India is soon going to benefit from more passive investment inflows as its government debt will be added to JP Morgan’s emerging markets government bond index from June, automatically reallocating more international cash to the country.

Mr Sanghani said that India’s economy has remained solid even as China’s has slowed, making the country relatively more attractive to international money.

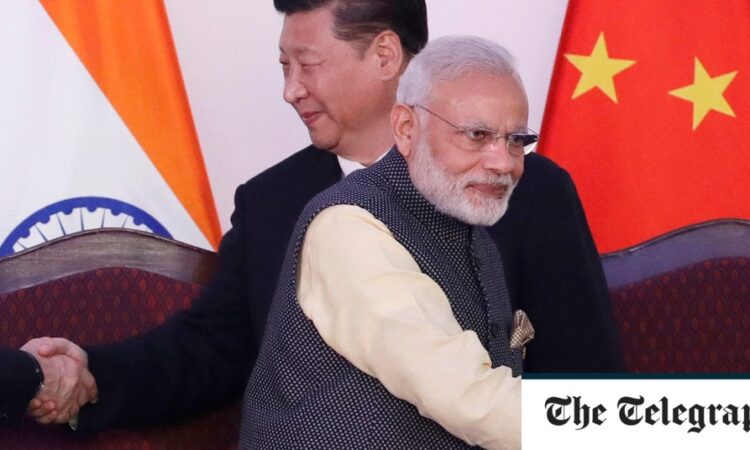

“Because of these structural headwinds you are seeing in China and its economy, because of some of the geopolitical tensions, in a relative sense India is starting to look a bit more appealing,” he said.

“It is not like things in India have been standing still. I think there are areas where things seem to be opening up to foreign investors.”

This includes improving liquidity in bond markets to gain a place in the JP Morgan index.

He expects pension money to become particularly important to future economic growth as governments around the world have major schemes in mind but have little fiscal headroom to finance their plans.

Mr Sanghani said: “I think [these funds] have a massive role to play. We see across the world right now that, frankly, there isn’t the fiscal space to do a lot.

“Particularly on these big issues around the energy transition for example, there is limited fiscal space.”

He pointed to the German government’s green spending plans which have been shot down by the constitutional court, while in the UK the Government is trying to enlist pension funds to invest more in Britain.

Mr Sanghani added: “There is an increasing onus for probably the public sector to try and make sure they are better mobilising either their existing pools of capital with their domestic pension funds or sovereign funds, but also trying to become more open to that foreign investment.”

Losing access to some of these international funds will be damaging to China’s economy at a time when it is already struggling to regain its pre-Covid momentum.

India’s economy is on track to out-grow China’s for the third consecutive year and, according to predictions from the International Monetary Fund, will keep doing so in every one of the five years of its forecast.

India’s stock market capitalisation is also gaining on China’s, according to Tim Hayes at Ned Davis Research, as the country gains on its bigger rival and draws in more international cash.

He said: “India’s demographic outlook and long-term growth potential are both far better than China’s.”