- This weekly round-up brings you the latest stories from the world of economics and finance.

- Top economy stories: Banking crisis fears ripple through global markets; Silicon Valley Bank collapse – what happened and what it means; People in UK face biggest drop in spending power for 70 years.

1. Banking crisis fears send shockwaves through markets

Fears of a global banking crisis increased following a slump in the share price of Swiss bank Credit Suisse and the collapse of US lender Silicon Valley Bank.

Credit Suisse’s share price dropped 24% on 15 March after its largest investor said it could not provide the bank with more money. The bank has made multi-billion dollar losses associated with the collapse of investment fund Archegos and Greensill Capital.

Stock markets subsequently fell around the world, with banking stocks seeing particularly large falls. The turmoil in banking stocks also triggered drops in yields for US Treasuries and Eurozone bonds, and gold prices renewed their recent rally as investors sought safe havens.

Switzerland’s central bank has since stepped in with $54 billion to shore up liquidity and investor confidence in Credit Suisse, making it the first major global bank to be thrown an emergency lifeline since the 2008 financial crisis.

But the sell-off of Credit Suisse shares has raised questions over potential problems that might be lurking in the wider banking system. Large US banks injected $30 billion in deposits into First Republic Bank on 16 March in an attempt to rescue the lender, after a 70% drop in its share price this month.

The wider banking-sector share slump came a day after ratings agency Moody’s Investors Service cut its outlook for the entire banking system to negative from stable because of the failure of Silicon Valley Bank and fellow US mid-sized lender Signature Bank (see more below).

Goldman Sachs has lowered its forecast for fourth-quarter US GDP growth because of risks that smaller banks will pull back on loans to preserve liquidity in the face of the potential banking crisis.

2. Silicon Valley Bank collapse: What happened and why?

California-based Silicon Valley Bank (SVB) was shut down by the state’s banking regulators on 10 March after a rapid slide in deposits. SVB served many start-ups and described itself as “the bank of the innovation economy”.

The bank counted nearly half of US venture capital-backed technology and healthcare companies among its customers, and its deposit outflows began because these clients were struggling to raise cash elsewhere. A tech downturn has led to a notable slowdown in start-up funding by venture capitalists.

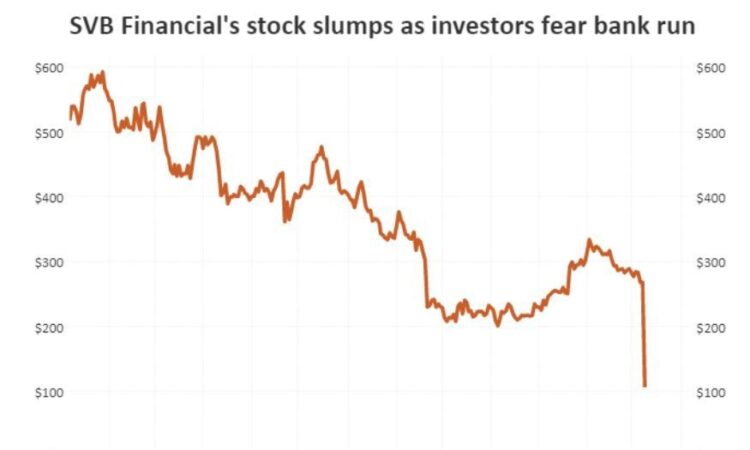

SVB launched a $1.75 billion share sale to try and shore up its balance sheet, but investors in its stock fretted over whether the capital raise would be sufficient given the deteriorating fortunes of many technology start-ups.

The bank’s stock price subsequently plunged by 60%, wiping out over $80 billion in value from its shares. Some start-ups then began pulling their money from the bank as a precautionary measure.

Reuters says SVB’s collapse is a sign that the “easy-cash era” is over, with higher interest rates dampening investors’ willingness to put money into early-stage or speculative businesses.

Corporate defaults are also rising amid the tightening monetary environment, with S&P Global saying Europe had the second-highest default count last year since 2009. It expects US and European default rates to reach 3.75% and 3.25%, respectively, in September, versus 1.6% and 1.4% a year before, with pessimistic forecasts of 6.0% and 5.5% not “out of the question”.

3. News in brief: Stories on the economy from around the world

People in the UK are facing their biggest drop in spending power for 70 years, says the government’s independent forecaster, the Office for Budget Responsibility (OBR). It comes after the government announced a new budget and said the country would avoid a recession this year. But the UK faces low growth and high debt, and the OBR says Brexit has hit business investment.

The European Central Bank has raised interest rates by 50 basis points, sticking with its fight against inflation and facing down calls by some investors to hold back on policy tightening until turmoil in the banking sector eases. Its deposit rate is now 3%, which is its highest level since late 2008.

Top Japanese companies agreed to their largest pay increases in a quarter of a century at annual labour talks this week, heeding Prime Minister Fumio Kishida’s call for higher wages to offset rising living costs. The decision may have a huge influence on kick-starting consumer demand and how soon the Bank of Japan ends its ultra-low interest rates.

The World Economic Forum’s Platform for Shaping the Future of Financial and Monetary Systems engages stakeholders across five industries: Banking & Capital Markets, Insurance & Asset Management, Private & Institutional Investors and Real Estate. The Platform is working with partners from the government and business sectors to design a more resilient, efficient and trusted financial system that reinforces long-term value creation and sustainable economic growth.

Contact us for more information on how to get involved.

The US Consumer Price Index rose by 6% in the year to February – its smallest annual increase since September 2021 and the eighth consecutive month that the annual rate has declined. But price increases remain high, and economists are divided over whether the data will push the Federal Reserve to hike interest rates next week.

Argentina’s annual inflation rate exceeded 100% in February, marking the first time it has hit triple figures since a period of hyperinflation in 1991. Inflation hit 102.5% last month, with consumers seeing price changes on an almost weekly basis.

Turkey’s budget deficit widened to TRY170.56 billion ($9 billion) in February, as the government implemented measures to minimize the economic impact of last month’s earthquake. Economists say government spending on rebuilding and aid efforts could lift the deficit-to-GDP ratio above 5% this year, against a government target of 3.5% set in September.

EU finance ministers have agreed on broad principles for reform of Europe’s fiscal rules to better accommodate investment and give more flexibility to cut debt for high-debt countries. The rules are facing challenges because public debt has risen due to government support during the pandemic and cost-of-living crisis. Efforts to stop climate change also require huge public investment.

Lebanon’s commercial banks resumed an open-ended strike on 14 March. The action follows legal changes that allow borrowers to repay foreign currency loans at old official exchange rates – a move triggered by a 98% drop in the value of the Lebanese pound. The banks say this has drained their foreign currency reserves and that they do not have enough liquidity to pay back depositors.

4. More on finance and the economy on Agenda

The explosion in talk of a banking crisis this week has also led to an explosion in the use of financial jargon. World Economic Forum Digital Editor Spencer Feingold explains five key financial terms.

Central banks may be rethinking their interest rate plans because of high numbers for core inflation – a measure that strips out volatile items such as food and energy to give a clearer sense of price behaviour across the economy.

Most economists think we will see a global recession this year. However, a “rolling recession” could soften the blow or even head off a full recession altogether. But what is a rolling recession?