Overall, we think policies will impact financial markets via three main channels: economic growth, inflation and demand for safe-haven assets.

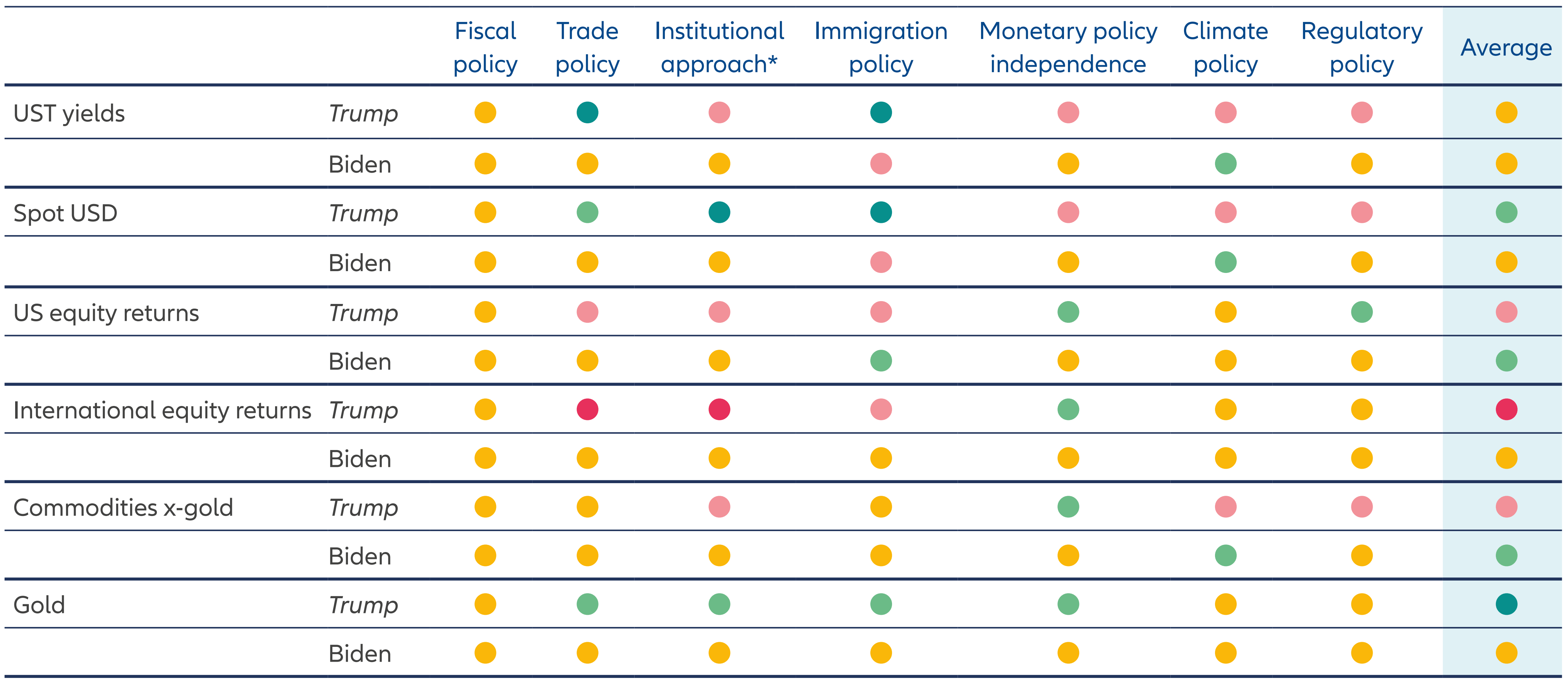

We’ve analysed the effects on markets across seven policy areas where we think the impact will be most pronounced (see below and Exhibit 1):

Fiscal policy: major stimulus is unlikely under a divided government

President Biden and former President Trump are both talking big on fiscal plans. Mr Biden has proposed USD 5.1 trillion in tax hikes partly offset by new spending, with a net USD 3.3 trillion in deficit reduction by 2034. Mr Trump aims to make his 2017 tax cuts permanent and further cut the corporate rate from 21% to 20%. While the estimated USD 6.1 trillion gross cost of Mr Trump’s tax plans may be partly offset by higher tariffs, a net reduction in the deficit is far from certain. What is certain is most of the 2017 tax cuts expire on 1 January 2026 and, under a divided government, Congress is unlikely to approve full tax cut extensions. That said, a majority of policymakers across government may be keen to prevent a fiscal cliff. As a result, regardless of who wins the presidency, market impact may prove neutral.

Trade policy: tariffs will be a focus for markets

Presidents can affect trade policy through tariffs without Congressional approval. This opens the door to unilateral actions that can influence growth, inflation and markets. Mr Biden and Mr Trump have both tried to subsidise US industry by increasing trade barriers, particularly against China. More of the same may follow, although Mr Trump’s “America First” approach appears comparably tougher, including a 10% blanket levy on all US imports plus a 60% tax on Chinese products. If implemented, this could create headwinds for foreign equities, in addition to a US inflationary impulse that could initially send US Treasury yields higher. The question is whether the US economy could withstand higher inflation and yields, suggesting a subsequent risk of recession and lower yields.

Institutional approach: geopolitical backdrop could shift under Mr Trump

Markets can expect continued support for institutions such as NATO, as well as Ukraine, Taiwan and an Israel-Palestine two-state solution if Biden is re-elected. But Mr Trump’s institutional approach may be less well received by some investors. This might include efforts to undermine NATO, less consultation with US allies and an end of support for Ukraine. Back home, Mr Trump would likely seek to terminate the remaining court cases against him and pardon the convictions of those involved in the 6 January 2021 attack on Capitol Hill. At the margin, these efforts may bolster global demand for safe-haven assets and weigh on international equities.

Immigration policy: keep an eye on labour supply

American presidents have some power to unilaterally affect immigration policy, at least temporarily. This means comparably tight immigration under Mr Trump could dampen the supply of labour, suggesting faster wage and consumer inflation, higher US Treasury yields and tighter margins for US companies. Relatively easier immigration under Mr Biden could have the opposite effect.

Monetary policy independence: expect the Fed to be under fire from Mr Trump

Markets are already laser-focused on potential US Federal Reserve (Fed) interest rate cuts. But under a Trump presidency a simple shift lower may not be sufficient. We think Mr Trump may undermine the Fed’s independence by openly and aggressively pushing for stimulus, before replacing Chair Jerome Powell at the expiry of his second term in May 2026. For US Treasuries, we think the impact may be felt more on short-term rates than long-term rates due to lingering inflation concerns. A narrower spread between US yields and the rest of the world could dampen the US dollar, while equities and commodities may benefit from the prospect of monetary stimulus.

Climate policy: energy policies will feed through to inflation and asset valuations

Mr Trump would likely undo many of his predecessor’s climate policies and aim to expand fossil fuel production. Such a move may initially boost the US economy via cheaper energy costs, prompting disinflation and lower US Treasury rates. Longer-term affects could, of course, be different. For Mr Biden, supporting the green energy transition may mean reduced oil and gas supplies, a potential driver of inflation, US Treasury yields, the dollar and commodities excluding gold.

Regulatory policy: Mr Trump’s plans to cut red tape may bolster US equities

We expect Mr Trump to put a greater focus on ease of doing business by reducing regulatory barriers across the energy, financial and consumer sectors. If effective, those moves could soften the rate of inflation in the near-term, leading to lower US Treasury yields and a weaker dollar. All else equal, this could also support US equities. Mr Biden’s regulatory approach should remain largely unchanged in a prospective second term, meaning neutral affects for markets, broadly.

Exhibit 1: Our expected market reaction to policies under the two main candidates (based on a 12-month investment horizon under a divided government)

Dark green = very positive impact, light green = positive impact, yellow = Neutral or TBD, light red = negative impact, dark red = very negative impact

Note: Assessment based on our expectation of a divided government. We still don’t know the exact agenda of both main candidates, while the risks around our expectations are huge.

Source: AllianzGI Global Economics & Strategy. Allianz of America, Bloomberg, Washington Post; Whitehouse.gov, Associated Press, Politico; as at June 2024