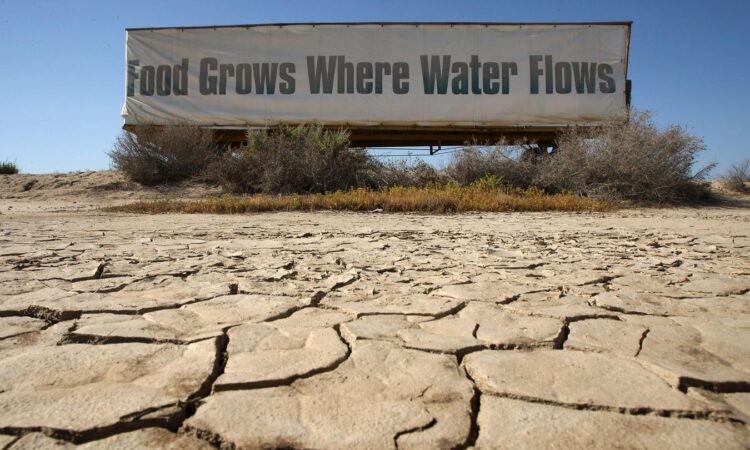

BUTTONWILLOW, CA – APRIL 16: A sign on a farm trailer reading “Food grows where water flows,” hangs … [+]

Getty Images

Climate risk is widely accepted as an issue for corporates and the wider economy. The latest research says that the risk of degradation of the natural environment could have just as big an impact, at a cost of 12% of UK GDP.

First-of-its-kind analysis from the UK’s Green Finance Institute (GFI), supported by Defra and the HM Treasure, has quantified the impact that nature degradation, both domestically and internationally, could have on the UK’s economy and financial sector. By putting economic numbers on the impact of nature degradation using a commonly used macro-economic model, it allows corporates, investors and policy-makers to really understand the potential impact of that degradation on that most sacred of economic metrics, GDP.

While we are all conscious of the impact of acute shocks, like a drought or a pandemic like COVID-10, the analysis shows that the ongoing, day-to-day degradation of nature is as severe for the economy as such a shock. As a comparison to the 12% loss driven by environmental degradation, the global financial crisis of 2008 took around 5% off the value of the UK GDP, while the Covid-19 pandemic cost the UK 11% of its GDP in 2020.

Understanding the connection between nature and the economy

Fundamentally the economy is dependent on, and operates within, nature and the environment. Ecosystem services affect core elements of society and the economy, from the water and soil that provides our food, natures provision of pollinators or regulation of the climate, even the mental health relating to nature. Perhaps most importantly, as Tom Oliver, professor of Applied Ecology at the University of Reading, one of the lead authors of the report points out, one of the dangers is that nature-related risks: “interact with each other and present significant threats” that could well be impacting the UK within the next decade.

Analysis from PwC in 2023 showed that over half of global GDP is exposed to nature risk, either moderately or highly dependent on nature, to the tune of $58 trillion. What’s significant here is that 2023 number, which is up almost one-third, or $14 trillion, since 2020. This understanding has led to new action with global goals to safeguard nature, the Kunming-Montreal Global Biodiversity Framework, agreed at the UN biodiversity summitCOP15 in December 2022.

One of the challenges that addressing the nature/biodiversity problem has faced is that prior to this research, there hasn’t been a detailed understanding of how material the risks are that the economy and financial system faces from nature degradation. This is leaving the economy and financial sector exposed, while these risks continue to rise unchecked.

Understanding how nature risk affects the economy

What the analysis captures specifically is the financial risks arising from the deterioration of nature and biodiversity, including: soil health decline; water shortages; global food security repercussions; zoonotic diseases that pass from animals to humans, like bird flu, swine flu, and Covid-19; and antimicrobial resistance, where bacteria and viruses no longer respond to medicines; as well as transition and litigation risks.

Helen Avery, director of Nature Programmes at the Green Finance Institute says: “The key thing to highlight in terms of impact costs, is that the entire economy is wholly dependent on nature. When there is water pollution into our seas, the tourism of our coastal towns is impacted. If we have soil health decline or livestock disease and our farmers become impacted – we see our food prices increase. When we have zoonotic diseases, we know we lose working hours, and put a strain on our national health service.”

Some sectors in particular face higher levels of nature-related financial risk. Electricity generation – which provides light and power in our homes and businesses – is dependent on surface water for cooling power stations, and any constraint in water supplies could impede production and raise energy prices.

Agriculture is reliant on soil and water quality, pollinators, and biodiversity. Meanwhile we depend on electricity generators for light and power in our homes, yet power stations are dependent on surface waters for cooling; any constraint in water supplies could impede production and raise energy prices. Manufacturing is about taking raw materials and turning them into goods – any slow down in that due to the exploitation of natural resources is likely to result in availability of goods and price increases.

Impacts go beyond industry to financial stability

These impacts on the real economy will also have a material financial impact on banks and other financial institutions. The analysis estimates that some banks could see reductions in the value of their domestic portfolios of up to around 4 – 5% in some cases. Noting that these estimates are likely to be conservative, this indicates that nature-related risk will not just impact the economy, but potentially financial resilience. In fact, PwC’s 2023 research showed that more than half (50.6%) of the market value of listed companies on 19 major stock exchanges is exposed to material nature risk– constituting nearly $45 trillion.

Today, these risks are not captured within UK prudential policies or wider risk management, including fiscal risk assessment. In the private sector, financial institutions neither account for nature-related risks in their decision-making nor routinely quantify them for the purpose of risk management, and companies do not routinely disclose or report on their nature-related risks.

In practice, this means that financial institutions need to work with their clients to understand their nature-related risks; corporates need to look at their business models really seriously to minimise any harm to nature and consider how they can be contributing to nature-positive outcomes.

Incorporating nature risk into reporting

There are several ways to incorporate nature-related risk. Mandatory reporting requirements already touching on nature and biodiversity include the EU’s Corporate Sustainability Reporting Directive and Sustainable Finance Disclosure Regulation, France’s Article 29, and the UK’s Biodiversity Net Gain strategy. Voluntary frameworks are being developed by the International Sustainability Standards Board, the Taskforce on Nature-related Financial Disclosure (TNFD), the Global Reporting Initiative, and the Science Based Targets Network.

The most prominent of these is the Taskforce for Nature-related Financial Disclosures, which provides a framework for businesses to report specifically on their nature-related risks and opportunities. Such frameworks though are only the beginning – industry and investors must understand the implications of that reporting. Avery says: “Disclosures are a really critical first step for business to understand its reliance on nature, and material risk as a result of its degradation. However, disclosures are just the first step. After a business understands its risks and opportunities, it needs to act to mitigate any harm through its operations and supply chain and then turn to nature-positive actions.”

Benefits of early action

The UK is one of the most nature-depleted countries in the world – three quarters of the UK has a high level of ecosystem degradation, with risks to financial services and the wider economy as a result. The analysis shows however, that half of the UK’s nature-related financial risks originate overseas – and that means that the UK’s businesses and industry are going to need to address their supply chains around the world. For businesses there are early-mover advantages for those that act to improve and support resiliency, particularly within those supply chains.

Like climate change, acting early to mitigate nature-related risks is vital, as continued degradation of nature can lock-in future risks. If ecological tipping points are breached either globally or locally, the implications could be severe and irreversible. Without full understanding of the data, it is impossible to address such risks. Avery explains: “Now we know the material risk. And we know what the impacts are going to look like – so we have an opportunity to take action.”

Where action on nature differs from climate however, is that acting now can bring immediate benefits for the economy in terms of reduced physical nature-related risks. Whereas for climate change, we are already committed to further damages for the next decades from past emissions due to lags in the climate system; for nature, reducing pressures now should enable recovery and measurable benefits for people, planet and prosperity within a few years.

Understanding the analysis

Work on the report Assessing the Materiality of Nature-Related Financial Risks for the UK was led by the Green Finance Institute (GFI), with a technical team involving the UK’s top researchers: the Environmental Change Institute at the University of Oxford, the University of Reading, the UN Environment Programme World Conservation Monitoring Centre (UNEP-WCMC), and the National Institute of Economic and Social Research (NIESR).

Avery explains that each scenario in the analysis had two components –modelled on chronic risk as beginning in 2023 and acute shocks as taking place in the early 2030s. She said: “The 12% GDP loss is projected should there be an AMR [antimicrobial resistance] pandemic scenario, which could be as early as 2030. All scenarios were verified by the scientific community as extreme but plausibly happening within the next decade. While it was modelled as occurring in the early 2030s, there is nothing to say that there won’t be a pandemic before then as we know the incidence of pandemics is increasing.”

What concerns Nicola Ranger, director for Greening Finance at the UK Integrating Finance and Biodiversity Programme and the Environmental Change Institute, University of Oxford, and another lead author of the report is that the report shows that “risks from environmental degradation and biodiversity loss are at least as severe and urgent [as those from climate change], and indeed that if not addressed, will double climate change losses.” That’s the key message from the report, as Avery says: “Nature cannot wait. We have to tackle both GHG emissions and nature degradation at the same time.”