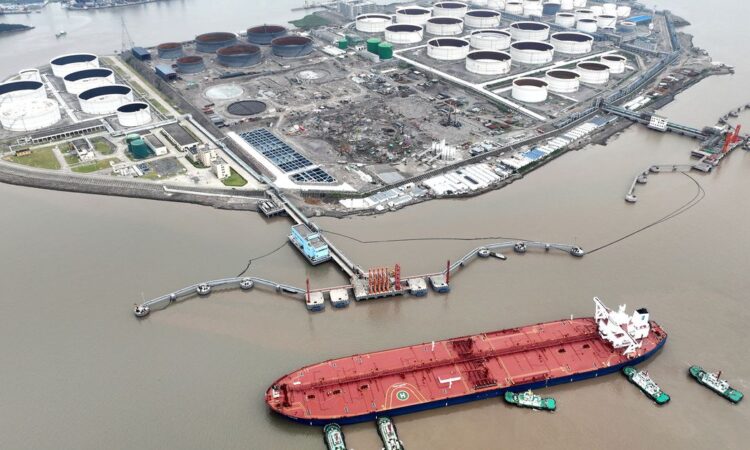

An aerial view shows tugboats helping a crude oil tanker to berth at an oil terminal, off Waidiao Island in Zhoushan, Zhejiang province, China July 18, 2022. cnsphoto via REUTERS /file photo Acquire Licensing Rights

BENGALURU, Aug 24 (Reuters) – Oil prices slipped on Thursday, still under pressure from the previous day’s weak data from major economies, which had investors worried about the demand outlook and as the dollar strengthened ahead of a speech from U.S. Federal Reserve Chair Jerome Powell.

Brent crude fell 16 cents, or 0.2%, to $83.05 a barrel by 11:41 a.m. EDT (1541 GMT). U.S. West Texas Intermediate crude fell 12 cents, or 0.2%, to $78.77 a barrel. At their session low, both sessions had been down by more than a dollar.

“Disappointing data and nerves that the Federal Reserve could reinforce a hawkish stance are weighing on oil,” said Fiona Cincotta, analyst at City Index.

On Wednesday Japan reported shrinking factory activity for a third straight month in August. Euro zone business activity also declined more than expected and Britain’s economy looked set to shrink in the current quarter.

U.S. business activity approached the stagnation point in August, with growth at its weakest since February. But data also that showed labor market conditions remained tight despite the Fed’s aggressive interest rate hikes.

Federal Reserve officials and other global central bankers were headed to Jackson Hole, where Powell will address the symposium on Friday. Investor caution on the eve of his remarks lifted the safe-haven dollar. A costlier greenback makes oil more expensive for holders of other currencies, denting demand.

On the supply side, Iran’s crude oil output will reach 3.4 million barrels per day (bpd) by the end of September, the country’s oil minister was quoted as saying by state media, even though U.S. sanctions remain in place.

U.S. officials are also drafting a proposal that would ease sanctions on Venezuela’s oil sector, allowing more companies and countries to import its crude oil, if the South American nation moves toward a free and fair presidential election, according to five people with knowledge of the plans.

A larger than expected fall in U.S. crude inventories helped limit further losses.

U.S. crude inventories (USOILC=ECI) fell by 6.1 million barrels in the week to Aug. 18 to 433.5 million barrels, compared with analysts’ expectations in a Reuters poll for a 2.8 million-barrel drop.

Meanwhile, analysts expect Saudi Arabia, the de facto leader of the Organization of the Petroleum Exporting Countries (OPEC), to extend its 1 million bpd voluntary production cut into October to help support the market.

Reporting by Shariq Khan; Additional reporting by Ahmad Ghaddar and Mohi Narayan; Editing by Kim Coghill, David Evans and David Gregorio

Our Standards: The Thomson Reuters Trust Principles.