Green freeports in Scotland: opportunities and challenges as we transition to a net zero economy – SPICe Spotlight

On 13 January 2023 the Scottish and UK governments announced that the Inverness and Cromarty Firth and Forth Green Freeports had been jointly selected to become Scotland’s first “Green Freeports”. This marked the conclusion of a fairly drawn out process which started following the 2019 UK General Election. This blog will set out the background to Scotland’s Green Freeports, give an overview of the two successful bids, and the economic benefits it is hoped will result from the Scottish and UK Governments’ investment.

As usual for our longer blog articles, we’ve added a contents popout below.

What’s in a name, anyway?

The UK Government, following the 2019 General Election, announced plans to create up to ten “freeports” across the UK by 2021, and launched a consultation in February 2020. The UK Budget presented on 3 March 2021 announced plans for eight freeports in England. The UK Government’s policy intention was to use freeports as part of the levelling up policy agenda, which aims to reduce regional inequalities. The consultation noted that:

…the government wants to establish Freeports, which have different customs rules than the rest of the country, that are innovative hubs, boost global trade, attract inward investment and increase productivity. In doing so, the government wants Freeports to generate employment opportunities to the benefit of some of our most deprived communities around the UK.

The Scottish Government wrote to the UK Government in February 2021, calling for the UK Government to support its plans for “green ports” in Scotland, and provide the same level of funding as was being provided for freeports in England. According to the Scottish Government, in addition to the objectives around regeneration, innovation and trade in the UK Government’s freeport model, the Scottish green ports should focus on sustainable, inclusive growth, fair work and a just transition to net zero.

The freeport/ green port proposals cover a number of reserved and devolved policy areas. While customs powers are generally reserved, tax, regeneration and innovation policy are all partly devolved, while planning policy is entirely devolved. Creating a proposal which would offer the same range of reliefs as in England would therefore require cooperation between the Scottish and UK Governments. UK in a Changing Europe, a network of academics and researchers, noted that the UK Government held an effective veto over the Scottish Government green port proposals, as the power to adjust tariffs within the economic zone is reserved.

On 17 September 2021, the Scottish Government announced that an agreement could not be reached with the UK Government as no assurances had been provided with respect to fair work and the transition to net zero. The Scottish Government announced that it would instead progress its green port proposals.

On 22 February 2022 the Scottish and UK governments announced that a deal had been reached to establish two “Green Freeports” in Scotland. The Scottish Government stated that the deals means:

- there will be a joint applicant prospectus, with Ministers and officials from both governments having an equal say in the assessment and selection process.

- applicants in Scotland are required to contribute towards a just transition to net-zero emissions by 2045.

- applicants in Scotland are required to set out how they will support high-quality employment opportunities that offer good salaries and conditions, and how fair work practices will be embedded in the green freeport area.

UK in a Changing Europe noted that, despite the delay, there are not significant differences between this “Green Freeport” model and the UK government’s original “freeports”:

These Scottish ‘Green Freeports’ are essentially the same as UK freeports, except that the SNP hopes that firms locating there will commit to paying living wages, pursuing inclusive growth, and to decarbonisation. While the Scottish government claim such goals are central to the Green Freeport idea it is not at all clear how binding any of these commitments will be, given the previous dispute with the UK government over such issues.

The Commonweal thinktank echoed these concerns, suggesting that:

The Scottish Government’s negotiated “improvements” to the UK Freeport model are scant, including a request that companies who wish to bid for Freeport status within the Freeport zones “may” wish to align to the Scottish Government’s Fair Work First criteria and “may” wish to make commitments on paying the Real Living Wage or recognising trade unions.

Previous freeports in the UK

The freeports will not be the first to operate in the UK. The House of Commons Library notes that seven freeports operated at various points between 1984 and 2012. In July 2012, the legislation that set up the remaining five freeports (Liverpool, Southampton, Port of Tilbury, Port of Sheerness and Prestwick Airport) expired. Fullfact note that there are around 80 “free zones” currently operating in the EU. It has been argued, however, that the operation of these zones is limited by EU state aid rules. Professor Catherine Barnard and Emilija Leinarte of Cambridge University have outlined the limitations of free zones in the EU:

Approvals for FZ [free zones] are also subject to EU state aid rules. Under EU law, it is illegal for member states to give financial help to some companies and not others in a way which would distort fair competition. State aid must be approved by the European Commission, which effectively holds a monopoly on the decision for the creation of FZ.

The difficulty of obtaining an FZ status can be illustrated by the Shannon FZ in the Republic of Ireland. The Shannon FZ was successfully launched in 1958 but, upon Ireland’s accession to the EU in 1973, the incentives in the Shannon FZ were limited in order to comply with EU state aid rules (e.g. the 0% corporate income tax was increased to 10%).

Following the UK’s exit from the EU, EU trade policy restrictions no longer apply, however the UK remains bound by international obligations, specifically the state aid rules of the World Trade Organisation (WTO). The House of Commons Library note that the WTO regime for state aid is ‘less stringent’ that state aid in the EU.

What will Green Freeports in Scotland offer?

The UK Government published a bidding prospectus for applicants which sets out the objectives, economic levers and delivery requirements. The key policies and reliefs that companies and local authorities within the Green Freeports can benefit from include:

- Taxation policy: including land and building transactions tax, enhanced structures and buildings allowance relief, enhanced capital allowances relief, national insurance contributions on salaries of new employees in the green freeport tax sites and business rates relief.

- Customs policy: authorised businesses within Green Freeport customs site will be able to import goods for storage or processing with import duties suspended, only paying these if goods are declared for home use in the UK.

- Seed capital: successful applicants can access seed funding of up to £25 million, subject to project approval by the Green Freeport programme board.

- Retained non-domestic rates: Increased non-domestic rates income arising from increased activity linked to the Green Freeport will be retained by the relevant local authorities, rather than redistributed centrally.

There were six bids in total submitted in Scotland, although one (Cairnryan) was withdrawn before the conclusion. On 13 January 2023 the Scottish and UK Governments announced that Opportunity Inverness and Cromarty Firth and Firth of Forth Green Freeport had been successful.[CA(8]

What do the Green Freeports say they will deliver?

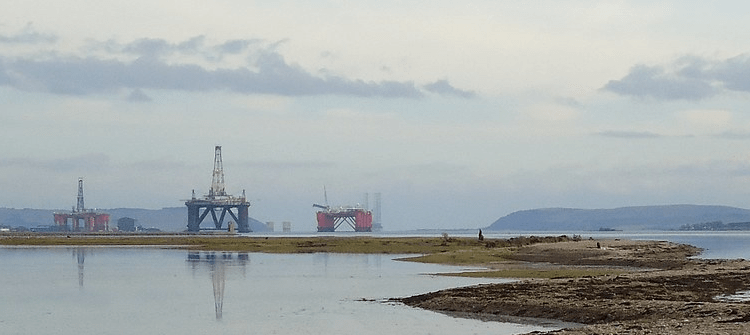

Opportunity Cromarty Firth is a partnership including the Port of Cromarty Firth and Global Energy Group, and outline that the focus of the bid is on the opportunities from offshore renewables and green hydrogen, and aims to maximise the business opportunities and employment for the region. Key benefits expected include:

- Up to 25,000 green jobs.

- Add £6bn to region’s economy.

- Attract £2.6bn in inward investment.

- Focus on creating a new innovation cluster.

Forth Green Freeport bid was led by Forth Ports, with partners including Babcock, Edinburgh Airport, Ineos and public sector organisations. The bid aims to support the delivery of a just transition, attract inward investment, build export capacity and create high quality jobs. Key benefits promised include:

- Up to £6 billion in private and public investment and contribute £4 billion in gross value add

- The potential to create 50,000 high quality jobs.

- Support transition to net zero through being a ‘catalyst for new green technologies, alternative fuels and renewable energy manufacturing’.

- Skills development programmes for young people.

- New freight, rail and alternative fuel terminals, and SME/start up incubators.

- Innovation network bringing together business and academia.

Key questions for parliamentary scrutiny

While the headline economic benefits promised by the Green Freeports will take some time to materialise, the policy remains topical despite the conclusion of the bidding process. On 20 February 2023, the Herald reported that the consortium behind the unsuccessful Clyde Green Freeport were considering a legal challenge to the outcome. The Green Party noted that the Bute House Agreement specifically excludes freeports, and that their members would oppose this policy. The Scottish Parliament’s Economy and Fair Work Committee have launched an inquiry into the Just Transition which focuses on the Grangemouth area – this includes the location of the Forth Green Freeport. Parliamentarians may wish to consider the following issues in scrutinising these investments:

- How can policy makers ensure that the investment and tax incentives offered to the two Green Freeports will result in economic benefits for their respective regions?

- How can policy makers ensure that the benefits are not simply as a result of firms relocating certain activities to benefit from lower costs, but lead to the establishment of deeper supply chains and the siting of high quality manufacturing activity in the regions for the long term?

- How will the investment support Scotland’s transition to net zero?

- How can the successful bids demonstrate that there have been no deterioration in environmental protections, and that the bids have aligned to the Scottish Government’s fair work agenda?

- Should businesses operating outside the low carbon sector be able to operate within the Green Freeport zones? Should there be some form of net zero test for Freeport operations?

Andrew Feeney-Seale and Niall Kerr, Senior Researchers, SPICe

“Cromarty Firth Oil Rigs 2” by Vicky Brock is licensed under CC BY-SA 2.0.