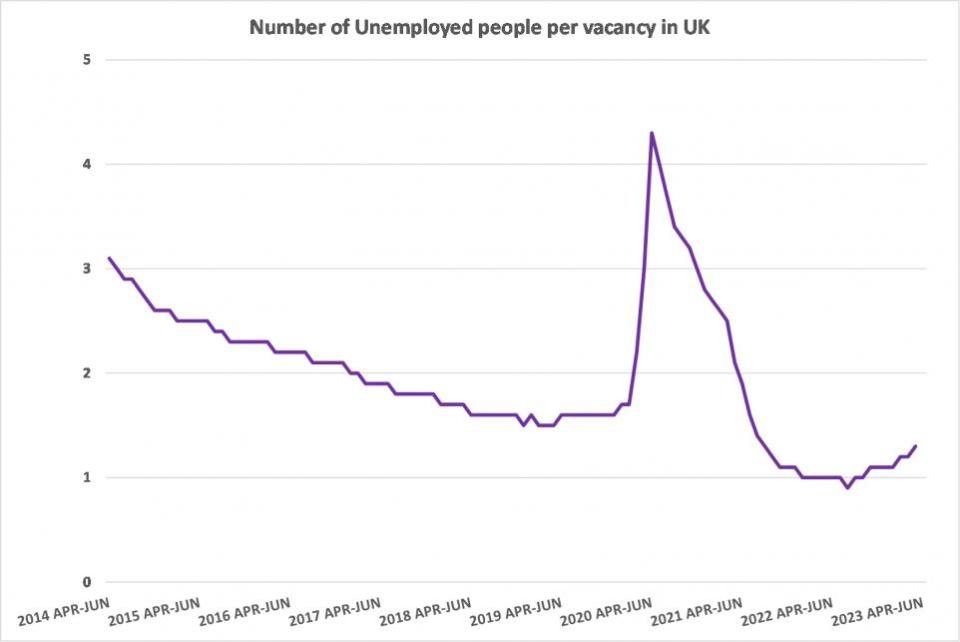

In the aftermath of the global pandemic the UK’s labour landscape is once again showing signs of stress, especially in Scotland. Latest figures indicate a drop in the employment rate coupled with a rise in unemployment and economic inactivity.

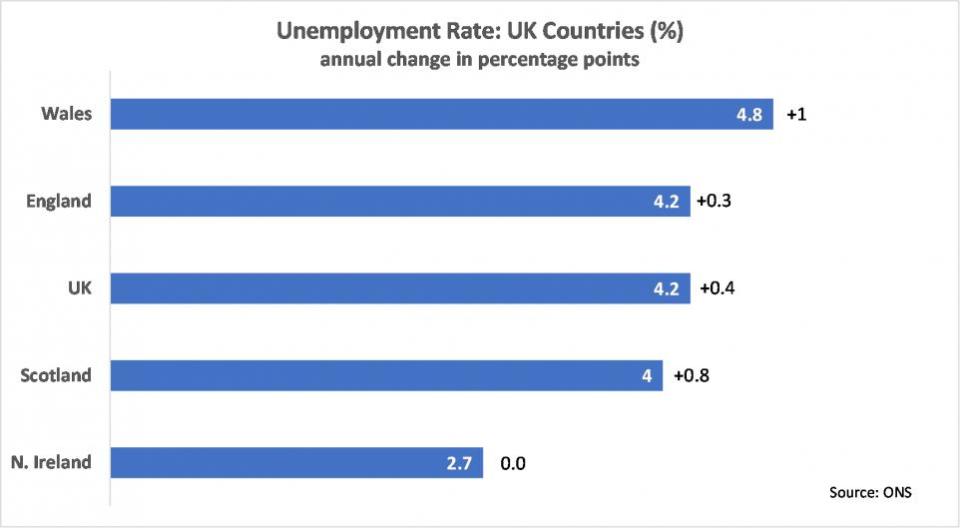

The latest estimate of unemployment among individuals aged 16 and over in Scotland is 4%, an increase from the pre-pandemic rate and a notable 0.9 percentage point jump on the previous quarter. This rate is marginally better than the broader UK unemployment figure of 4.2%.

Meanwhile, Scotland’s employment rate has seen a decline. Sitting at 74.2%, it’s down by 1.1 percentage points both since the pre-pandemic period and over the last quarter. This is a bit below the UK’s average employment rate of 75.7%.

Economic inactivity – those neither employed not actively seeking work – in Scotland is another area of concern. The rate was 22.6%, a rise from before the pandemic and higher than the UK average of 20.9%.

Despite the gloom in employment metrics, wages exhibited an exceptional surge as a significant one-off payment in June to NHS workers led to a jump in wages beyond market expectations.

Including bonuses, wages rose by 8.2% year-on-year in the three months to June, as reported by the Office for National Statistics (ONS). Regular pay, which excludes bonuses, saw an even more significant hike to 7.8% for the quarter – the highest since comparable records began in 2001.

While wage growth provides a silver lining, it comes with implications. The Bank of England is feeling pressured to raise interest rates, potentially impacting borrowing costs. This seems likely even though some employers are downsizing in the face of a slowing economy.

But there’s more to this intricate economic tapestry. Despite the wage rise, salaries for new hires were at their lowest in 27 months in July. Experts predict an interest rate hike from 5.25% to 5.5% come September but many believe this could be the peak, hinting at the risk of rate hike overkill.

The labour market’s recent downturn doesn’t eclipse certain bright spots either. Recruitment agencies in Scotland reported an increase in permanent staff appointments in July, the most rapid growth in 13 months. The IT & computing and blue collar sectors led this charge, showcasing the most significant rise in job vacancies.

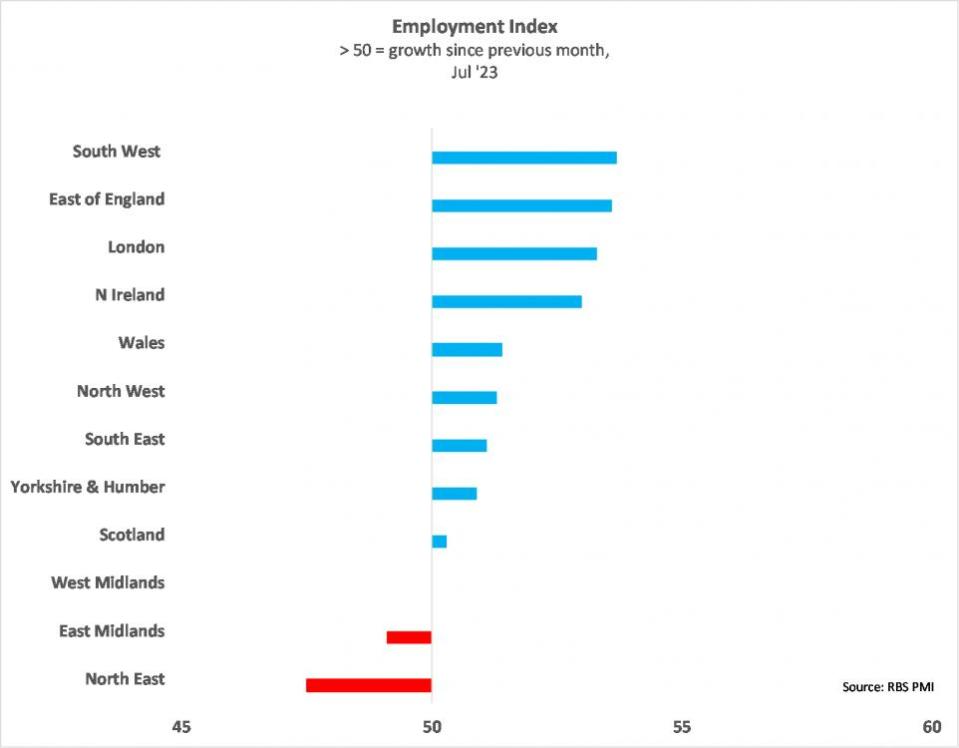

Demand for permanent staff in Scotland increased in July, but the rate of growth cooled to a 29-month low and was only mild. Moreover, the upturn was weaker than that seen at the UK level.

Back-to-back expansions in temporary job openings were recorded across Scotland in July. The rate of growth quickened on the month and was faster than the UK average.

Not all regions in the UK shared this buoyancy. The Royal Bank of Scotland’s Regional PMI survey revealed that July saw a drop in new business activity in most areas, with London and the West Midlands being the only exceptions. Wales, in particular, experienced a sharp decline in demand for goods and services.

While the overall employment scenario might look grim, especially with the recent dip in job vacancies and employment, there are pockets of growth and positive indicators. Wage growth and the sporadic demand for permanent staff offers hope.

As the UK grapples with these shifts in its labour market, the path to economic stability remains a balancing act of policies, market dynamics, and global factors.

Gavin Mochan is managing director of S1jobs.