In Greece of late, no news has meant good news. A period of stability made a welcome change from the excitement of the early 2010s, which involved the country’s virtual bankruptcy and a bailout by the EU, European Central Bank and International Monetary Fund that brought harsh austerity, deep recession, social strife and political conflict. In a few bitter years, the national economy shrank by over a quarter, while tax hikes and benefit cuts caused disposable incomes to decline by even more.

Then came Covid, and it was as grim here as everywhere, yet some positive things happened too. Ordinary Greeks surprised themselves by sticking to the rules with less fuss than the Dutch, while their government surprised everyone by putting in place a reliable, user-friendly digital infrastructure faster and better than Germany’s. Greece’s economy, heavily dependent on tourism, plunged further in lockdown than those of more diversified economies, but afterwards it bounced back stronger.

The unemployment rate remains high – it was 10.8% in January – and one of the highest in the EU, yet that’s a far cry from its peak of 28.7%, reached in November 2013.

Pfizer recently decided to create a research centre in Thessaloniki, Greece’s second-largest city, where Albert Bourla, the company’s CEO, was born and raised. Both Microsoft and Google have invested in cloud computing in the country, and Athens has emerged as a film industry hub, as seen in Tehran, the Netflix series, shot entirely on location in the city.

Businesses and the government have been looking forward to an inflow of funds worth billions, earmarked for Greece courtesy of the recovery and resilience facility and other EU programmes. All in all, economic sentiment at the start of 2023 was bullish. Greece, it seems, is out of the woods.

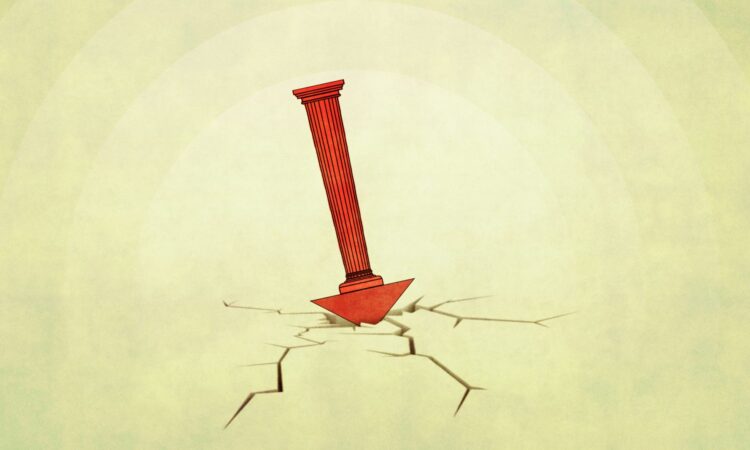

For my generation of Greeks, who were born in the last last century, there has been a sense of déjà vu about all this. We had been here before: in 2004, Greece won the Uefa European Football Championship, successfully organised the Olympic Games in Athens, and the country even came third in the Eurovision Song Contest, all in quick succession. We were on a winning streak. Then came the forest fires of 2007, the riots of 2008, the debt crisis of 2009-2010, and the political instability of 2010-2015, when the country discovered that its prosperity was built on sand.

The government that took office after the October 2009 general election found that the budget deficit on its hands was not 3.7% of GDP, as reported by its predecessor, but over four times as large. The market turmoil that followed put at risk the solvency of Greece and, briefly, the integrity of the euro area as a whole.

The bailout threw a lifeline to a penniless government. At a stroke, it also removed power over domestic policy from the country’s political class, handing it over instead to unelected, middle-ranking officials in Brussels, Frankfurt and Washington DC. The humiliation, added to the sudden impoverishment, fuelled a nationalist backlash across the political spectrum, which transformed Greek politics almost overnight. The rest, as they say, is history.

This time round, the nagging suspicion that behind the hype Greece remains a second-rate country was brought home by the devastating train crash in March, in which 57 people lost their lives. Although the inquiry is still under way, we have been officially told that automated safety systems worth hundreds of millions, paid for by taxpayers – both Greek and European – were left to rot while rail traffic control on the country’s one and only mainline was conducted manually. All it took was a moment’s distraction by one station manager, duly arrested and prosecuted.

It is too soon to tell what the consequences for Greece’s economy will be in years to come. Still, with a demoralised government under attack by the opposition – the latter not exactly renowned for its competence when in office – and a general election looming, the country looks ripe for a new cycle of instability.

This is not to say that we are on the verge of a new Greek crisis. In 2010 the economy collapsed after a long reckless run. This time the stakes aren’t quite that high, though they are significant nonetheless. The question for Greece is whether the economy can break out of its lower-league status and get on to a path of sustainable growth – or must we resign ourselves to a future of near stagnation?

When compared to conditions before the debt crisis broke out, living standards are certainly lower. Despite everything, GDP is still 16% below its 2009 level. Things look a bit better in per capita terms (GDP per head down by 12% over the period), but then again population decline is hardly a cause for celebration. Although unemployment has now fallen to pre-crisis levels, the exodus of at least half a million young educated Greeks last decade means that the number of people in employment – 4.1 million last summer – remains well below the pre-crisis number of 4.5 million. As for average wages, in 2021 they were 25% lower than in 2009.

As regards the economic fundamentals that made the headlines back in 2010, the picture looks more reassuring. Public debt has been stabilised in value terms, although it has risen as a share of GDP. The budget deficit is set to reach 2% of GDP in 2023, whereas in 2009 it was over 15%.

The assumption that the euro crisis was down to fiscal irresponsibility was soon set aside by economists who came to see it mostly as a result of current account imbalances. After all, why else should Spain, with a public debt below Germany’s, also get into trouble? From this perspective, the transformation of Greece has been remarkable. In January-September 2022, the exports-to-GDP ratio reached 38%. During the same period in 2008 – the pre-crisis peak – it was a mere 24%.

Imports have also risen, so the current account deficit, having fallen below 1% of GDP in 2013-2015, has risen again to 10%, having been 15% in 2008. Over a quarter of export earnings are accounted for by the petroleum industry, which imports crude oil, refines and re-exports it, making good money but creating few jobs. The share of medium- and high-tech goods in manufacturing exports has fallen since before the crisis. And tourism is estimated to contribute almost half of all exports, as well as a quarter of all jobs, and a fifth of GDP.

Dependence on tourism (“our heavy industry”, as government ministers and business spokespeople like to say) is problematic in the short term, given that most of the jobs it provides are low-skill and low-pay. In the longer-term it is unwise, given that it is vulnerable to geopolitical risk, not to mention climate change.

In a way, good and bad news are both the legacy of austerity and of Greece’s internal devaluation – the doctrine that since Greece, as a member of the eurozone, could not devalue its currency out of the crisis, it should instead devalue wages and prices. Wages have duly fallen, partly because of the recession, and also due to cuts in public sector pay in 2010, and the 22% cut to the minimum wage in 2012. Prices never fell, and are now rising faster than in the rest of Europe, evidence of the fact that product market deregulation, also advocated by the EU-ECB-IMF troika, was less enthusiastically pursued, and more successfully resisted, than the labour market sort.

In retrospect, the trouble with Greece’s bailout was not so much that it imposed austerity – what else is there really for a country with a budget deficit of over 15% of GDP? On a different level, the troika’s approach rested on the unspoken assumption that Greece is a low-performing economy, and that it should stop pretending otherwise. So the bailout deal made sure Greece remained a low-performing economy.

Investment, especially of the productive kind, is now less than half what it was pre-crisis. Adult skills – of workers and managers – remain incredibly low. Public administration has been digitalised, which is great, but in other respects remains unhelpful, plus it is now understaffed. Justice remains excruciatingly slow, and not as impartial or independent from government as it should be. Infrastructure, supported by EU funding, is a mix of modern and antiquated, as the recent train crash made plain. All in all, most ingredients of sustainable growth are missing.

This was not lost on the committee headed by Sir Christopher Pissarides, Nobel laureate and LSE professor, whose recommendations were embraced by the current government. But progress has been disappointing. The Greek economy seems trapped in a low-added-value, low-skilled, low-wage trajectory.

Manos Matsaganis is professor of public finance at Polytechnic University of Milan, and head of the Greek and European Economy Observatory at ELIAMEP (Hellenic Foundation for European and Foreign Policy) in Athens