While pressure from inflation and interest rates continue to weigh heavy, the most recent quarter did see a strong positive balance of companies investing in main media and a reverse in sales promotion spend in an effort to boost brands, according to the IPA Bellwether report.

Those looking for insight into the health of the UK marketing ecosystem in the latest IPA Bellwether report will find reasons to be cheerful and cause for concern in equal measure.

Those looking for insight into the health of the UK marketing ecosystem in the latest IPA Bellwether report will find reasons to be cheerful and cause for concern in equal measure.

The latest quarterly report from the IPA and S&P Global, a respected and long running barometer of reported and predicted spend paints a mixed picture of companies’ confidence and spending.

For example, total marketing budgets across all channels increased by a net balance of 5.3% in the third quarter, superficially a reason for optimism until you to look to the second quarter where that figure was 6.4%. The most recent quarter returned the weakest level of total budget growth since the fourth quarter of 2022.

Meanwhile, of those revising spending upward, “main media” – channels often used for brand building – drove the growth this quarter. A net balance of 7.4% of companies report they are upwardly revising their main media budgets. This is the strongest growth recorded in this category in a year and a half.

It’s also a sharp contrast to what sat behind any growth in the second quarter, where sales promotion spend leaped to record levels. In the most recent quarter, more marketers were decreasing their sales promotion budgets than increasing, a net balance of -1.5%.

S&P Global Market Intelligence principal economist Joe Hayes, says this is cause for optimism.

“We saw last quarter that firms had become concerned by persistence of the cost-of-living crisis, which drove a record rise in sales promotions spending. In the latest quarter, however, firms have gone back to brand-building, with anecdotal evidence suggesting that this move has been made both defensively and offensively,” he says, adding: “With demand conditions coming under pressure, companies will have to position themselves strongly to stand out from their competitors.”

Gloomy outlook

Looking further out, Bellwether co-authors S&P Global forecast that UK ad spend will decline by 0.6% for calendar year 2023 and by 0.4% in full year 2024. This expected decrease in spend comes as it downgrades its expectations for growth next year for the UK economy as a whole. Previously, it was forecast that the economy would grow modestly by 0.4% in 2024; however, it is now expected that it will decline by 0.1% next year.

The economy is going to be ‘meh’ in 2024 but your marketing plan can’t be

This is more pessimistic than other forecasts such as that from the British Chambers of Commerce, which expects the UK economy to maintain modest growth of 0.3% in 2024, down from 0.4% in 2024 levels.

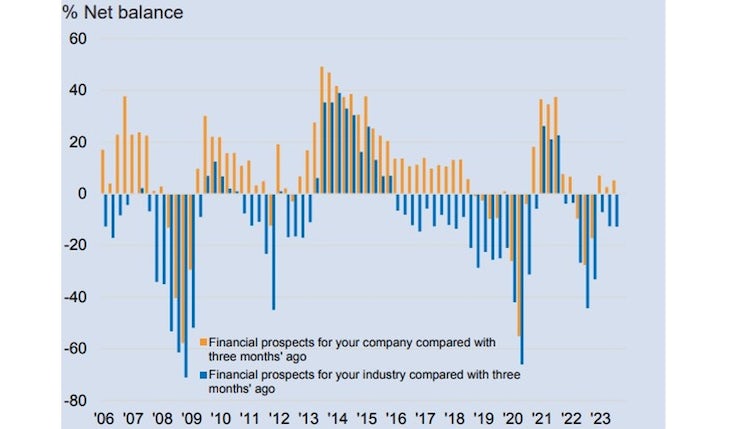

While forecasts for the UK’s economic prospects vary, no return to strong growth is expected. These pessimistic to cautious sentiments by economists are reflected by marketers’ expectations for their industry. The proportion of marketers who are downbeat (24.9%) about expectations for their sector was double that of those who are optimistic (12.1%), according to the Bellwether report. This is the most negative assessment of industry-wide fortunes in the year-to-date.

There is more optimism among marketers when it comes to prospects for their own business, a net balance of 5.2% say they feel in a better position than they did three months ago.

Media channel spending

Returning to the current quarter, a positive balance of 4.3% was reported for direct marketing. Similarly to sales promotion this represented a slowdown from the second quarter, which saw investment rise at the sharpest rate since 2006. and a net balance of 7.3% of companies increasing budgets.

Market research budgets saw another quarter where more companies were decreasing than increasing. It had a net balance of -1.5% in the third quarter (versus -2.9% in the previous period).

Within main media, online advertising budgets saw the strongest growth, with a net balance of 9.1% of companies upwardly revising their spending on the channel. Video and published brand advertising saw more modest growth, with net balances of 0.9% and 0.8%, respectively. Although video saw much slower growth than in the previous quarter (net balance of 3.2%), it has now been in growth for almost three years consecutively.

Audio and out-of-home advertising both saw net declines of 10.8% and 12.1% respectively.