UK Economy Set for a Turnaround in Late 2024: Implications and Expectations

The UK’s economic landscape, riddled with challenges, is set to experience a much-needed turnaround in the second half of 2024. The Treasury and the Bank of England are steering towards a ‘soft landing’, with a modest growth rate of 0.3%. This promising trajectory, as forecasted by a group of 52 economists surveyed by Bloomberg, suggests that the likelihood of a recession is relatively slim.

Struggle and Resilience

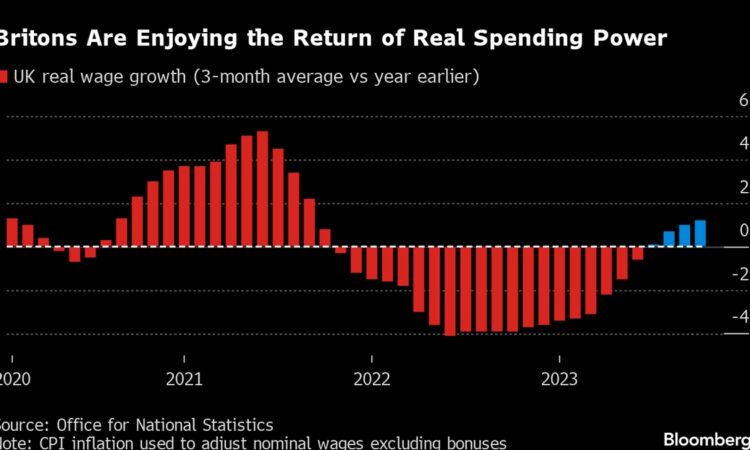

The UK economy demonstrated surprising resilience in 2023, defying gloomy forecasts. Despite grappling with persistent inflation, weak GDP growth, rising borrowing costs, and increased living expenses, the economy remained sturdy. Inflation, which fell to 3.9% in November 2023, is anticipated to stay above the government-set target until the end of 2025. This has led financial markets to predict interest rate cuts due to cooling inflation and weak economic growth.

Employment and Housing Challenges

Challenges still loom large, with unemployment expected to rise and job vacancies predicted to decrease. Additionally, average annual pay growth is likely to decrease. Housing costs have also surged due to the Bank of England’s aggressive interest rate hikes, compelling landlords to raise rents to offset their own borrowing costs. The housing market, which experienced a 1.8% decline in 2023, is predicted to stagnate or continue its descent in 2024.

Potential Upswing

However, the predicted economic upturn in late 2024 could provide a strategic advantage for the incumbent government, led by Rishi Sunak. As the nation prepares for a potential election later in the year, this positive economic trajectory, coinciding with falling inflation and resolution of the prolonged cost-of-living crisis, could offer much-needed relief to consumers and a boost to the government’s popularity.