US Dollar Weekly Forecast: Bearish

- Risk events ahead: US GDP (2nd estimate) and US PCE inflation

- US Treasury yields rise ahead of sizeable government auction

- US Dollar basket tests crucial long-term trend indicator

- Implied rate cuts ease slightly from 4 full rate cuts in 2024 to 3

Dollar May Drift Lower Alongside Incoming Economic Data

The dollar has been moving lower, in a similar fashion to US yields and US economic data as the world’s largest economy appears to be feeling the effects of tight financial conditions. Labour data has eased since the October NFP report, retail sales and CPI data dropped and overall sentiment data has been revised lower too.

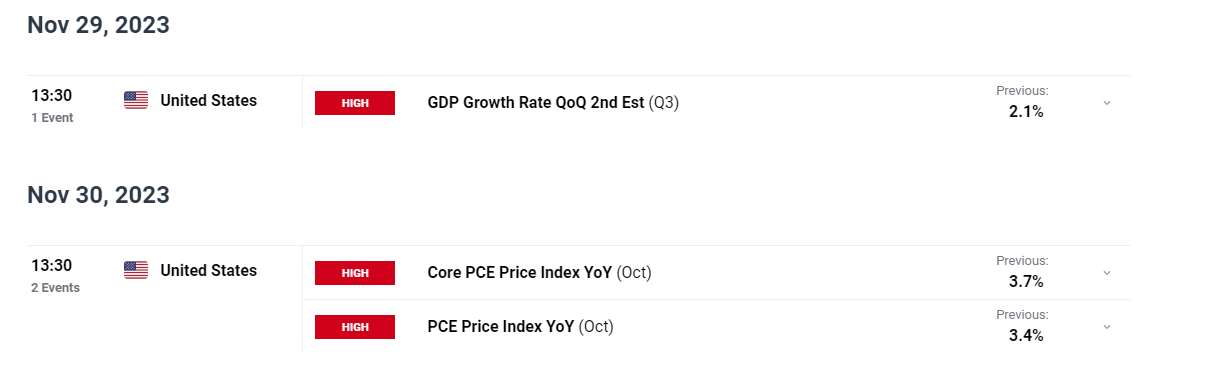

In the coming week, High impact US data includes the second estimate of Q3 GDP as well as US Personal Consumption Expenditure (PCE) data – the Fed’s preferred measure of inflation.

Customize and filter live economic data via our DailyFX economic calendar

Learn how to plan and prepare ahead of high impact economic data by claiming our free guide including an actionable news trading strategy:

Recommended by Richard Snow

Trading Forex News: The Strategy

The initial estimate for Q3 GDP (annualized) revealed an impressive 4.9%, however, the second estimate will test the remaining resilience of the economy as general activity data has worsened.

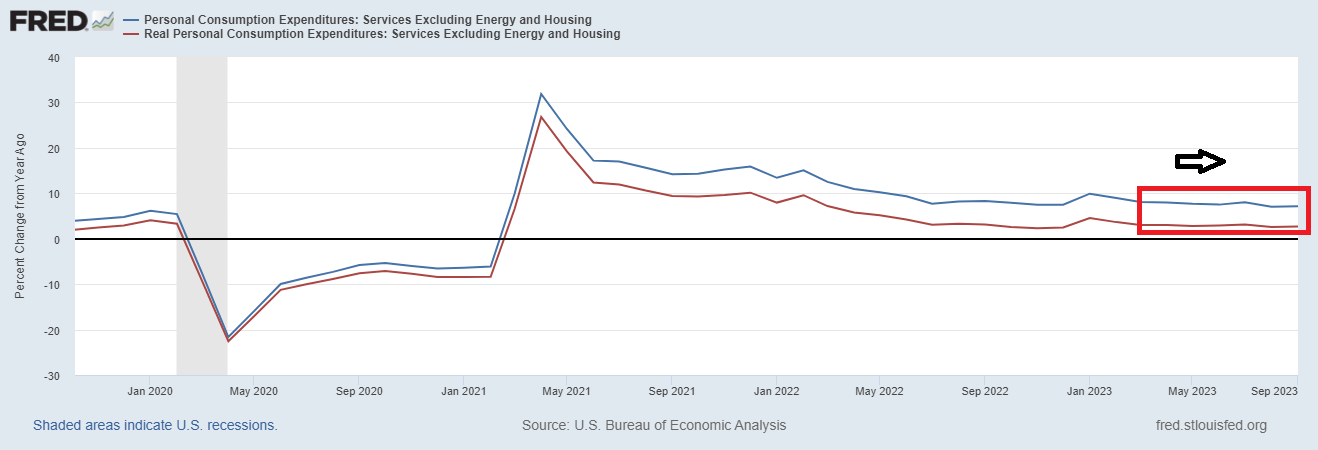

One data point closely watched by the Fed is ‘core services excluding housing and energy’, which provides an indication of widespread prices within the services sector where prices have proven to be sticky. The graph below reveals the sideways movement in price pressures which are yet to show a concerted move to the downside. Progress in this measure could contribute towards another leg lower in the dollar as markets look ahead to next year when at least three 25 basis point hikes are priced in.

PCE Services Excluding Energy and Housing

Source: Federal Reserve, prepared by Richard Snow

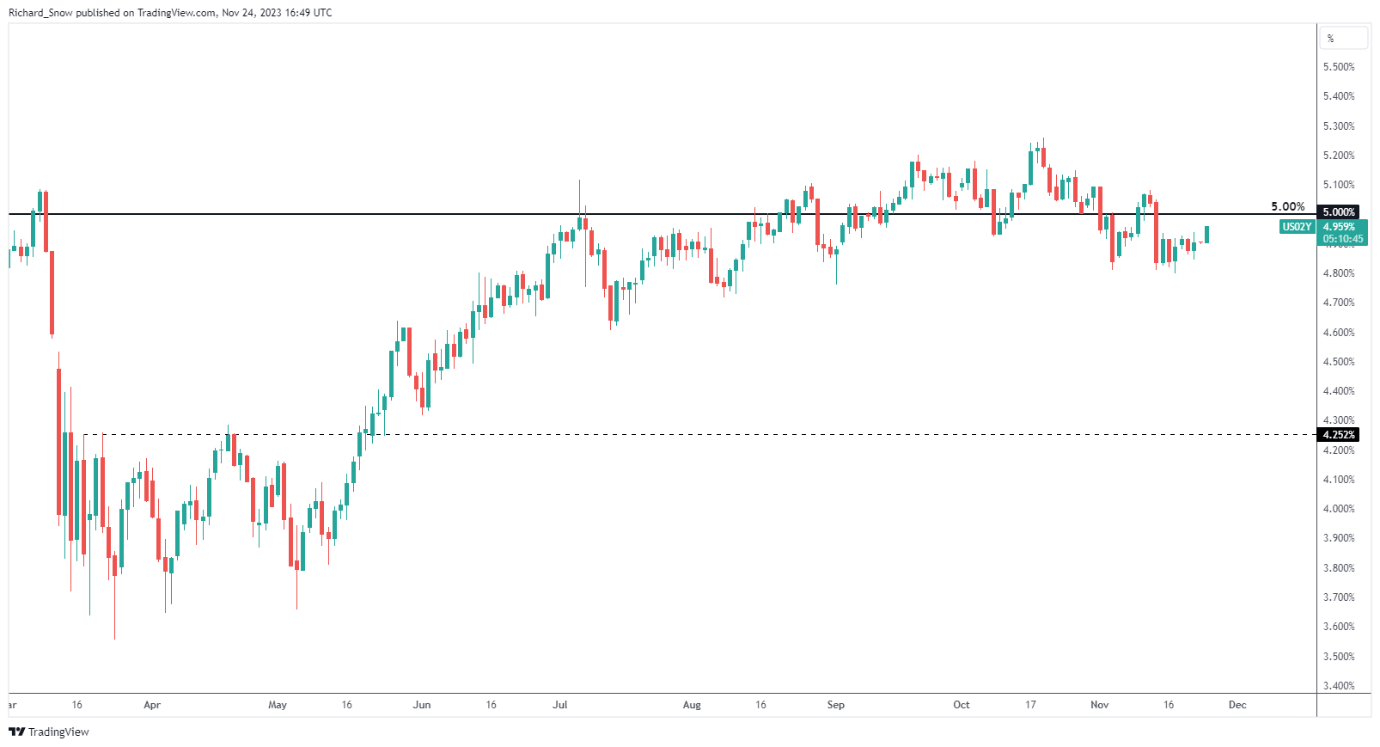

US Treasury Yields Rise Ahead of Sizeable Auction

The US Treasury is scheduled to auction a decent chunk of US debt next week to fund the US government and its operations. Almost in anticipation, the bond market has propped up yields of the 2-year note in the hopes of acquiring the securities at an attractive yield. While yields have come down from the peak above 5%, levels are still attractive considering it is essentially viewed as a ‘risk free’ asset. Elevated yields may actually see the dollar supported until the major event risk enters the fray from Wednesday.

US 2-Year Treasury Yields

Source: TradingView, prepared by Richard Snow

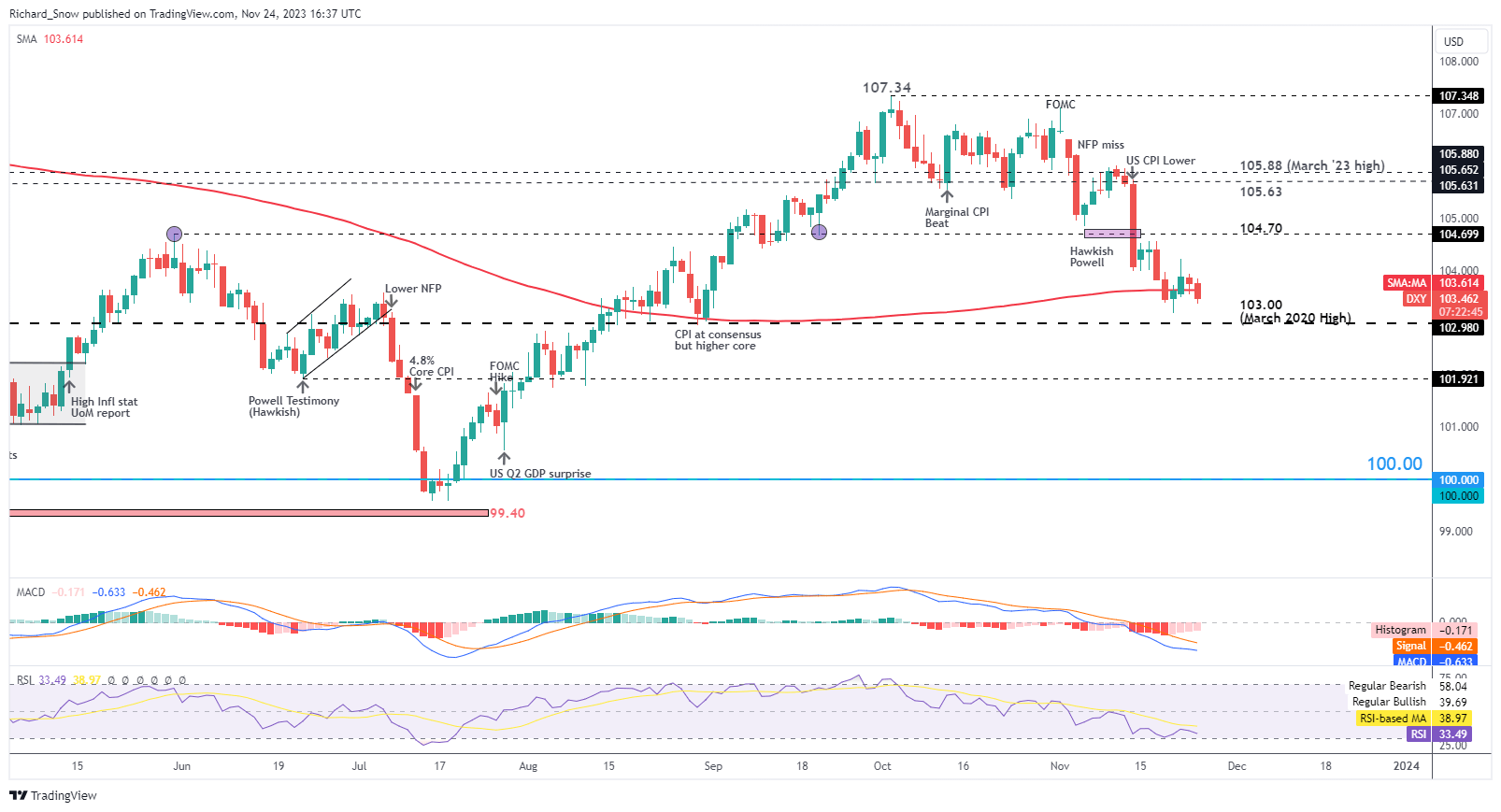

US Dollar Basket (DXY) Tests Crucial Long-Term Trend Indicator

The dollar tested the 200-day simple moving average (SMA) late on Friday after is struggled to build on the bearish momentum after trading below the dynamic level of support previously. A daily close below the 200 SMA could see DXY test 103 flat in the week to come, especially if GDP and inflation data underwhelm. Thereafter, 101.92 comes into view as a level of consideration on the downside. The RSI shows that the bearish move could soon run out of momentum as the indicator approaches oversold territory.

Stronger than anticipated data particularly on the inflation front, could revitalise the dollar and see it recover some of the recent losses. Resistance appears all the way up at 104.70 which poses a tall order.

US Dollar Basket (DXY) Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

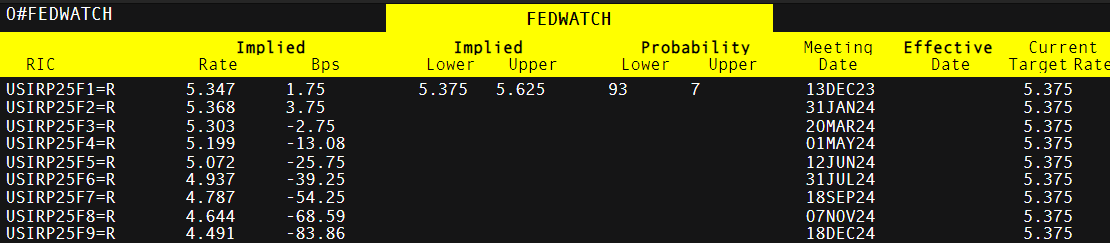

Markets have also reigned in reactionary expectations of 100 basis points of cuts next year when CPI came out lower than anticipated for the month of October. Currently, markets expect three full interest rate cuts next year with the possibility of a fourth before December 2024. Any relief from the slight reduction in rate cut expectations may prove to be short lived.

Implied US Interest Rate Probabilities

Source: Refinitiv, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

Recommended by Richard Snow

Traits of Successful Traders