- About 10 countries in Africa have amassed enough savings in US dollars

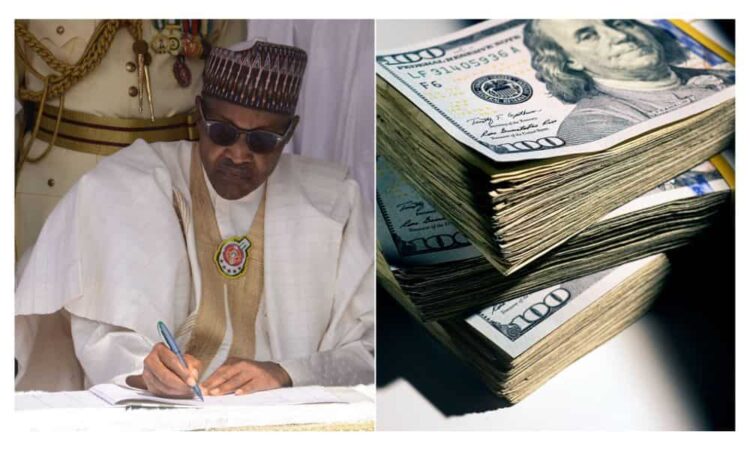

- Nigeria is leading the pack with about $149.32 billion of its funds saved in US dollars

- South Africa follows the country with 67.81 billion of its money saved in US dollars

A country’s financial strength can be measured by its gross savings, including household incomes, businesses, and the government, which reflects its economic stability and growth.

Data from the World Bank on 28 African countries show an average of $17.69 billion saved in savings in 2021.

Credit: ATU Images

Source: Getty Images

Some African countries surpassed this average by a wide margin, with Nigeria leading the pack with $149.32 billion in savings.

Nigeria’s leadership is mainly due to its vast oil reserves, BusinesInsider says.

PAY ATTENTION: Follow us on Instagram – get the most important news directly in your favourite app!

South Africa: $67.81 billion

South Africa comes second with $67.81 billion, with its diversified economy and strong financial services sector, which has helped it to amass enough savings in US dollars.

Algeria: $59.56 billion

Algeria’s oil and gas sector is the primary driving force for its economy, reflecting its high savings. Algeria has tried to diversify its economy recently, which reflects in its financial fortunes and savings in US dollars.

Morocco: $ 41.17 billion

The country has seen remarkable economic growth recently, with tourism and manufacturing as the primary driving force for its economy. The move has helped the country build up sizable savings.

Egypt: $31.09 billion

The North African country’s biggest economy is one of the largest African countries with savings in US dollars, with its global trade and economic strength.

Ethiopia: $27.93 billion

Ethiopia, which recently emerged as one of Africa’s fastest-growing economies, with its agriculture and manufacturing sector, has about accumulated savings in US dollars.

Angola: 27.1 billion

The country’s oil reserves have made it a major player in the continent’s economy, which has helped it amass a significant amount and savings in American dollars,

Angola’s oil reserves have been a significant source of wealth for the country, but it has also made strides in diversifying its economy. This has helped Angola build up substantial savings.

Kenya: -18.11 billion

Another fastest-growing economy in Africa, Kenya has grown its savings in US dollars with its telecommunications and financial services sectors, which could help it grow further.

Ghana:-16.87 billion USD

Despite Ghana’s recent economic woes, the West African country has significant savings in US dollars, with its oil and gas sector playing an important role. Ghana has also tried to diversify its economy and drive savings.

DR Congo – 13.27 billion USD

The beleaguered country has tried to amass enough amount in US dollars. Its natural resources, such as copper and cobalt, contribute to its economy.

New data shows 15 Africa’s most expensive cities to live in in 2022

Legit.ng reports that as consumer goods and energy prices surge across Africa and the world, the impact on people’s finances and purchasing powers continues to be depleted.

The cost of living index examines the cost of living in a city compared to others. It also looks at the price of consumer goods, rent, and cost of healthcare, among others.

According to Wikipedia, the cost of living index is a price index that measures the cost of living over time or regions.

Source: Legit.ng