But the fiscal straitjacket this arrangement is placing on the Government has led to outcry in some quarters.

“Nobody challenges the independence of the Bank of England to set the short-term interest rate and to forecast inflation,” says John Redwood, a veteran Conservative MP and former cabinet minister.

“But nor should anyone challenge the right of Government and parliament to set fiscal policy. If the Bank persists in selling bonds at big losses, it preempts crucial money needed for other purposes.”

Does it have to be this way? The short answer is: no.

“QE and QT is not a Bank of England independent policy – it is a joint policy with the Treasury,” says Sir Jacob Rees-Mogg, a former business secretary.

“No other central bank is doing it in this way, so it could be done differently at lower cost.”

The Federal Reserve has taken a very different approach. The US central bank effectively registers a loss and promises to pay it off over time, rather than charging it immediately to the taxpayer.

The Fed can do this because it has more income streams than the Bank.

Most notably, it keeps the income from seigniorage – the profit made from printing banknotes. Andrew Bailey last week pointed out that Britain does not have the same setup.

“This option is not available to us here in the United Kingdom. Courtesy of the 1844 Bank Charter Act, and following the Currency and Banknotes Act of 1928, all seigniorage income generated by the Bank’s Issue Department is paid directly to HM Treasury,” the Governor said.

“At the current rate, this is around £4bn per year. So neither have we retained the positive cash balances in the APF as they accumulated when Bank Rate was low, nor do we have access to a future income stream, against which we could off-set negative cashflows in the future in the way that other central banks are approaching it.”

Of course, Parliament can change the laws that the Governor references. It could let the Bank keep the £4bn a year from printing banknotes to pay off the losses on QE.

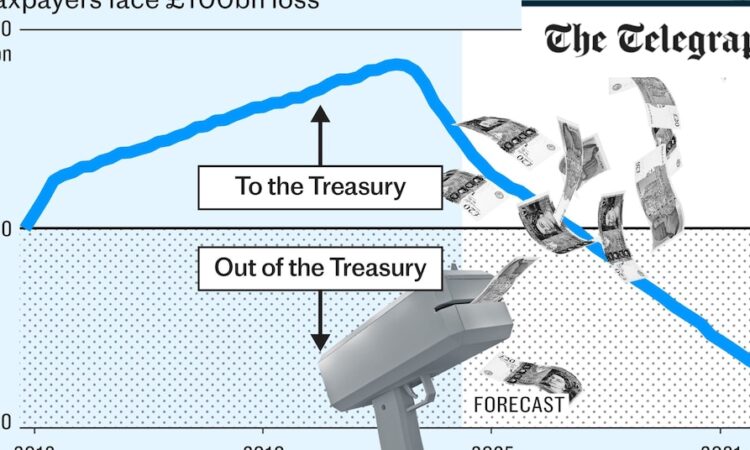

The process would be slow – it would take more than quarter of a century to cover the net loss of £106bn.

But at least it would represent a predictable loss of income for the Treasury, rather than risk the large and unpredictable costs of the current regime.

If following the Fed is not an option, Britain could copy the European Central Bank (ECB).

The ECB holds on to the bonds it purchased until they mature, meaning it receives the full face value of the bonds.

By contrast, the Bank of England is actively selling some of its bonds. When interest rates rise, the market price of bonds falls.

The Bank bought when rates were low and is now selling at a loss.

Another difference is how the Bank and the ECB treat the new money they created to buy those bonds.

The ECB pays less interest to commercial banks on the reserves they hold at the central bank.

It pays nothing on the portion of reserves lenders are compelled to hold by regulations, only giving them a return on the money which they hold over and above that minimum level, in a process known as tiering.

By contrast the Bank of England pays its base rate – 5.25pc – on all reserves, which is more than it receives in income on the bonds in its QE portfolio.

Redwood argues that since the Bank only started paying interest on reserves at all in 2006, it should not be unimaginable to reverse that decision, at least in part.