National View: Blocking US Steel sale would be harmful to our nation’s economy – Duluth News Tribune

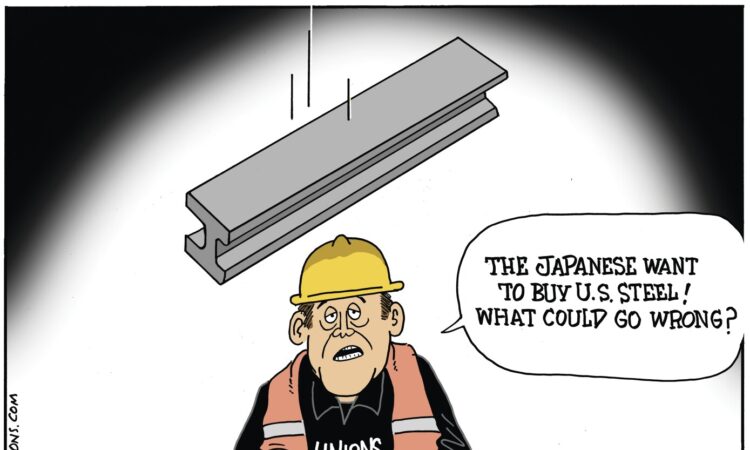

The buyout of U.S. Steel by the global company Nippon Steel has become controversial because Nippon Steel is a Japanese company. Ironically, the E.U. has no concerns about the merger while American protectionists are doubling down in attempting to block the deal.

reported on May 6, “the European Union cleared U.S. Steel’s $14.9 billion buyout by Japan’s Nippon Steel on Monday, allaying competition concerns from a deal that has drawn political opposition in the United States.”

Opposition by U.S. politicians and labor leaders is not based on sound economic policy. Political pressure failed to stop shareholders of U.S. Steel from last month approving its merger with Nippon Steel. However, it’s now clear that’s not the end of the story, as regulatory demands have forced Nippon to delay the expected closing date by approximately three months. Politicians on both sides of the aisle, meanwhile, continue promoting the myth that the deal will hurt American workers and harm national security.

The truth is the exact opposite. The deal would bring new investment to the economy and would shore up a flailing domestic company that long ago lost its luster due to mismanagement. It raises no true national security concerns and instead likely would lead to an expansion of domestic steel production.

When proposed last December, the deal drew opposition from the administration of President Joe Biden, unions, and Rust Belt Republicans. With an election around the corner, it is no surprise politicians are banging the drum of nationalism, but they do so at the expense of long-term security and economic growth.

Trade between the U.S. and Japan benefits both nations. Corporations and individuals in Japan have become a major source of foreign direct investment in American business, boosting domestic GDP. Four nations accounted for half of all the foreign direct investment in the United States as of 2021: Japan ($721 billion), Germany ($637 billion), Canada ($607 billion), and the U.K. ($565 billion). That’s according to the

. Inhibiting Japanese investment in the U.S. would cause an economic disaster that would be difficult to fix.

According to the

, “foreign direct investment in the United States … reached $5 trillion cumulatively at the end of 2021 on a historical-cost basis.” Such investments benefit American workers and the economy when “international companies in the United States build new factories, fund U.S.-based research and development (R&D), and grow their well-established U.S. operations.” According to the alliance, these international firms employ almost 8 million Americans in good jobs.

When protectionists promote trade wars and shun foreign investment, they ignore that an American economy with no foreign direct investment would be considerably smaller and its workers measurably poorer.

The economics of this deal are straightforward. U.S. Steel would remain “U.S. Steel” and would not move out of Pittsburgh. Technology that Nippon Steel has used to make the production of steel more efficient would allow the company to make electrical steel and automotive flat steel for North America. Nippon Steel’s goal is to grow the company into the best steelmaker in the nation and expand domestic production. Where is the economic threat in that?

Claims that Japanese investment to save an American steelmaker would somehow harm national security are just as baffling. As

, a research fellow at the Heritage Foundation, argued, “A possible renewal of U.S. Steel under new management strongly counters the notion that this deal threatens our national security.” To be sure, the Pentagon relies on steel for tanks, aircraft, and other hardware. But if this deal fails, a company that manufactures 10% of domestic steel would be in danger of going out of business.

A loss of economic viability and yet another bankruptcy of a U.S. steel company poses the real security threat, not investment from a reliable ally. If protectionists are successful in blocking the Nippon Steel–U.S. Steel deal, our economy would suffer, as would national security.

Brian Garst is vice president of the Center for Freedom and Prosperity (freedomandprosperity.org) in Fairfax, Virginia. The nonprofit was created more than 20 years ago to, in its words, “advance market liberalization.”