When Nicola Sturgeon looks back on her economic legacy, what will she feel most proud of: the big industrial plants on Scotland’s coast churning out wind turbines for export, the near monthly launch of newly built ships on the Clyde, or the thriving green venture capital community sprouting up in Edinburgh?

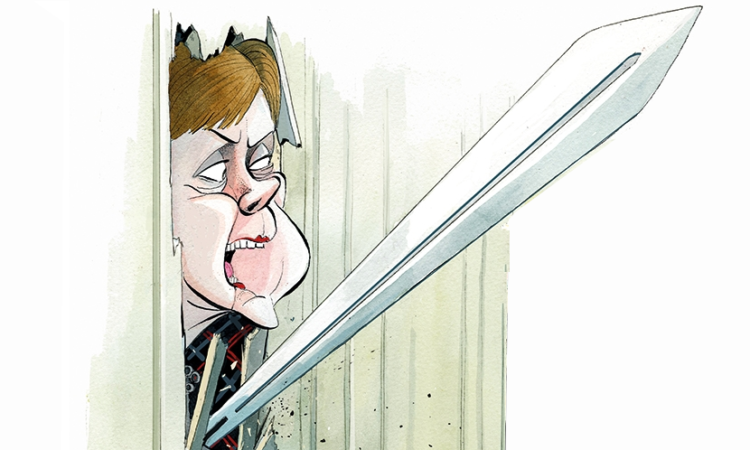

An inability to deal with economic reality is the final entry in the ledger of Sturgeon’s economic legacy

That kind of fond reminiscing won’t happen of course because none of these things exist. The fiasco of the Sturgeon administration trying to organise the building of new ferries on the Clyde while supposedly saving Scottish commercial shipbuilding is well documented. The two ferries at the centre of the farce are now five years late and at least £150 million over budget. The latest development was the announcement on Wednesday that Caledonian Maritime Assets Limited, the Scottish agency in charge of ferry procurement, has appointed a senior lawyer to investigate whether the contract for the ferries was ‘rigged’.

The return of commercial shipbuilding on the Clyde remains a dream, as does turning Scotland into a powerhouse of green industrial manufacturing. The Scottish government pumped tens of millions of pounds into engineering firm Bifab in the hope it would become a big player in the market for manufacturing offshore wind turbines. It failed. And then there was the scandal of the Lochaber aluminium smelter and the Scottish government’s willingness to be used as a catalyst for a controversial, highly complex structured finance transaction. Sturgeon’s government promised Lochaber would deliver an economic revival for parts of the Highlands. It never materialised.

Industrial policy under Nicola Sturgeon has been characterised by naivety, costly ineptitude and vibe politics. Give her a photocall with a hardhat on and she was there. Anything beyond that though – the hard graft of getting to grips with Scotland’s economy and what should drive its growth – and there was little more than the outsourcing to a more junior minister, putting in place talking shops and producing aspirational reports to give the impression of activity.

There was also a general feeling that Sturgeon simply did not get business, and, more importantly, did not wish to get it. This was more than mere disinterest. There was a sense with her administration that business is a tawdry endeavour to be tolerated but not encouraged. This is in contrast with her predecessor, Alex Salmond, a former oil economist who was happy to talk of Scotland emulating Ireland’s ‘Celtic Tiger’ model by cutting corporation tax.

Would Salmond have brought the anti-business Scottish Green party into government? It seems unlikely.

Economics is the policy area where Nicola Sturgeon has been least sure-footed. As I write this, I am reminded of an incident in the Holyrood chamber a couple of years ago when she was asked about the importance of quantitative easing in helping countries finance their response to economic shocks. Her rambling answer showed a fundamental lack of understanding of what quantitative easing is.

Which brings us to the most worrisome part of Nicola Sturgeon’s economic record, which is the relentless pushing of a policy that would have had a devastating impact on Scotland’s economy if it had come to fruition. The economic policy she was most keen to implement, but thankfully never had the chance to, was to make Scotland the first part of any of the world’s advanced economies to cut itself off from its in-place monetary and fiscal base while creating new trade friction with its biggest import and export markets.

Whether Sturgeon has ever grasped the economic implications of this is unclear. It seems likely she has some intuition that such a radical policy would hurt many Scots but rationalises it as a price worth paying for sovereignty. After all, she is on the record as stating independence ‘transcends’ economic issues. When a policy position is a matter of faith rather than reason then no amount of economic facts or logic will lead to a reconsideration.

This became most evident in the latter part of Sturgeon’s time in office. After years of trying and failing to come up with a sensible economic case for separating Scotland from the rest of the UK, her administration resorted to aiming to distort facts in pursuit of a credible narrative. In January 2020, then finance secretary Derek Mackay announced the Sturgeon administration would publish an alternative version of the Scottish government’s official annual statistics outlining Scotland’s overall tax and spend figures.

The Government Expenditure & Revenue Scotland (Gers) numbers have been a thorn in the side of secessionists for years because they demonstrate how a Scotland newly exited from the UK would start off with a large structural fiscal deficit. Having failed to deliver a credible economic case for independence with its 2018 Sustainable Growth Commission report, it seemed the Sturgeon administration would now be relying on alternative facts to justify its policy.

Despite follow-on finance minister Kate Forbes stating in 2021 she was still committed to ‘alternative Gers’, they have never been produced. In its last attempt at putting forward an economic case for leaving the UK (it’s October paper, Building a new Scotland: a stronger economy with independence) the Sturgeon administration instead chose simply to ignore the fiscal problem. As in other areas, it was a signal she had finally run out of road.

That inability to deal with economic reality is the final entry in the ledger of Sturgeon’s economic legacy. Her discomfort with economic truths ties her to a wider trend we’ve seen in democracies in recent times: a shunning of reality in favour of fantasy, as seen with the spouting of Trumpian myths and Brexiteer fake promises. In that way at least she has very much been a politician of her time.